Form Hcp-2 - Rhode Island Health Care Provider Tax Return

ADVERTISEMENT

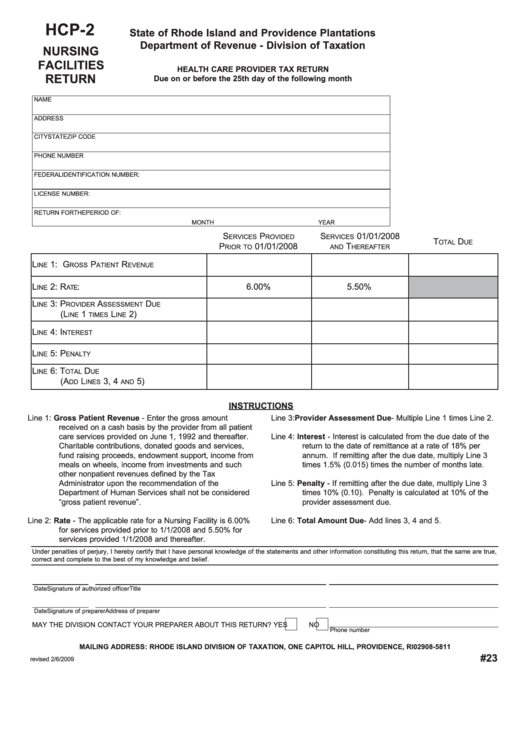

HCP-2

State of Rhode Island and Providence Plantations

Department of Revenue - Division of Taxation

NURSING

FACILITIES

HEALTH CARE PROVIDER TAX RETURN

RETURN

Due on or before the 25th day of the following month

NAME

ADDRESS

CITY

STATE

ZIP CODE

PHONE NUMBER

FEDERAL IDENTIFICATION NUMBER:

LICENSE NUMBER:

RETURN FOR THE PERIOD OF:

MONTH

YEAR

S

P

S

01/01/2008

ERVICES

ROVIDED

ERVICES

T

D

OTAL

UE

P

01/01/2008

T

RIOR TO

AND

HEREAFTER

L

1: G

P

R

INE

ROSS

ATIENT

EVENUE

L

2: R

:

6.00%

5.50%

INE

ATE

L

3: P

A

D

INE

ROVIDER

SSESSMENT

UE

(L

1

L

2)

INE

TIMES

INE

L

4: I

INE

NTEREST

L

5: P

INE

ENALTY

L

6: T

D

INE

OTAL

UE

(A

L

3, 4

5)

DD

INES

AND

INSTRUCTIONS

Line 1: Gross Patient Revenue - Enter the gross amount

Line 3: Provider Assessment Due - Multiple Line 1 times Line 2.

received on a cash basis by the provider from all patient

care services provided on June 1, 1992 and thereafter.

Line 4: Interest - Interest is calculated from the due date of the

Charitable contributions, donated goods and services,

return to the date of remittance at a rate of 18% per

fund raising proceeds, endowment support, income from

annum. If remitting after the due date, multiply Line 3

meals on wheels, income from investments and such

times 1.5% (0.015) times the number of months late.

other nonpatient revenues defined by the Tax

Administrator upon the recommendation of the

Line 5: Penalty - If remitting after the due date, multiply Line 3

Department of Human Services shall not be considered

times 10% (0.10). Penalty is calculated at 10% of the

“gross patient revenue”.

provider assessment due.

Line 2: Rate - The applicable rate for a Nursing Facility is 6.00%

Line 6: Total Amount Due - Add lines 3, 4 and 5.

for services provided prior to 1/1/2008 and 5.50% for

services provided 1/1/2008 and thereafter.

Under penalties of perjury, I hereby certify that I have personal knowledge of the statements and other information constituting this return, that the same are true,

correct and complete to the best of my knowledge and belief.

Date

Signature of authorized officer

Title

Date

Signature of preparer

Address of preparer

MAY THE DIVISION CONTACT YOUR PREPARER ABOUT THIS RETURN? YES

NO

Phone number

MAILING ADDRESS: RHODE ISLAND DIVISION OF TAXATION, ONE CAPITOL HILL, PROVIDENCE, RI 02908-5811

#23

revised 2/6/2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1