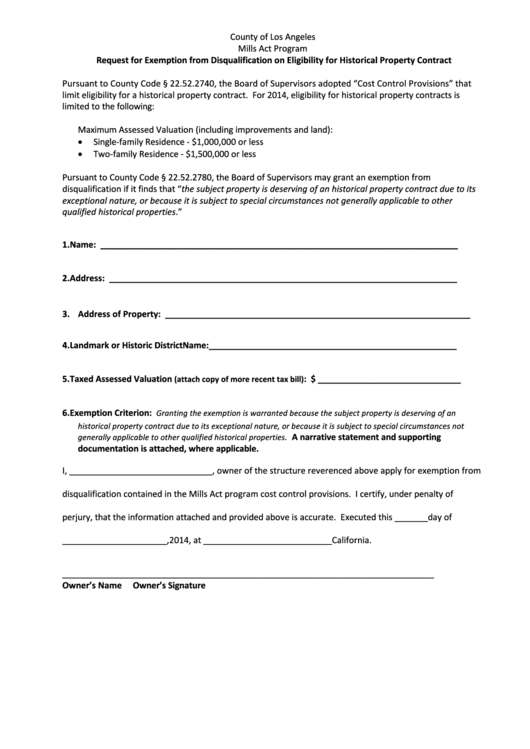

County of Los Angeles

Mills Act Program

Request for Exemption from Disqualification on Eligibility for Historical Property Contract

Pursuant to County Code § 22.52.2740, the Board of Supervisors adopted “Cost Control Provisions” that

limit eligibility for a historical property contract. For 2014, eligibility for historical property contracts is

limited to the following:

Maximum Assessed Valuation (including improvements and land):

•

Single-family Residence - $1,000,000 or less

•

Two-family Residence - $1,500,000 or less

Pursuant to County Code § 22.52.2780, the Board of Supervisors may grant an exemption from

disqualification if it finds that “the subject property is deserving of an historical property contract due to its

exceptional nature, or because it is subject to special circumstances not generally applicable to other

qualified historical properties.”

1. Name: ___________________________________________________________________________

2. Address: _________________________________________________________________________

3. Address of Property: ________________________________________________________________

4. Landmark or Historic District Name:____________________________________________________

5. Taxed Assessed Valuation

: $ ______________________________

(attach copy of more recent tax bill)

6. Exemption Criterion:

Granting the exemption is warranted because the subject property is deserving of an

historical property contract due to its exceptional nature, or because it is subject to special circumstances not

. A narrative statement and supporting

generally applicable to other qualified historical properties

documentation is attached, where applicable.

I, ______________________________, owner of the structure reverenced above apply for exemption from

disqualification contained in the Mills Act program cost control provisions. I certify, under penalty of

perjury, that the information attached and provided above is accurate. Executed this _______day of

______________________,2014, at ___________________________California.

_________________________________

_____________________________________________

Owner’s Name

Owner’s Signature

1

1