Form Pa-40 J - Pa Schedule J - Income From Estates Or Trusts - 2015

ADVERTISEMENT

1502910050

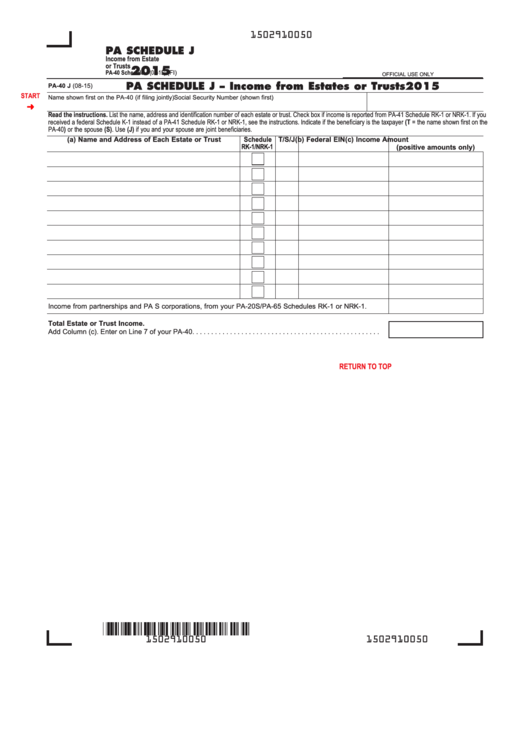

PA SCHEDULE J

Income from Estate

or Trusts

2015

PA-40 Schedule J (08-15) (FI)

OFFICIAL USE ONLY

PA SCHEDULE J – Income from Estates or Trusts

2015

PA-40 J (08-15)

START

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

Read the instructions. List the name, address and identification number of each estate or trust. Check box if income is reported from PA-41 Schedule RK-1 or NRK-1. If you

received a federal Schedule K-1 instead of a PA-41 Schedule RK-1 or NRK-1, see the instructions. Indicate if the beneficiary is the taxpayer (T = the name shown first on the

PA-40) or the spouse (S). Use (J) if you and your spouse are joint beneficiaries.

(a) Name and Address of Each Estate or Trust

Schedule T/S/J

(b) Federal EIN

(c) Income Amount

RK-1/NRK-1

(positive amounts only)

Income from partnerships and PA S corporations, from your PA-20S/PA-65 Schedules RK-1 or NRK-1.

Total Estate or Trust Income.

Add Column (c). Enter on Line 7 of your PA-40. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

RETURN TO TOP

PRINT FORM

Reset Entire Form

1502910050

1502910050

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1