Form Dr-602 - Intangible Personal Property Tax - Application For Extension Of Time To File Return - 2000

ADVERTISEMENT

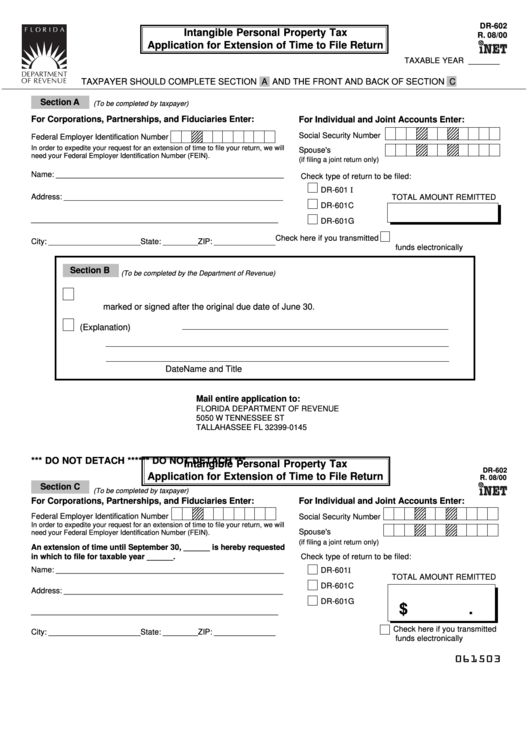

DR-602

Intangible Personal Property Tax

R. 08/00

Application for Extension of Time to File Return

TAXABLE YEAR _______

TAXPAYER SHOULD COMPLETE SECTION A AND THE FRONT AND BACK OF SECTION C

Section A

(To be completed by taxpayer)

For Corporations, Partnerships, and Fiduciaries Enter:

For Individual and Joint Accounts Enter:

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

Social Security Number

Federal Employer Identification Number

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

In order to expedite your request for an extension of time to file your return, we will

Spouse's S.S. Number

1 2 3 4

1 2 3 4 5

1 2 3 4

1 2 3 4 5

need your Federal Employer Identification Number (FEIN).

1 2 3 4

1 2 3 4 5

(if filing a joint return only)

Name: ____________________________________________________

Check type of return to be filed:

DR-601 I

Address: __________________________________________________

TOTAL AMOUNT REMITTED

DR-601C

____________________________________________________

DR-601G

Check here if you transmitted

City: _____________________ State: ________ ZIP: ______________

funds electronically

Section B

(To be completed by the Department of Revenue)

1.

Your application for extension has been denied due to late filing. Your application was post-

marked or signed after the original due date of June 30.

2.

Other (Explanation)

Date

Name and Title

Mail entire application to:

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0145

*** DO NOT DETACH ***

*** DO NOT DETACH ***

Intangible Personal Property Tax

DR-602

Application for Extension of Time to File Return

R. 08/00

Section C

(To be completed by taxpayer)

For Corporations, Partnerships, and Fiduciaries Enter:

For Individual and Joint Accounts Enter:

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

Federal Employer Identification Number

Social Security Number

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

In order to expedite your request for an extension of time to file your return, we will

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

1 2 3 4 5

Spouse's S.S. Number

1 2 3 4 5

1 2 3 4 5

need your Federal Employer Identification Number (FEIN).

1 2 3 4 5

1 2 3 4 5

(if filing a joint return only)

An extension of time until September 30, ______ is hereby requested

Check type of return to be filed:

in which to file for taxable year ______.

Name: ____________________________________________________

DR-601I

TOTAL AMOUNT REMITTED

DR-601C

Address: __________________________________________________

DR-601G

$

.

____________________________________________________

Check here if you transmitted

City: _____________________ State: ________ ZIP: ______________

funds electronically

061503

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1