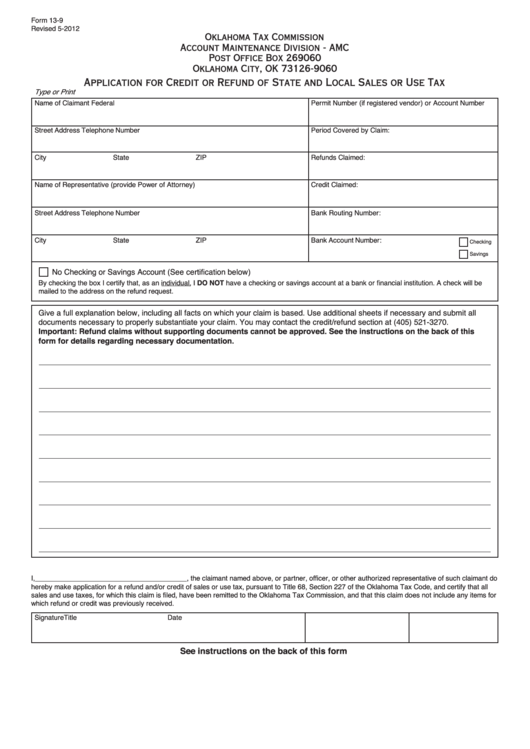

Form 13-9

Revised 5-2012

Oklahoma Tax Commission

Account Maintenance Division - AMC

Post Office Box 269060

Oklahoma City, OK 73126-9060

Application for Credit or Refund of State and Local Sales or Use Tax

Type or Print

Name of Claimant

Federal I.D. or SSN

Permit Number (if registered vendor) or Account Number

Street Address

Telephone Number

Period Covered by Claim:

City

State

ZIP

Refunds Claimed:

Name of Representative (provide Power of Attorney)

Credit Claimed:

Street Address

Telephone Number

Bank Routing Number:

City

State

ZIP

Bank Account Number:

Checking

Savings

No Checking or Savings Account (See certification below)

By checking the box I certify that, as an individual, I DO NOT have a checking or savings account at a bank or financial institution. A check will be

mailed to the address on the refund request.

Give a full explanation below, including all facts on which your claim is based. Use additional sheets if necessary and submit all

documents necessary to properly substantiate your claim. You may contact the credit/refund section at (405) 521-3270.

Important: Refund claims without supporting documents cannot be approved. See the instructions on the back of this

form for details regarding necessary documentation.

I, _______________________________________ , the claimant named above, or partner, officer, or other authorized representative of such claimant do

hereby make application for a refund and/or credit of sales or use tax, pursuant to Title 68, Section 227 of the Oklahoma Tax Code, and certify that all

sales and use taxes, for which this claim is filed, have been remitted to the Oklahoma Tax Commission, and that this claim does not include any items for

which refund or credit was previously received.

Signature

Title

Date

See instructions on the back of this form

1

1 2

2