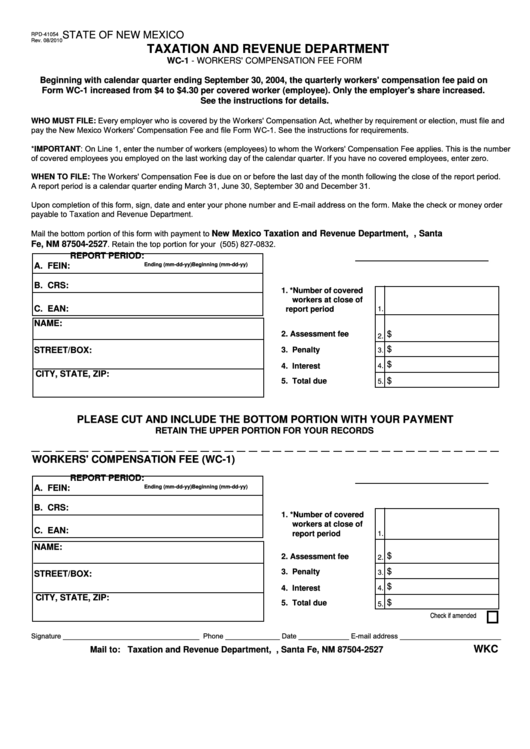

STATE OF NEW MEXICO

RPD-41054

Rev. 08/2010

TAXATION AND REVENUE DEPARTMENT

WC-1 - WORKERS' COMPENSATION FEE FORM

Beginning with calendar quarter ending September 30, 2004, the quarterly workers' compensation fee paid on

Form WC-1 increased from $4 to $4.30 per covered worker (employee). Only the employer's share increased.

See the instructions for details.

WHO MUST FILE: Every employer who is covered by the Workers' Compensation Act, whether by requirement or election, must file and

pay the New Mexico Workers' Compensation Fee and file Form WC-1. See the instructions for requirements.

*IMPORTANT: On Line 1, enter the number of workers (employees) to whom the Workers' Compensation Fee applies. This is the number

of covered employees you employed on the last working day of the calendar quarter. If you have no covered employees, enter zero.

WHEN TO FILE: The Workers' Compensation Fee is due on or before the last day of the month following the close of the report period.

A report period is a calendar quarter ending March 31, June 30, September 30 and December 31.

Upon completion of this form, sign, date and enter your phone number and E-mail address on the form. Make the check or money order

payable to Taxation and Revenue Department.

Mail the bottom portion of this form with payment to

New Mexico Taxation and Revenue Department, P.O. Box 2527, Santa

. Retain the top portion for your records. For assistance call (505) 827-0832.

Fe, NM 87504-2527

REPORT PERIOD:

A. FEIN:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

B. CRS:

1. *Number of covered

workers at close of

C. EAN:

report period

1.

NAME:

$

2. Assessment fee

2.

3.

$

3. Penalty

STREET/BOX:

$

4. Interest

4.

CITY, STATE, ZIP:

$

5. Total due

5.

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

WORKERS' COMPENSATION FEE (WC-1)

REPORT PERIOD:

A. FEIN:

Beginning (mm-dd-yy)

Ending (mm-dd-yy)

B. CRS:

1. *Number of covered

workers at close of

C. EAN:

report period

1.

NAME:

$

2. Assessment fee

2.

$

3.

3. Penalty

STREET/BOX:

$

4. Interest

4.

CITY, STATE, ZIP:

$

5. Total due

5.

Check if amended

Signature ___________________________________ Phone ______________ Date _____________ E-mail address __________________________

WKC

Mail to: Taxation and Revenue Department, P.O. Box 2527, Santa Fe, NM 87504-2527

1

1