BOE-501-DB (S2F) REV. 7 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

INSTRUCTIONS

EXEMPT BUS OPERATOR DIESEL FUEL TAX RETURN

(User of Fuel Under Sections 60039, 60100 (a) (5) (B) and 60502.2, Revenue and Taxation Code)

Payments: You can make your payment by paper check, Online ACH Debit (ePay) or by credit card. To use ePay, go

to our website at , click on the eServices tab and log in to make a payment. To pay by credit card, go

to our website or call 1-855-292-8931. Mandatory EFT accounts must pay by EFT or ePay. Be sure to sign and mail

your return.

GENERAL INFORMATION

The State Board of Equalization (BOE) is responsible for collecting taxes under the Diesel Fuel Tax Law.

If you are interested in filing your Exempt Bus Operator Diesel Fuel Tax Return electronically with the BOE, please

contact us at the number listed at the bottom of page (S2B).

To obtain the latest information on any product codes or if you need help completing this form, please visit the BOE's

website at .

This return is for reporting ex-tax fuel only. The law does not authorize an exempt bus operator to claim a refund or

credit when tax-paid fuel is used in an exempt manner - only the supplier (the ultimate vendor) that sells fuel to the

exempt bus operator may claim a refund. An exempt bus operator that purchases tax-paid fuel for use in exempt

operations must seek a refund from its vendor, and the vendor may seek a refund from the BOE.

FILING REQUIREMENTS

In addition, bus operators must pay the current diesel fuel tax for all other ex-tax diesel fuel used on highways in

non-exempt bus operations in this state. Only dyed diesel and ex-tax undyed diesel can be reported on this form.

Under section 60205 of the Diesel Fuel Tax Law, every exempt bus operator must file a return on or before the last day

of a calendar month following the period for which tax is due, with a remittance payable to the State Board of

Equalization. This return must be filed even if you have no tax liability. Under section 60207 of the Diesel Fuel Tax Law,

late payment will result in a 10 percent (0.10) penalty and interest at an adjusted annual rate established under section

6591.5 of the Revenue and Taxation Code.

DEFINITIONS

Dyed Diesel Fuel means diesel fuel that is dyed under the United States Environmental Protection Agency or the

Internal Revenue Service rules for high sulfur diesel fuel or low sulfur diesel fuel or any requirements subsequently set

by the United States Environmental Protection Agency or the Internal Revenue Service and considered destined for

nontaxable, off-highway uses.

Undyed Diesel Fuel means diesel fuel that is not subject to the United States Environmental Protection Agency or the

Internal Revenue Service diesel fuel dyeing requirements.

Ex-tax Diesel Fuel means diesel fuel that has been purchased under an exemption certificate, without payment of the

California Diesel Fuel Tax to a supplier or vendor. Ex-tax diesel fuel also includes dyed diesel fuel purchased without

payment of the diesel fuel tax to a supplier or vendor.

Note: If you sell undyed diesel fuel to anyone other than an exempt bus operator, the fuel must be sold as tax paid fuel.

When you purchase the fuel, which is to be resold tax-paid, you must pay the tax on the portion to be resold by

submitting a partial exemption certificate to your vendor/supplier.

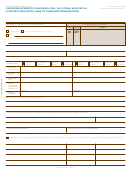

PREPARATION OF RECEIPT SCHEDULE 2A

Receipt Schedule 2A is included with every Exempt Bus Operator Diesel Fuel Tax Return. You must select a product

code for the type of product reported and enter the product code on the schedule. Photocopy additional schedules as

required, to report only one product code per page. For each schedule, complete the information in box (d) Product

Code in the header of the schedule. Boxes (a) Company Name, (b) Account Number, (c) Schedule Code and (e)

Month/Year will be completed for you.

Do not complete columns 1 through 4, 9, and 10. Enter (5) Acquired From (Seller's Name), (6) Seller's Federal

Employer Identification Number (FEIN) or BOE account number if FEIN is not available, (7) Document Date (mm/dd/yy),

(8) Document Number (invoice or receipt number) and (11) Billed Gallons.

Only report purchases of dyed diesel fuel and/or undyed diesel fuel purchased ex-tax under an exemption certificate.

DIESEL FUEL PRODUCT CODES

The Diesel Fuel Tax is imposed on any liquid that is commonly or commercially known or sold as a fuel that is suitable

for use in a diesel powered highway vehicle.

To obtain the latest information on any product codes or if you need help completing this form, please call us at the

number listed at the bottom of page (S2B) or visit the BOE's website at: .

1

1 2

2 3

3 4

4