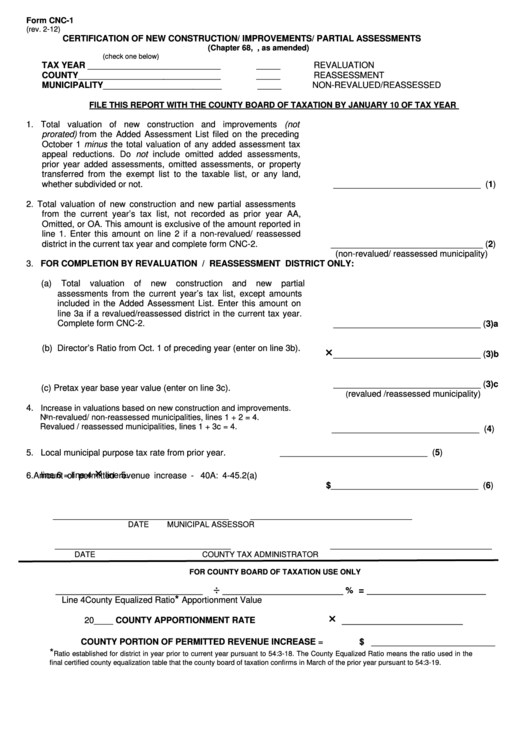

Form CNC-1

(rev. 2-12)

CERTIFICATION OF NEW CONSTRUCTION/ IMPROVEMENTS/ PARTIAL ASSESSMENTS

(Chapter 68, P.L. 1976, as amended)

(check one below)

TAX YEAR ____________________________

_____ REVALUATION

COUNTY______________________________

_____ REASSESSMENT

MUNICIPALITY_________________________

_____ NON-REVALUED/REASSESSED

FILE THIS REPORT WITH THE COUNTY BOARD OF TAXATION BY JANUARY 10 OF TAX YEAR

1. Total valuation of new construction and improvements (not

prorated) from the Added Assessment List filed on the preceding

October 1 minus the total valuation of any added assessment tax

appeal reductions. Do not include omitted added assessments,

prior year added assessments, omitted assessments, or property

transferred from the exempt list to the taxable list, or any land,

whether subdivided or not.

_______________________________ (1)

2. Total valuation of new construction and new partial assessments

from the current year’s tax list, not recorded as prior year AA,

Omitted, or OA. This amount is exclusive of the amount reported in

line 1. Enter this amount on line 2 if a non-revalued/ reassessed

district in the current tax year and complete form CNC-2.

________________________________ (2)

(non-revalued/ reassessed municipality)

3. FOR COMPLETION BY REVALUATION / REASSESSMENT DISTRICT ONLY:

(a) Total

valuation

of

new

construction

and

new

partial

assessments from the current year’s tax list, except amounts

included in the Added Assessment List. Enter this amount on

line 3a if a revalued/reassessed district in the current tax year.

Complete form CNC-2.

_______________________________ (3)a

(b) Director’s Ratio from Oct. 1 of preceding year (enter on line 3b).

_______________________________ (3)b

_______________________________ (3)c

(c) Pretax year base year value (enter on line 3c).

revalued /reassessed municipality)

(

4.

Increase in valuations based on new construction and improvements.

Non-revalued/ non-reassessed municipalities, lines 1 + 2 = 4.

Revalued / reassessed municipalities, lines 1 + 3c = 4.

_______________________________ (4)

5. Local municipal purpose tax rate from prior year.

_______________________________ (5)

6. Amount of permitted revenue increase - N.J.S.A. 40A: 4-45.2(a)

line 6 = line 4 line 5.

$_______________________________ (6)

_____________________________________

__________________________________

DATE

MUNICIPAL ASSESSOR

_____________________________________

__________________________________

DATE

COUNTY TAX ADMINISTRATOR

FOR COUNTY BOARD OF TAXATION USE ONLY

÷

____________________________

_______________________

=

%

_________________________

*

Line 4

County Equalized Ratio

Apportionment Value

_______________________

20____ COUNTY APPORTIONMENT RATE

COUNTY PORTION OF PERMITTED REVENUE INCREASE =

$ __________________________

*

Ratio established for district in year prior to current year pursuant to N.J.S.A. 54:3-18. The County Equalized Ratio means the ratio used in the

final certified county equalization table that the county board of taxation confirms in March of the prior year pursuant to N.J.S.A. 54:3-19.

1

1 2

2