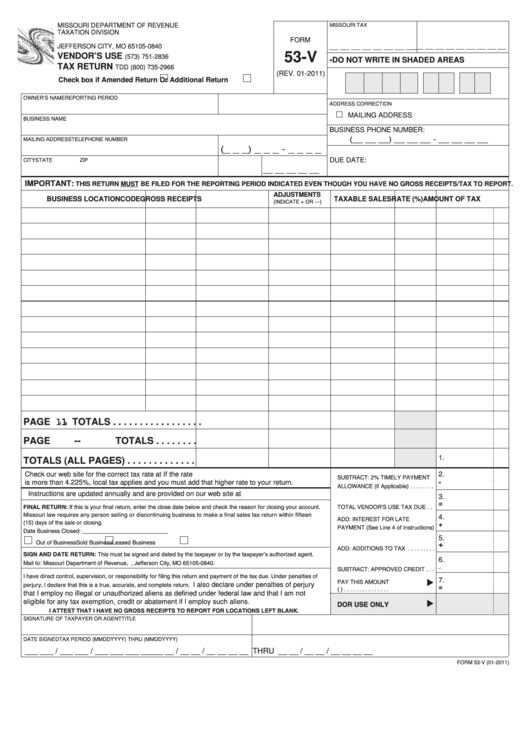

MISSOURI DEPARTMENT OF REVENUE

MISSOURI TAX I.D. NUMBER

FEDERAL I.D. NUMBER

TAXATION DIVISION

P.O. BOX 840

FORM

__ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __ __

JEFFERSON CITY, MO 65105-0840

53-V

VENDOR’S USE

(573) 751-2836

• DO NOT WRITE IN SHADED AREAS

TAX RETURN

TDD (800) 735-2966

(REV. 01-2011)

Check box if Amended Return

Or Additional Return

OWNER’S NAME

REPORTING PERIOD

ADDRESS CORRECTION

MAILING ADDRESS

BUSINESS NAME

BUSINESS PHONE NUMBER:

(__ __ __) __ __ __ - __ __ __ __

MAILING ADDRESS

TELEPHONE NUMBER

(_ _ _) _ _ _ - _ _ _ _

DUE DATE:

CITY

STATE

ZIP

__ __ __ __ __

IMPORTANT:

THIS RETURN MUST BE FILED FOR THE REPORTING PERIOD INDICATED EVEN THOUGH YOU HAVE NO GROSS RECEIPTS/TAX TO REPORT.

ADJUSTMENTS

BUSINESS LOCATION

CODE

GROSS RECEIPTS

TAXABLE SALES

RATE (%)

AMOUNT OF TAX

(INDICATE + OR —)

PAGE 1 1 TOTALS . . . . . . . . . . . . . . . . .

PAGE

--

TOTALS . . . . . . . .

1.

TOTALS (ALL PAGES) . . . . . . . . . . . . .

Check our web site for the correct tax rate at If the rate

2.

SUBTRACT: 2% TIMELY PAYMENT

-

is more than 4.225%, local tax applies and you must add that higher rate to your return.

ALLOWANCE (if Applicable) . . . . . . . .

Instructions are updated annually and are provided on our web site at

3.

=

FINAL RETURN: If this is your final return, enter the close date below and check the reason for closing your account.

TOTAL VENDOR’S USE TAX DUE . .

Missouri law requires any person selling or discontinuing business to make a final sales tax return within fifteen

4.

ADD: INTEREST FOR LATE

(15) days of the sale or closing.

+

PAYMENT (See Line 4 of Instructions)

Date Business Closed: ___________________________

5.

Out of Business

Sold Business

Leased Business

+

ADD: ADDITIONS TO TAX . . . . . . . . .

SIGN AND DATE RETURN: This must be signed and dated by the taxpayer or by the taxpayer’s authorized agent.

6.

Mail to: Missouri Department of Revenue, P.O. Box 840, Jefferson City, MO 65105-0840.

-

SUBTRACT: APPROVED CREDIT . . .

I have direct control, supervision, or responsibility for filing this return and payment of the tax due. Under penalties of

7.

PAY THIS AMOUNT

perjury, I declare that this is a true, accurate, and complete return. I also declare under penalties of perjury

=

(U.S. Funds Only) . . . . . . . . . . . . . . .

that I employ no illegal or unauthorized aliens as defined under federal law and that I am not

eligible for any tax exemption, credit or abatement if I employ such aliens.

DOR USE ONLY

I ATTEST THAT I HAVE NO GROSS RECEIPTS TO REPORT FOR LOCATIONS LEFT BLANK.

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE SIGNED

TAX PERIOD (MMDDYYYY) THRU (MMDDYYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

__ __ / __ __ / __ __ __ __ THRU __ __ / __ __ / __ __ __ __

FORM 53-V (01-2011)

1

1 2

2 3

3