Form Tw-3 - Annual Reconciliation Of Return - City Of Troy, Ohio - 2010

ADVERTISEMENT

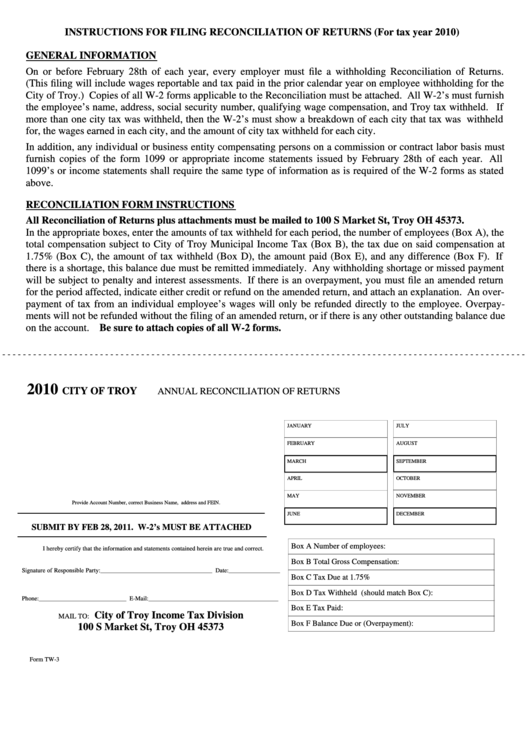

INSTRUCTIONS FOR FILING RECONCILIATION OF RETURNS (For tax year 2010)

GENERAL INFORMATION

On or before February 28th of each year, every employer must file a withholding Reconciliation of Returns.

(This filing will include wages reportable and tax paid in the prior calendar year on employee withholding for the

City of Troy.) Copies of all W-2 forms applicable to the Reconciliation must be attached. All W-2’s must furnish

the employee’s name, address, social security number, qualifying wage compensation, and Troy tax withheld. If

more than one city tax was withheld, then the W-2’s must show a breakdown of each city that tax was withheld

for, the wages earned in each city, and the amount of city tax withheld for each city.

In addition, any individual or business entity compensating persons on a commission or contract labor basis must

furnish copies of the form 1099 or appropriate income statements issued by February 28th of each year. All

1099’s or income statements shall require the same type of information as is required of the W-2 forms as stated

above.

RECONCILIATION FORM INSTRUCTIONS

All Reconciliation of Returns plus attachments must be mailed to 100 S Market St, Troy OH 45373.

In the appropriate boxes, enter the amounts of tax withheld for each period, the number of employees (Box A), the

total compensation subject to City of Troy Municipal Income Tax (Box B), the tax due on said compensation at

1.75% (Box C), the amount of tax withheld (Box D), the amount paid (Box E), and any difference (Box F). If

there is a shortage, this balance due must be remitted immediately. Any withholding shortage or missed payment

will be subject to penalty and interest assessments. If there is an overpayment, you must file an amended return

for the period affected, indicate either credit or refund on the amended return, and attach an explanation. An over-

payment of tax from an individual employee’s wages will only be refunded directly to the employee. Overpay-

ments will not be refunded without the filing of an amended return, or if there is any other outstanding balance due

on the account. Be sure to attach copies of all W-2 forms.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

2010

CITY OF TROY

ANNUAL RECONCILIATION OF RETURNS

JANUARY

JULY

FEBRUARY

AUGUST

MARCH

SEPTEMBER

APRIL

OCTOBER

MAY

NOVEMBER

Provide Account Number, correct Business Name, address and FEIN.

JUNE

DECEMBER

SUBMIT BY FEB 28, 2011. W-2’s MUST BE ATTACHED

Box A

Number of employees:

I hereby certify that the information and statements contained herein are true and correct.

Box B

Total Gross Compensation:

Signature of Responsible Party:_____________________________________ Date:_________________

Box C

Tax Due at 1.75%

Box D

Tax Withheld (should match Box C):

Phone:_____________________________ E-Mail:___________________________________________

Box E

Tax Paid:

City of Troy Income Tax Division

MAIL TO:

Box F

Balance Due or (Overpayment):

100 S Market St, Troy OH 45373

Form TW-3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1