Form It-141 - West Virginia Fiduciary Income Tax Return - 2015

ADVERTISEMENT

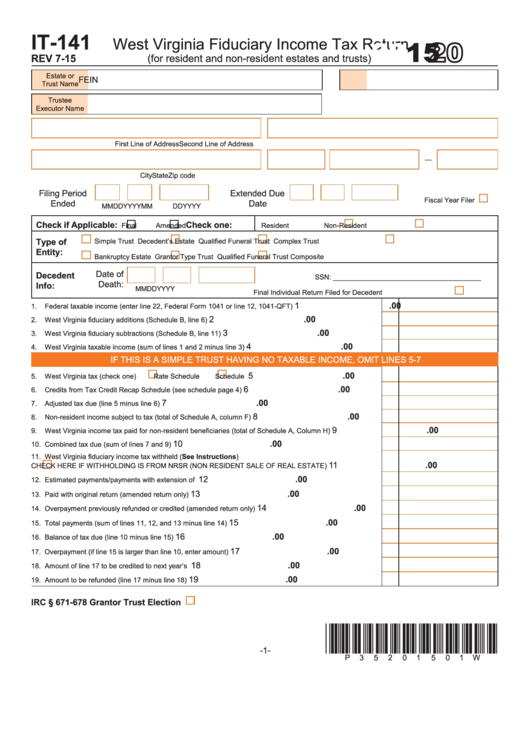

IT-141

West Virginia Fiduciary Income Tax Return

2015

REV 7-15

(for resident and non-resident estates and trusts)

Estate or

FEIN

Trust Name

Trustee

Executor Name

First Line of Address

Second Line of Address

—

City

State

Zip code

Filing Period

Extended Due

Fiscal Year Filer

Ended

Date

MM

DD

YYYY

MM

DD

YYYY

Check if Applicable:

Check one:

Final

Amended

Resident

Non-Resident

Type of

Simple Trust

Decedent’s Estate

Qualified Funeral Trust

Complex Trust

Entity:

Bankruptcy Estate

Grantor Type Trust

Qualified Funeral Trust Composite

Date of

Decedent

SSN: ______________________________________

Death:

Info:

MM

DD

YYYY

Final Individual Return Filed for Decedent

1

.00

1.

Federal taxable income (enter line 22, Federal Form 1041 or line 12, 1041-QFT)..............................................

2

.00

2.

West Virginia fiduciary additions (Schedule B, line 6)..........................................................................................

3

.00

3.

West Virginia fiduciary subtractions (Schedule B, line 11)...................................................................................

4

.00

4.

West Virginia taxable income (sum of lines 1 and 2 minus line 3).......................................................................

IF THIS IS A SIMPLE TRUST HAVING NO TAXABLE INCOME, OMIT LINES 5-7

5

.00

5.

West Virginia tax (check one)

Rate Schedule

Schedule NR.......................................................

6

.00

6.

Credits from Tax Credit Recap Schedule (see schedule page 4)........................................................................

7

.00

7.

Adjusted tax due (line 5 minus line 6)..................................................................................................................

.00

8

8.

Non-resident income subject to tax (total of Schedule A, column F)...................................................................

9

.00

9.

West Virginia income tax paid for non-resident beneficiaries (total of Schedule A, Column H)...........................

10

.00

10. Combined tax due (sum of lines 7 and 9)............................................................................................................

11. West Virginia fiduciary income tax withheld (See Instructions)

11

.00

CHECK HERE IF WITHHOLDING IS FROM NRSR (NON RESIDENT SALE OF REAL ESTATE)................

12

.00

12. Estimated payments/payments with extension of time........................................................................................

13

.00

13. Paid with original return (amended return only)...................................................................................................

14

.00

14. Overpayment previously refunded or credited (amended return only).................................................................

15

.00

15. Total payments (sum of lines 11, 12, and 13 minus line 14)................................................................................

16

.00

16. Balance of tax due (line 10 minus line 15)...........................................................................................................

17

.00

17. Overpayment (if line 15 is larger than line 10, enter amount)...............................................................................

18

.00

18. Amount of line 17 to be credited to next year’s tax..............................................................................................

19

.00

19. Amount to be refunded (line 17 minus line 18)....................................................................................................

IRC § 671-678 Grantor Trust Election

*p35201501w*

-1-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4