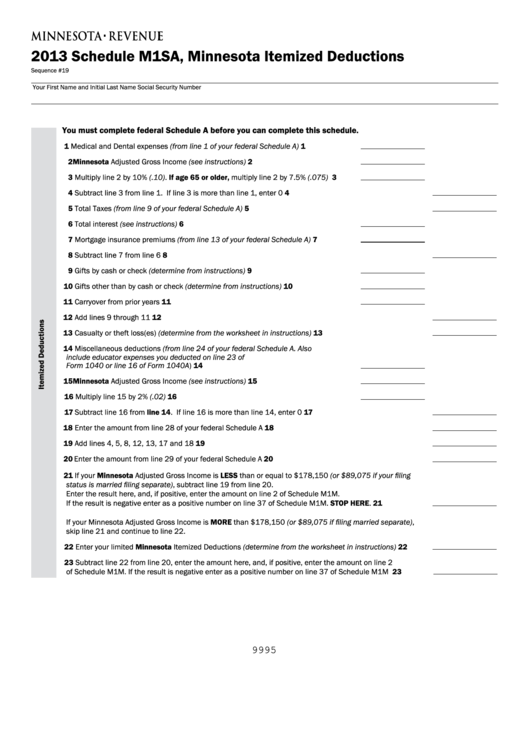

2013 Schedule M1SA, Minnesota Itemized Deductions

Sequence #19

Your First Name and Initial

Last Name

Social Security Number

You must complete federal Schedule A before you can complete this schedule.

1 Medical and Dental expenses (from line 1 of your federal Schedule A) . . . . . . . . . . . 1

2 Minnesota Adjusted Gross Income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Multiply line 2 by 10% (.10) . If age 65 or older, multiply line 2 by 7 .5% (.075) . . . . . 3

4 Subtract line 3 from line 1 . If line 3 is more than line 1, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total Taxes (from line 9 of your federal Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Total interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Mortgage insurance premiums (from line 13 of your federal Schedule A) . . . . . . . . . 7

8 Subtract line 7 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Gifts by cash or check (determine from instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Gifts other than by cash or check (determine from instructions) . . . . . . . . . . . . . . . 10

11 Carryover from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Add lines 9 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Casualty or theft loss(es) (determine from the worksheet in instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Miscellaneous deductions (from line 24 of your federal Schedule A. Also

include educator expenses you deducted on line 23 of

Form 1040 or line 16 of Form 1040A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Minnesota Adjusted Gross Income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Multiply line 15 by 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Subtract line 16 from line 14 . If line 16 is more than line 14, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Enter the amount from line 28 of your federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Add lines 4, 5, 8, 12, 13, 17 and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Enter the amount from line 29 of your federal Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 If your Minnesota Adjusted Gross Income is LESS than or equal to $178,150 (or $89,075 if your filing

status is married filing separate), subtract line 19 from line 20 .

Enter the result here, and, if positive, enter the amount on line 2 of Schedule M1M .

If the result is negative enter as a positive number on line 37 of Schedule M1M . STOP HERE . . . . . . . . . 21

If your Minnesota Adjusted Gross Income is MORE than $178,150 (or $89,075 if filing married separate),

skip line 21 and continue to line 22 .

22 Enter your limited Minnesota Itemized Deductions (determine from the worksheet in instructions) . . . . 22

23 Subtract line 22 from line 20, enter the amount here, and, if positive, enter the amount on line 2

of Schedule M1M . If the result is negative enter as a positive number on line 37 of Schedule M1M . . . . 23

9995

1

1 2

2 3

3