Clear Form

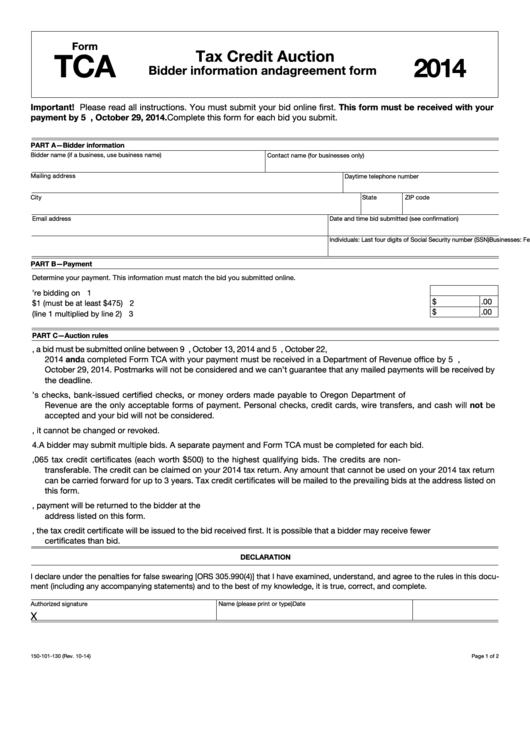

Form

Tax Credit Auction

TCA

2014

Bidder information and agreement form

Important! Please read all instructions. You must submit your bid online first. This form must be received with your

payment by 5 p.m. PDT, October 29, 2014. Complete this form for each bid you submit.

PART A—Bidder information

Bidder name (if a business, use business name)

Contact name (for businesses only)

Mailing address

Daytime telephone number

City

State

ZIP code

Date and time bid submitted (see confirmation)

Email address

Businesses: Federal employer identification number (FEIN) or Oregon business identification number (BIN)

Individuals: Last four digits of Social Security number (SSN)

PART B—Payment

Determine your payment. This information must match the bid you submitted online.

1. Number of certificates you’re bidding on ......................................................................................................... 1

$

.00

2. Bid amount per certificate in multiples of $1 (must be at least $475) .............................................................. 2

$

.00

3. Payment due (line 1 multiplied by line 2) .......................................................................................................... 3

PART C—Auction rules

1. To be considered in the auction, a bid must be submitted online between 9 a.m., October 13, 2014 and 5 p.m. PDT, October 22,

2014 and a completed Form TCA with your payment must be received in a Department of Revenue office by 5 p.m. PDT,

October 29, 2014. Postmarks will not be considered and we can’t guarantee that any mailed payments will be received by

the deadline.

2. Bank-issued cashier’s checks, bank-issued certified checks, or money orders made payable to Oregon Department of

Revenue are the only acceptable forms of payment. Personal checks, credit cards, wire transfers, and cash will not be

accepted and your bid will not be considered.

3. Once a bid is submitted, it cannot be changed or revoked.

4. A bidder may submit multiple bids. A separate payment and Form TCA must be completed for each bid.

5. We will issue up to 4,065 tax credit certificates (each worth $500) to the highest qualifying bids. The credits are non-

transferable. The credit can be claimed on your 2014 tax return. Any amount that cannot be used on your 2014 tax return

can be carried forward for up to 3 years. Tax credit certificates will be mailed to the prevailing bids at the address listed on

this form.

6. If the associated bid does not result in the issuance of a tax credit certificate, payment will be returned to the bidder at the

address listed on this form.

7. If there is a tie, the tax credit certificate will be issued to the bid received first. It is possible that a bidder may receive fewer

certificates than bid.

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined, understand, and agree to the rules in this docu-

ment (including any accompanying statements) and to the best of my knowledge, it is true, correct, and complete.

Authorized signature

Name (please print or type)

Date

X

150-101-130 (Rev. 10-14)

Page 1 of 2

1

1 2

2