Instructions For Completing The Florida Business Tax Application (Form Dr-1)

ADVERTISEMENT

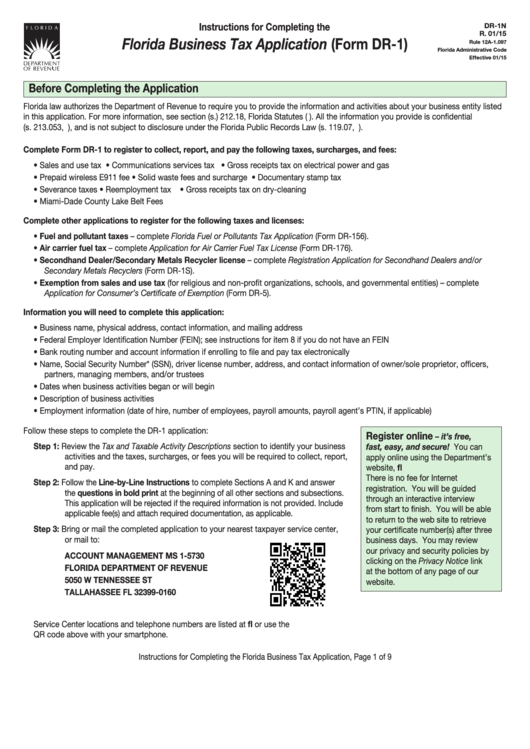

Instructions for Completing the

DR-1N

R. 01/15

Florida Business Tax Application (Form DR-1)

Rule 12A-1.097

Florida Administrative Code

Effective 01/15

Before Completing the Application

Florida law authorizes the Department of Revenue to require you to provide the information and activities about your business entity listed

in this application. For more information, see section (s.) 212.18, Florida Statutes (F.S.). All the information you provide is confidential

(s. 213.053, F.S.), and is not subject to disclosure under the Florida Public Records Law (s. 119.07, F.S.).

Complete Form DR-1 to register to collect, report, and pay the following taxes, surcharges, and fees:

• Sales and use tax

• Communications services tax

• Gross receipts tax on electrical power and gas

• Prepaid wireless E911 fee

• Solid waste fees and surcharge

• Documentary stamp tax

• Severance taxes

• Reemployment tax

• Gross receipts tax on dry-cleaning

• Miami-Dade County Lake Belt Fees

Complete other applications to register for the following taxes and licenses:

• Fuel and pollutant taxes – complete Florida Fuel or Pollutants Tax Application (Form DR-156).

• Air carrier fuel tax – complete Application for Air Carrier Fuel Tax License (Form DR-176).

• Secondhand Dealer/Secondary Metals Recycler license – complete Registration Application for Secondhand Dealers and/or

Secondary Metals Recyclers (Form DR-1S).

• Exemption from sales and use tax (for religious and non-profit organizations, schools, and governmental entities) – complete

Application for Consumer’s Certificate of Exemption (Form DR-5).

Information you will need to complete this application:

• Business name, physical address, contact information, and mailing address

• Federal Employer Identification Number (FEIN); see instructions for item 8 if you do not have an FEIN

• Bank routing number and account information if enrolling to file and pay tax electronically

• Name, Social Security Number* (SSN), driver license number, address, and contact information of owner/sole proprietor, officers,

partners, managing members, and/or trustees

• Dates when business activities began or will begin

• Description of business activities

• Employment information (date of hire, number of employees, payroll amounts, payroll agent’s PTIN, if applicable)

Follow these steps to complete the DR-1 application:

Register online

– it’s free,

Step 1: Review the Tax and Taxable Activity Descriptions section to identify your business

fast, easy, and secure! You can

activities and the taxes, surcharges, or fees you will be required to collect, report,

apply online using the Department’s

and pay.

website,

There is no fee for Internet

Step 2: Follow the Line-by-Line Instructions to complete Sections A and K and answer

registration. You will be guided

the questions in bold print at the beginning of all other sections and subsections.

through an interactive interview

This application will be rejected if the required information is not provided. Include

from start to finish. You will be able

applicable fee(s) and attach required documentation, as applicable.

to return to the web site to retrieve

Step 3: Bring or mail the completed application to your nearest taxpayer service center,

your certificate number(s) after three

or mail to:

business days. You may review

our privacy and security policies by

ACCOUNT MANAGEMENT MS 1-5730

clicking on the Privacy Notice link

FLORIDA DEPARTMENT OF REVENUE

at the bottom of any page of our

5050 W TENNESSEE ST

website.

TALLAHASSEE FL 32399-0160

Service Center locations and telephone numbers are listed at or use the

QR code above with your smartphone.

Instructions for Completing the Florida Business Tax Application, Page 1 of 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9