BOE-501-DB (S2B) REV. 7 (4-13)

PREPARATION OF THE TAX RETURN

Note: Tax-paid diesel fuel cannot be reported on this tax return. Exempt bus operators must either purchase undyed (clear)

ex-tax diesel fuel for their exempt use or purchase dyed diesel for their exempt use.

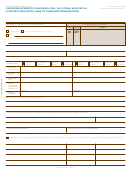

Report of Diesel Fuel Transactions Section

Line 1.

Enter the total gallons of undyed diesel fuel purchased ex-tax. (Enter the total gallons from Receipt Schedule

2A, column 11.)

Line 2.

Enter the total gallons of dyed diesel fuel purchased. (Enter from Receipt Schedule 2A, column 11.)

Line 3.

Enter the total gallons of ex-tax diesel fuel used off-highway.

Exempt Bus Operator Tax Return Section

Line 4.

Enter the total gallons of both dyed and ex-tax undyed diesel fuel used in exempt bus operations.

Line 5.

The current rate of tax per gallon for exempt bus operations.

Line 6.

Multiply the gallons on line 4 by the rate on line 5 and enter the amount of tax due. If some of the fuel used in

exempt bus operations is fuel on which tax has been paid, you cannot obtain a refund or credit on this return.

You must contact your vendor and provide an exemption certificate to the vendor to obtain credit for any tax

erroneously paid on your purchase.

Line 7.

Enter the total gallons of ex-tax diesel fuel purchased and used in vehicles in non-exempt bus operations. These

gallons include ex-tax diesel fuel used in charter and passenger stage operations. Tax-paid fuel used in

non-exempt bus operations is not reportable on this return.

Line 8.

The current rate of tax per gallon for non-exempt operations.

Line 9.

Multiply the gallons on line 7 by the rate on line 8 and enter the amount of tax due.

Line 10. Enter the amount of tax due by adding lines 6 and 9.

Line 11. If you are paying the tax amount shown on line 10 or filing the return after the due date shown on the front of the

return, you will owe a penalty of 10 percent of the amount of tax due. Multiply the tax on line 10 by (.10) and

enter here.

Line 12. If you are paying the tax amount shown on line 10 after the due date shown on the front of the return, you will

owe interest. The interest rate shown on the front of the return applies for each month, or fraction of a month,

that your payment is late. Multiply the tax due on line 10 by the interest rate shown, then multiply the result by

the number of months, or fraction of a month, that have elapsed since the due date and enter here.

Line 13. Enter the amount due, including any applicable late charges by adding lines 10, 11, and 12.

If you need additional information, please contact the State Board of Equalization, Motor Carrier Office, P.O. Box 942879,

Sacramento, CA 94279-0065. You may also visit the BOE website at or call the Taxpayer Information Section at

1-800-400-7115 (TTY:711); from the main menu, select the option Special Taxes and Fees.

1

1 2

2 3

3 4

4