Form 331 - Surety Bond

Download a blank fillable Form 331 - Surety Bond in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 331 - Surety Bond with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

Print Form

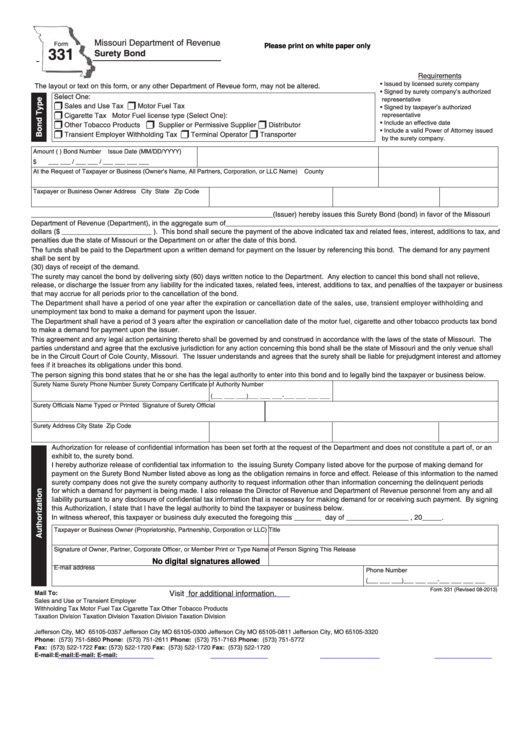

Missouri Department of Revenue

Form

Please print on white paper only

331

Surety Bond

Requirements

• Issued by licensed surety company

The layout or text on this form, or any other Department of Reveue form, may not be altered.

• Signed by surety company’s authorized

Select One:

representative

r

r

Sales and Use Tax

Motor Fuel Tax

• Signed by taxpayer’s authorized

r

representative

Cigarette Tax

Motor Fuel license type (Select One):

• Include an effective date

r

r

r

Other Tobacco Products

Supplier or Permissive Supplier

Distributor

• Include a valid Power of Attorney issued

r

r

r

Transient Employer Withholding Tax

Terminal Operator

Transporter

by the surety company.

Amount (U.S. Currency)

Bond Number

Issue Date (MM/DD/YYYY)

$

___ ___ / ___ ___ / ___ ___ ___ ___

At the Request of Taxpayer or Business (Owner’s Name, All Partners, Corporation, or LLC Name)

County

Taxpayer or Business Owner Address

City

State

Zip Code

______________________________________________________________ (Issuer) hereby issues this Surety Bond (bond) in favor of the Missouri

Department of Revenue (Department), in the aggregate sum of ______________________________________________________________________

dollars ($ _______________________ ). This bond shall secure the payment of the above indicated tax and related fees, interest, additions to tax, and

penalties due the state of Missouri or the Department on or after the date of this bond.

The funds shall be paid to the Department upon a written demand for payment on the Issuer by referencing this bond. The demand for any payment

shall be sent by U.S. mail. The Issuer shall upon receipt honor all partial or full demands for payment and make payment to the Department within thirty

(30) days of receipt of the demand.

The surety may cancel the bond by delivering sixty (60) days written notice to the Department. Any election to cancel this bond shall not relieve,

release, or discharge the Issuer from any liability for the indicated taxes, related fees, interest, additions to tax, and penalties of the taxpayer or business

that may accrue for all periods prior to the cancellation of the bond.

The Department shall have a period of one year after the expiration or cancellation date of the sales, use, transient employer withholding and

unemployment tax bond to make a demand for payment upon the Issuer.

The Department shall have a period of 3 years after the expiration or cancellation date of the motor fuel, cigarette and other tobacco products tax bond

to make a demand for payment upon the issuer.

This agreement and any legal action pertaining thereto shall be governed by and construed in accordance with the laws of the state of Missouri. The

parties understand and agree that the exclusive jurisdiction for any action concerning this bond shall be the state of Missouri and the only venue shall

be in the Circuit Court of Cole County, Missouri. The Issuer understands and agrees that the surety shall be liable for prejudgment interest and attorney

fees if it breaches its obligations under this bond.

The person signing this bond states that he or she has the legal authority to enter into this bond and to legally bind the taxpayer or business below.

Surety Name

Surety Phone Number

Surety Company Certificate of Authority Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Surety Officials Name Typed or Printed

Signature of Surety Official

Surety Address

City

State

Zip Code

Authorization for release of confidential information has been set forth at the request of the Department and does not constitute a part of, or an

exhibit to, the surety bond.

I hereby authorize release of confidential tax information to the issuing Surety Company listed above for the purpose of making demand for

payment on the Surety Bond Number listed above as long as the obligation remains in force and effect. Release of this information to the named

surety company does not give the surety company authority to request information other than information concerning the delinquent periods

for which a demand for payment is being made. I also release the Director of Revenue and Department of Revenue personnel from any and all

liability pursuant to any disclosure of confidential tax information that is necessary for making demand for or receiving such payment. By signing

this Authorization, I state that I have the legal authority to bind the taxpayer or business below.

In witness whereof, this taxpayer or business duly executed the foregoing this _______ day of ________________ , 20_____.

Taxpayer or Business Owner (Proprietorship, Partnership, Corporation or LLC)

Title

Signature of Owner, Partner, Corporate Officer, or Member

Print or Type Name of Person Signing This Release

No digital signatures allowed

E-mail address

Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

Form 331 (Revised 08-2013)

Visit

for additional information.

Mail To:

Sales and Use or Transient Employer

Withholding Tax

Motor Fuel Tax

Cigarette Tax

Other Tobacco Products

Taxation Division

Taxation Division

Taxation Division

Taxation Division

P.O. Box 357

P.O. Box 300

P.O. Box 811

P.O. Box 3320

Jefferson City, MO 65105-0357

Jefferson City MO 65105-0300

Jefferson City MO 65105-0811

Jefferson City, MO 65105-3320

Phone: (573) 751-5860

Phone: (573) 751-2611

Phone: (573) 751-7163

Phone: (573) 751-5772

Fax: (573) 522-1722

Fax: (573) 522-1720

Fax: (573) 522-1720

Fax: (573) 522-1720

E-mail:

businesstaxregister@dor.mo.gov

E-mail:

excise@dor.mo.gov

E-mail:

excise@dor.mo.gov

E-mail:

excise@dor.mo.gov

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1