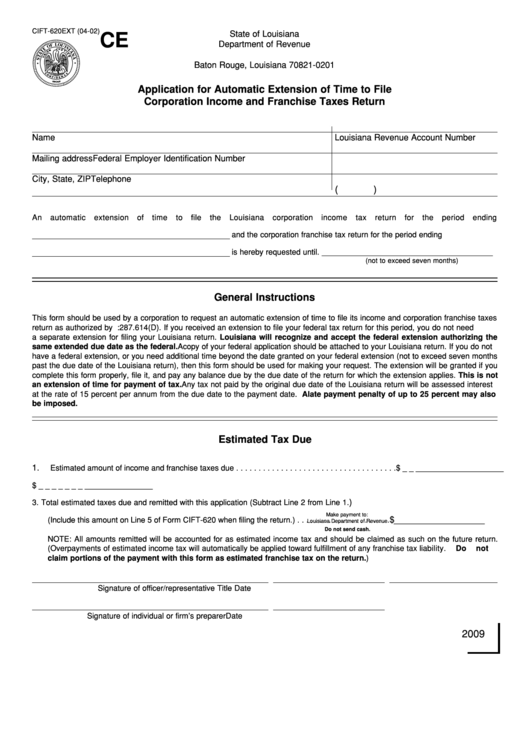

CIFT-620EXT (04-02)

State of Louisiana

CE

Department of Revenue

P.O. Box 201

Baton Rouge, Louisiana 70821-0201

Application for Automatic Extension of Time to File

Corporation Income and Franchise Taxes Return

Name

Louisiana Revenue Account Number

Mailing address

Federal Employer Identification Number

City, State, ZIP

Telephone

(

)

An

automatic

extension

of

time

to

file

the

Louisiana

corporation

income

tax

return

for

the

period

ending

and the corporation franchise tax return for the period ending

is hereby requested until. _______________________________________

(not to exceed seven months)

General Instructions

This form should be used by a corporation to request an automatic extension of time to file its income and corporation franchise taxes

return as authorized by R.S. 47:287.614(D). If you received an extension to file your federal tax return for this period, you do not need

a separate extension for filing your Louisiana return. Louisiana will recognize and accept the federal extension authorizing the

same extended due date as the federal. A copy of your federal application should be attached to your Louisiana return. If you do not

have a federal extension, or you need additional time beyond the date granted on your federal extension (not to exceed seven months

past the due date of the Louisiana return), then this form should be used for making your request. The extension will be granted if you

complete this form properly, file it, and pay any balance due by the due date of the return for which the extension applies. This is not

an extension of time for payment of tax. Any tax not paid by the original due date of the Louisiana return will be assessed interest

at the rate of 15 percent per annum from the due date to the payment date. A late payment penalty of up to 25 percent may also

be imposed.

Estimated Tax Due

1.

Estimated amount of income and franchise taxes due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

2.

Less all previously remitted estimated income and franchise tax payments . . . . . . . . . . . . . . . . . . . $ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

)

3.

Total estimated taxes due and remitted with this application (Subtract Line 2 from Line 1.

Make payment to:

$ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Include this amount on Line 5 of Form CIFT-620 when filing the return.) . . . . . . . . . . . . . . . . . . . . .

Louisiana Department of Revenue

Do not send cash.

NOTE: All amounts remitted will be accounted for as estimated income tax and should be claimed as such on the future return.

(Overpayments of estimated income tax will automatically be applied toward fulfillment of any franchise tax lia

bility.

Do

not

claim portions of the payment with this form as estimated franchise tax on the return.)

Signature of officer/representative

Title

Date

Signature of individual or firm’s preparer

Date

2009

1

1