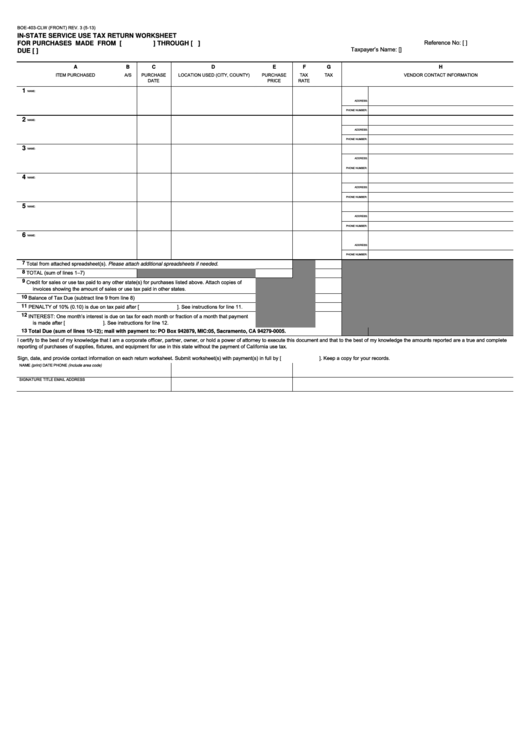

BOE-403-CLW (FRONT) REV. 3 (5-13)

IN-STATE SERVICE USE TAX RETURN WORKSHEET

Reference No: [

]

FOR PURCHASES MADE FROM [

] THROUGH [

]

Taxpayer’s Name: [

]

DUE [

]

A

B

C

D

E

F

G

H

ITEM PURCHASED

A/S

PURCHASE

LOCATION USED (CITY, COUNTY)

PURCHASE

TAX

TAX

VENDOR CONTACT INFORMATION

DATE

PRICE

RATE

1

NAME:

ADDRESS:

PHONE NUMBER:

2

NAME:

ADDRESS:

PHONE NUMBER:

3

NAME:

ADDRESS:

PHONE NUMBER:

4

NAME:

ADDRESS:

PHONE NUMBER:

5

NAME:

ADDRESS:

PHONE NUMBER:

6

NAME:

ADDRESS:

PHONE NUMBER:

Total from attached spreadsheet(s). Please attach additional spreadsheets if needed.

7

8

TOTAL (sum of lines 1–7)

9

Credit for sales or use tax paid to any other state(s) for purchases listed above. Attach copies of

invoices showing the amount of sales or use tax paid in other states.

Balance of Tax Due (subtract line 9 from line 8)

10

PENALTY of 10% (0.10) is due on tax paid after [

]. See instructions for line 11.

11

12

INTEREST: One month’s interest is due on tax for each month or fraction of a month that payment

is made after [

]. See instructions for line 12.

13

Total Due (sum of lines 10-12); mail with payment to: PO Box 942879, MIC:05, Sacramento, CA 94279-0005.

I certify to the best of my knowledge that I am a corporate officer, partner, owner, or hold a power of attorney to execute this document and that to the best of my knowledge the amounts reported are a true and complete

reporting of purchases of supplies, fixtures, and equipment for use in this state without the payment of California use tax.

Sign, date, and provide contact information on each return worksheet. Submit worksheet(s) with payment(s) in full by [

]. Keep a copy for your records.

NAME (print)

DATE

PHONE (include area code)

SIGNATURE

TITLE

EMAIL ADDRESS

1

1 2

2