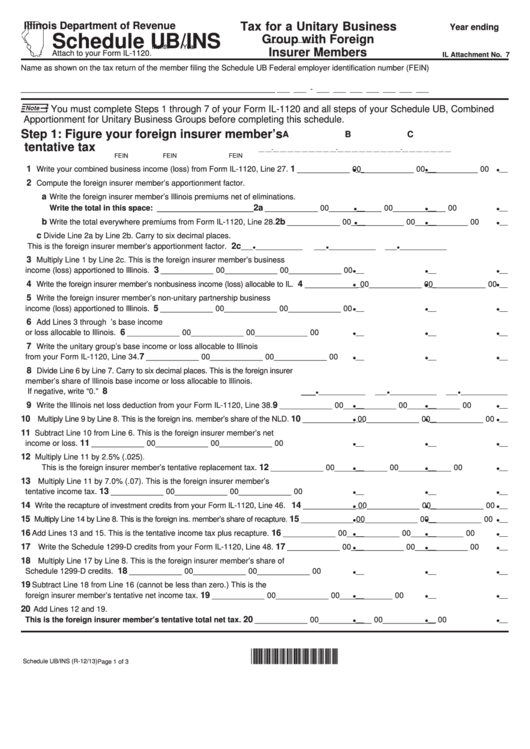

Illinois Department of Revenue

Tax for a Unitary Business

Year ending

Schedule UB/INS

_____ _____

Group with Foreign

Month

Year

Insurer Members

Attach to your Form IL-1120.

IL Attachment No. 7

Name as shown on the tax return of the member filing the Schedule UB

Federal employer identification number (FEIN)

__________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

You must complete Steps 1 through 7 of your Form IL-1120 and all steps of your Schedule UB, Combined

Apportionment for Unitary Business Groups before completing this schedule.

Step 1: Figure your foreign insurer member’s

A

B

C

tentative tax

__ __-__ __ __ __ __ __ __

__ __-__ __ __ __ __ __ __

__ __-__ __ __ __ __ __ __

FEIN

FEIN

FEIN

Write your combined business income (loss) from Form IL-1120, Line 27.

____________ 00

____________ 00

____________ 00

1

1

Compute the foreign insurer member’s apportionment factor.

2

Write the foreign insurer member’s Illinois premiums net of eliminations.

a

____________ 00 ____________ 00

____________ 00

2a

Write the total in this space: ______________________

Write the total everywhere premiums from Form IL-1120, Line 28.

____________ 00 ____________ 00

____________ 00

b

2b

Divide Line 2a by Line 2b. Carry to six decimal places.

c

This is the foreign insurer member’s apportionment factor.

___

____________

___

____________

___

____________

2c

•

•

•

Multiply Line 1 by Line 2c. This is the foreign insurer member’s business

3

income (loss) apportioned to Illinois.

____________ 00

____________ 00

____________ 00

3

Write the foreign insurer member’s nonbusiness income (loss) allocable to IL.

____________ 00

____________ 00

____________ 00

4

4

Write the foreign insurer member’s non-unitary partnership business

5

income (loss) apportioned to Illinois.

____________ 00

____________ 00

____________ 00

5

Add Lines 3 through 5. This is the foreign insurer member’s base income

6

or loss allocable to Illinois.

____________ 00

____________ 00

____________ 00

6

Write the unitary group’s base income or loss allocable to Illinois

7

from your Form IL-1120, Line 34.

____________ 00

____________ 00

____________ 00

7

Divide Line 6 by Line 7. Carry to six decimal places. This is the foreign insurer

8

member’s share of Illinois base income or loss allocable to Illinois.

If negative, write “0.”

8 ___ •

____________

___

•

____________

___

•

____________

Write the Illinois net loss deduction from your Form IL-1120, Line 38.

____________ 00

____________ 00

____________ 00

9

9

Multiply Line 9 by Line 8. This is the foreign ins. member’s share of the NLD.

____________ 00

____________ 00

____________ 00

10

10

Subtract Line 10 from Line 6. This is the foreign insurer member’s net

11

income or loss.

____________ 00

____________ 00

____________ 00

11

Multiply Line 11 by 2.5% (.025)

.

12

This is the foreign insurer member’s tentative replacement tax.

____________ 00

____________ 00

____________ 00

12

Multiply Line 11 by 7.0% (.07). This is the foreign insurer member’s

13

tentative income tax.

____________ 00

____________ 00

____________ 00

13

Write the recapture of investment credits from your Form IL-1120, Line 46.

____________ 00

____________ 00

____________ 00

14

14

Multiply Line 14 by Line 8. This is the foreign ins. member’s share of recapture.

____________ 00

____________ 00

____________ 00

15

15

Add Lines 13 and 15. This is the tentative income tax plus recapture.

____________ 00

____________ 00

____________ 00

16

16

Write the Schedule 1299-D credits from your Form IL-1120, Line 48.

____________ 00

____________ 00

____________ 00

17

17

Multiply Line 17 by Line 8. This is the foreign insurer member’s share of

18

Schedule 1299-D credits.

____________ 00

____________ 00

____________ 00

18

Subtract Line 18 from Line 16 (cannot be less than zero.) This is the

19

foreign insurer member’s tentative net income tax.

____________ 00

____________ 00

____________ 00

19

Add Lines 12 and 19.

20

____________ 00

____________ 00

____________ 00

20

This is the foreign insurer member’s tentative total net tax.

*333501110*

Page 1 of 3

Schedule UB/INS (R-12/13)

1

1 2

2 3

3