Save

Print

Clear

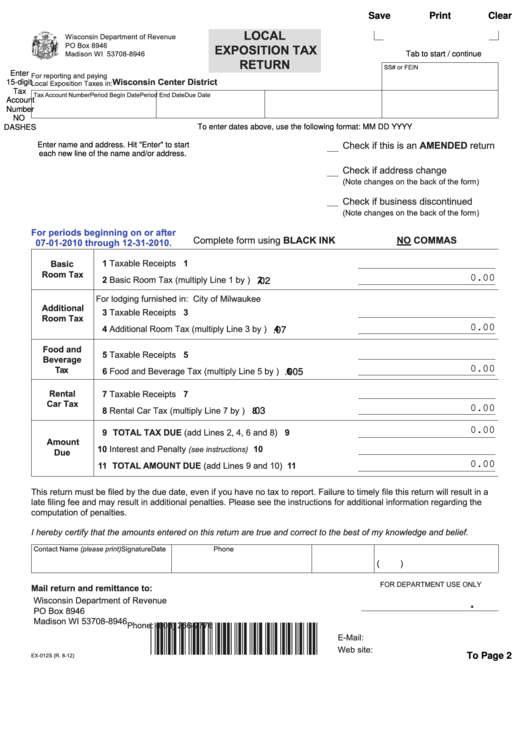

LOCAL

Wisconsin Department of Revenue

PO Box 8946

EXPOSITION TAX

Madison WI 53708-8946

Tab to start / continue

RETURN

SS# or FEIN

Enter

For reporting and paying

Wisconsin Center District

15-digit

Local Exposition Taxes in:

Tax

Tax Account Number

Period Begin Date

Period End Date

Due Date

Account

Number

NO

DASHES

To enter dates above, use the following format: MM DD YYYY

Check if this is an AMENDED return

Enter name and address. Hit "Enter" to start

each new line of the name and/or address.

Check if address change

(Note changes on the back of the form)

Check if business discontinued

(Note changes on the back of the form)

For periods beginning on or after

Complete form using BLACK INK

NO COMMAS

07-01-2010 through 12-31-2010.

1 Taxable Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Basic

Room Tax

2 Basic Room Tax (multiply Line 1 by

) . . . . . . . . . . . . . 2

0.00

.02

For lodging furnished in: City of Milwaukee

Additional

3 Taxable Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Room Tax

4 Additional Room Tax (multiply Line 3 by

) . . . . . . . . . . 4

0.00

.07

Food and

5 Taxable Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Beverage

Tax

0.00

6 Food and Beverage Tax (multiply Line 5 by

) . . . . . . . 6

.005

Rental

7 Taxable Receipts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Car Tax

0.00

8 Rental Car Tax (multiply Line 7 by

) . . . . . . . . . . . . . . 8

.03

0.00

9 TOTAL TAX DUE (add Lines 2, 4, 6 and 8) . . . . . . . . . . . . . . 9

Amount

10 Interest and Penalty

. . . . . . . . . . . . . . . . . . . 10

(see instructions)

Due

11 TOTAL AMOUNT DUE (add Lines 9 and 10) . . . . . . . . . . . . . 11

0.00

This return must be filed by the due date, even if you have no tax to report. Failure to timely file this return will result in a

late filing fee and may result in additional penalties. Please see the instructions for additional information regarding the

computation of penalties.

I hereby certify that the amounts entered on this return are true and correct to the best of my knowledge and belief.

Contact Name (please print)

Signature

Date

Phone

(

)

FOR DEPARTMENT USE ONLY

Mail return and remittance to:

.

Wisconsin Department of Revenue

PO Box 8946

Madison WI 53708-8946

Phone: (608) 266-2776

E-Mail: DORBusinessTax@revenue.wi.gov

Web site:

EX-012S (R. 8-12)

To Page 2

1

1 2

2