Form 104ep - Colorado Tax-Individuals Worksheet - 2012

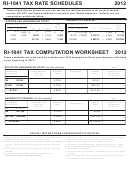

ADVERTISEMENT

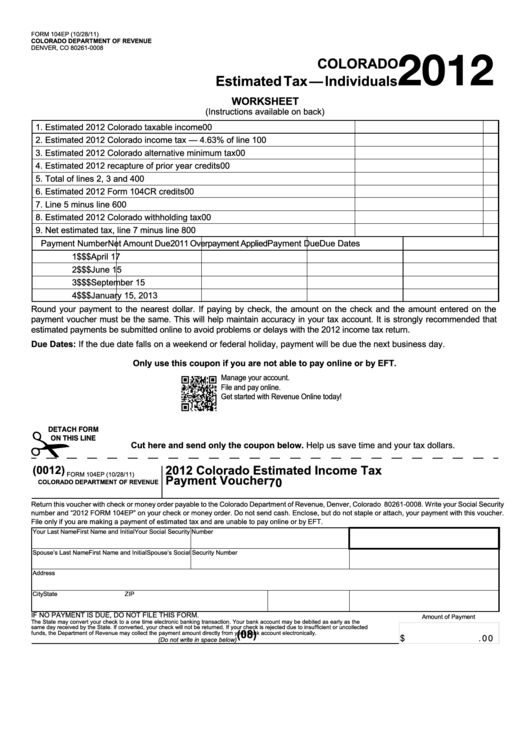

FORM 104EP (10/28/11)

COLORADO DEPARTMENT OF REVENUE

2012

DENVER, CO 80261-0008

COLORADO

Estimated Tax — Individuals

WORKSHEET

(Instructions available on back)

1. Estimated 2012 Colorado taxable income

00

2. Estimated 2012 Colorado income tax — 4.63% of line 1

00

3. Estimated 2012 Colorado alternative minimum tax

00

4. Estimated 2012 recapture of prior year credits

00

5. Total of lines 2, 3 and 4

00

6. Estimated 2012 Form 104CR credits

00

7. Line 5 minus line 6

00

8. Estimated 2012 Colorado withholding tax

00

00

9. Net estimated tax, line 7 minus line 8

Payment Number

Net Amount Due

2011 Overpayment Applied

Payment Due

Due Dates

1

$

$

$

April 17

2

$

$

$

June 15

3

$

$

$

September 15

4

$

$

$

January 15, 2013

Round your payment to the nearest dollar. If paying by check, the amount on the check and the amount entered on the

payment voucher must be the same. This will help maintain accuracy in your tax account. It is strongly recommended that

estimated payments be submitted online to avoid problems or delays with the 2012 income tax return.

Due Dates: If the due date falls on a weekend or federal holiday, payment will be due the next business day.

Only use this coupon if you are not able to pay online or by EFT.

Manage your account.

File and pay online.

Get started with Revenue Online today!

DETACH FORM

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

2012 Colorado Estimated Income Tax

(0012)

FORM 104EP (10/28/11)

Payment Voucher

70

COLORADO DEPARTMENT OF REVENUE

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0008. Write your Social Security

number and “2012 FORM 104EP” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher.

File only if you are making a payment of estimated tax and are unable to pay online or by EFT.

Your Last Name

First Name and Initial

Your Social Security Number

Spouse’s Last Name

First Name and Initial

Spouse’s Social Security Number

Address

City

State

ZIP

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.

Amount of Payment

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the

same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected

(08)

funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

$

. 0 0

(Do not write in space below)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2