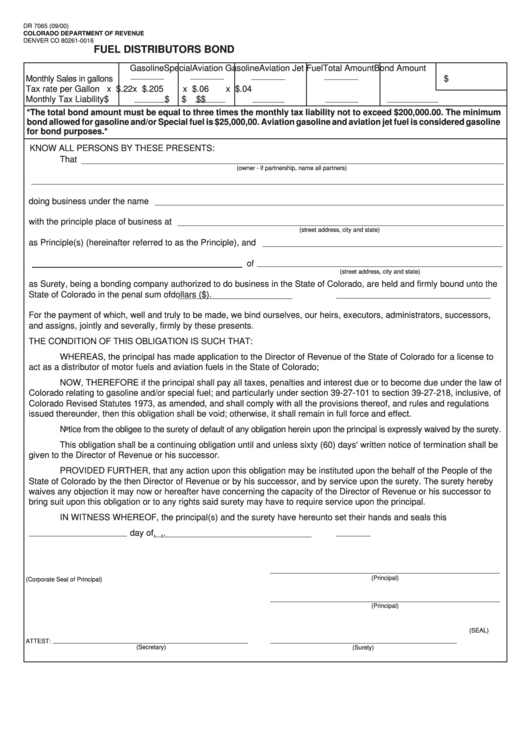

DR 7065 (09/00)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0016

FUEL DISTRIBUTORS BOND

Gasoline

Special

Aviation Gasoline Aviation Jet Fuel Total Amount

Bond Amount

Monthly Sales in gallons

$

Tax rate per Gallon

x $.22

x $.205

x $.06

x $.04

Monthly Tax Liability

$

$

$

$

$

*The total bond amount must be equal to three times the monthly tax liability not to exceed $200,000.00. The minimum

bond allowed for gasoline and/or Special fuel is $25,000,00. Aviation gasoline and aviation jet fuel is considered gasoline

for bond purposes.*

KNOW ALL PERSONS BY THESE PRESENTS:

That

(owner - if partnership, name all partners)

doing business under the name

with the principle place of business at

(street address, city and state)

as Principle(s) (hereinafter referred to as the Principle), and

of

(street address, city and state)

as Surety, being a bonding company authorized to do business in the State of Colorado, are held and firmly bound unto the

State of Colorado in the penal sum of

dollars ($

).

For the payment of which, well and truly to be made, we bind ourselves, our heirs, executors, administrators, successors,

and assigns, jointly and severally, firmly by these presents.

THE CONDITION OF THIS OBLIGATION IS SUCH THAT:

WHEREAS, the principal has made application to the Director of Revenue of the State of Colorado for a license to

act as a distributor of motor fuels and aviation fuels in the State of Colorado;

NOW, THEREFORE if the principal shall pay all taxes, penalties and interest due or to become due under the law of

Colorado relating to gasoline and/or special fuel; and particularly under section 39-27-101 to section 39-27-218, inclusive, of

Colorado Revised Statutes 1973, as amended, and shall comply with all the provisions thereof, and rules and regulations

issued thereunder, then this obligation shall be void; otherwise, it shall remain in full force and effect.

Notice from the obligee to the surety of default of any obligation herein upon the principal is expressly waived by the surety.

This obligation shall be a continuing obligation until and unless sixty (60) days' written notice of termination shall be

given to the Director of Revenue or his successor.

PROVIDED FURTHER, that any action upon this obligation may be instituted upon the behalf of the People of the

State of Colorado by the then Director of Revenue or by his successor, and by service upon the surety. The surety hereby

waives any objection it may now or hereafter have concerning the capacity of the Director of Revenue or his successor to

bring suit upon this obligation or to any rights said surety may have to require service upon the principal.

IN WITNESS WHEREOF, the principal(s) and the surety have hereunto set their hands and seals this

day of

, A.D.,

.

(Principal)

(Corporate Seal of Principal)

(Principal)

(SEAL)

ATTEST:

(Secretary)

(Surety)

1

1 2

2