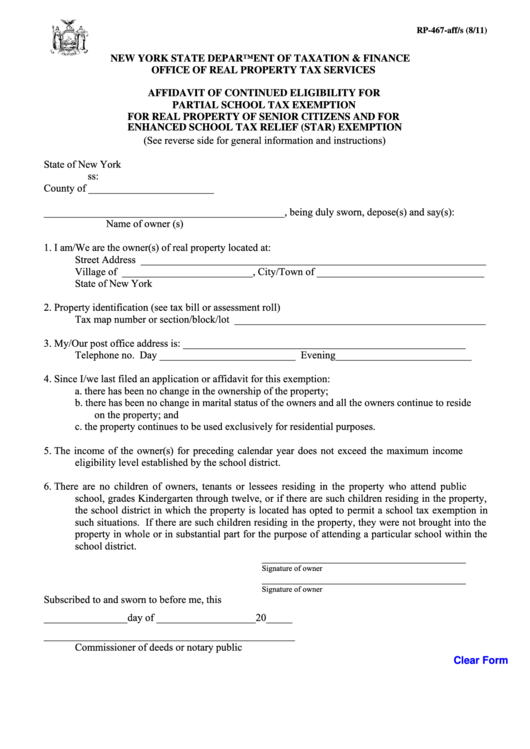

RP-467-aff/s (8/11)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

AFFIDAVIT OF CONTINUED ELIGIBILITY FOR

PARTIAL SCHOOL TAX EXEMPTION

FOR REAL PROPERTY OF SENIOR CITIZENS AND FOR

ENHANCED SCHOOL TAX RELIEF (STAR) EXEMPTION

(See reverse side for general information and instructions)

State of New York

ss:

County of ________________________

______________________________________________, being duly sworn, depose(s) and say(s):

Name of owner (s)

1.

I am/We are the owner(s) of real property located at:

Street Address __________________________________________________________________

Village of _________________________, City/Town of ________________________________

State of New York

2.

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot ________________________________________________

3.

My/Our post office address is: ______________________________________________________

Telephone no. Day __________________________

Evening__________________________

4.

Since I/we last filed an application or affidavit for this exemption:

a.

there has been no change in the ownership of the property;

b.

there has been no change in marital status of the owners and all the owners continue to reside

on the property; and

c.

the property continues to be used exclusively for residential purposes.

5.

The i ncome o f t he o wner(s) f or p receding cal endar year d oes n ot ex ceed the m aximum income

eligibility level established by the school district.

6.

There a re no c hildren of ow ners, t enants or l essees r esiding i n t he pr operty w ho a ttend publ ic

school, grades Kindergarten through twelve, or if there are such children residing in the property,

the school district in which the property is located has opted to permit a school tax exemption in

such situations. If there are such children residing in the property, they were not brought into the

property in whole or in substantial part for the purpose of attending a particular school within the

school district.

_______________________________________

Signature of owner

_______________________________________

Signature of owner

Subscribed to and sworn to before me, this

________________day of ___________________20_____

________________________________________________

Commissioner of deeds or notary public

Clear Form

1

1 2

2