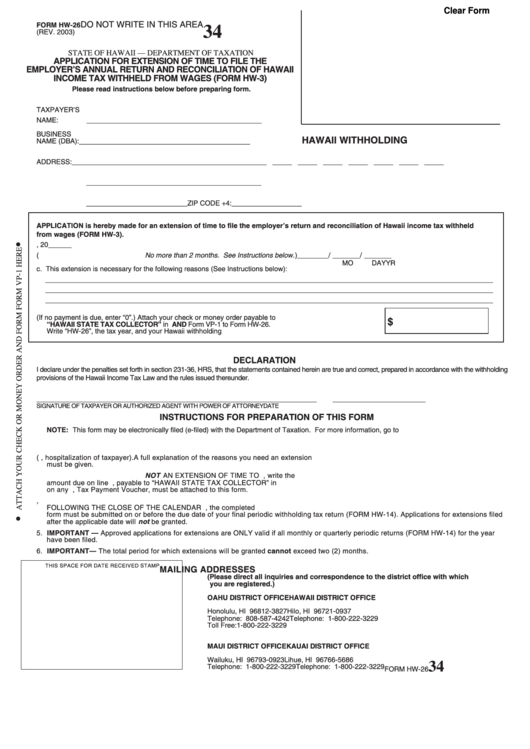

Clear Form

DO NOT WRITE IN THIS AREA

FORM HW-26

34

(REV. 2003)

STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR EXTENSION OF TIME TO FILE THE

EMPLOYER’S ANNUAL RETURN AND RECONCILIATION OF HAWAII

INCOME TAX WITHHELD FROM WAGES (FORM HW-3)

Please read instructions below before preparing form.

TAXPAYER’S

NAME:

_____________________________________________

BUSINESS

HAWAII WITHHOLDING I.D. NO.

____________________________________

NAME (DBA):

ADDRESS:

_____________________________________________

_____ _____ _____ _____ _____ _____ _____ _____

_____________________________________________

__________________________ZIP CODE +4:__________________

APPLICATION is hereby made for an extension of time to file the employer’s return and reconciliation of Hawaii income tax withheld

from wages (FORM HW-3).

a. For calendar year ending December 31, 20______

b. An extension is requested until ( No more than 2 months. See Instructions below. )

________/ _______/ _______

MO

DAY

YR

c. This extension is necessary for the following reasons (See Instructions below):

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

d. ADDITIONAL TAXES DUE. (If no payment is due, enter “0”.) Attach your check or money order payable to

$

“HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. Bank AND Form VP-1 to Form HW-26.

Write “HW-26”, the tax year, and your Hawaii withholding I.D. No. on your check or money order. ....................

DECLARATION

I declare under the penalties set forth in section 231-36, HRS, that the statements contained herein are true and correct, prepared in accordance with the withholding

provisions of the Hawaii Income Tax Law and the rules issued thereunder.

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT WITH POWER OF ATTORNEY

DATE

INSTRUCTIONS FOR PREPARATION OF THIS FORM

NOTE: This form may be electronically filed (e-filed) with the Department of Taxation. For more information, go to

1. Extensions will only be granted for periods of 2 months or less.

2. Extensions will only be granted for a good reason (e.g., hospitalization of taxpayer). A full explanation of the reasons you need an extension

must be given.

3. This extension of time to file is NOT AN EXTENSION OF TIME TO PAY. If additional income taxes withheld are due for the year, write the

amount due on line d. Your check or money order for the entire amount, payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn

on any U.S. bank and Form VP-1, Tax Payment Voucher, must be attached to this form.

4. Submit the completed form to the taxation district with which you are registered ON OR BEFORE THE LAST DAY OF FEBRUARY,

FOLLOWING THE CLOSE OF THE CALENDAR YEAR. Where the business terminates or permanently stops paying wages, the completed

form must be submitted on or before the due date of your final periodic withholding tax return (FORM HW-14). Applications for extensions filed

after the applicable date will not be granted.

5. IMPORTANT — Approved applications for extensions are ONLY valid if all monthly or quarterly periodic returns (FORM HW-14) for the year

have been filed.

6. IMPORTANT— The total period for which extensions will be granted cannot exceed two (2) months.

THIS SPACE FOR DATE RECEIVED STAMP

MAILING ADDRESSES

(Please direct all inquiries and correspondence to the district office with which

you are registered.)

OAHU DISTRICT OFFICE

HAWAII DISTRICT OFFICE

P.O. Box 3827

P.O. Box 937

Honolulu, HI 96812-3827

Hilo, HI 96721-0937

Telephone: 808-587-4242

Telephone: 1-800-222-3229

Toll Free: 1-800-222-3229

MAUI DISTRICT OFFICE

KAUAI DISTRICT OFFICE

P.O. Box 923

P.O. Box 1686

Wailuku, HI 96793-0923

Lihue, HI 96766-5686

34

Telephone: 1-800-222-3229

Telephone: 1-800-222-3229

FORM HW-26

1

1