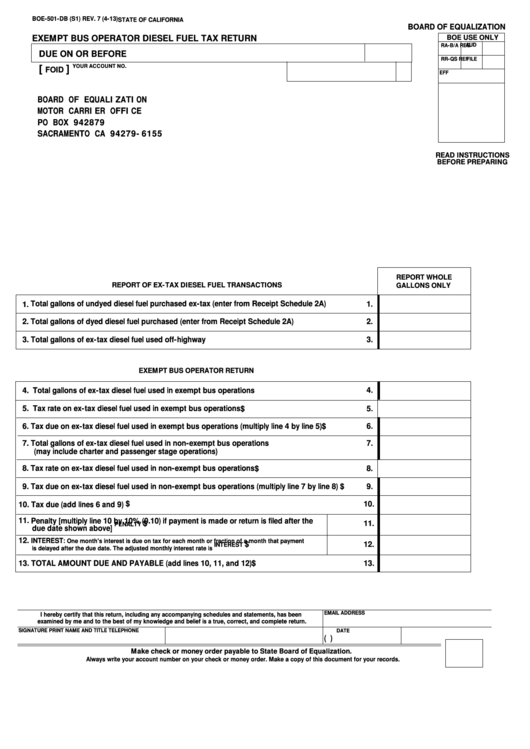

BOE-501-DB (S1) REV. 7 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

EXEMPT BUS OPERATOR DIESEL FUEL TAX RETURN

BOE USE ONLY

RA-B/A

AUD

REG

DUE ON OR BEFORE

RR-QS

FILE

REF

YOUR ACCOUNT NO.

[

]

FOID

EFF

BOARD OF EQUALIZATION

MOTOR CARRIER OFFICE

PO BOX 942879

SACRAMENTO CA 94279-6155

READ INSTRUCTIONS

BEFORE PREPARING

REPORT WHOLE

REPORT OF EX-TAX DIESEL FUEL TRANSACTIONS

GALLONS ONLY

1. Total gallons of undyed diesel fuel purchased ex-tax (enter from Receipt Schedule 2A)

1.

2. Total gallons of dyed diesel fuel purchased (enter from Receipt Schedule 2A)

2.

3. Total gallons of ex-tax diesel fuel used off-highway

3.

EXEMPT BUS OPERATOR RETURN

4. Total gallons of ex-tax diesel fuel used in exempt bus operations

4.

5. Tax rate on ex-tax diesel fuel used in exempt bus operations

5.

$

$

6. Tax due on ex-tax diesel fuel used in exempt bus operations (multiply line 4 by line 5)

6.

7. Total gallons of ex-tax diesel fuel used in non-exempt bus operations

7.

(may include charter and passenger stage operations)

8. Tax rate on ex-tax diesel fuel used in non-exempt bus operations

$

8.

9. Tax due on ex-tax diesel fuel used in non-exempt bus operations (multiply line 7 by line 8)

9.

$

10.

$

10. Tax due (add lines 6 and 9)

11. Penalty [multiply line 10 by 10% (0.10) if payment is made or return is filed after the

11.

$

PENALTY

due date shown above]

12.

INTEREST:

One month's interest is due on tax for each month or fraction of a month that payment

$

12.

INTEREST

is delayed after the due date. The adjusted monthly interest rate is

13. TOTAL AMOUNT DUE AND PAYABLE (add lines 10, 11, and 12)

13.

$

EMAIL ADDRESS

I hereby certify that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct, and complete return.

SIGNATURE

PRINT NAME AND TITLE

TELEPHONE

DATE

(

)

Make check or money order payable to State Board of Equalization.

Always write your account number on your check or money order. Make a copy of this document for your records.

CONTINUE

1

1 2

2 3

3 4

4