FOR

CALENDAR YEAR

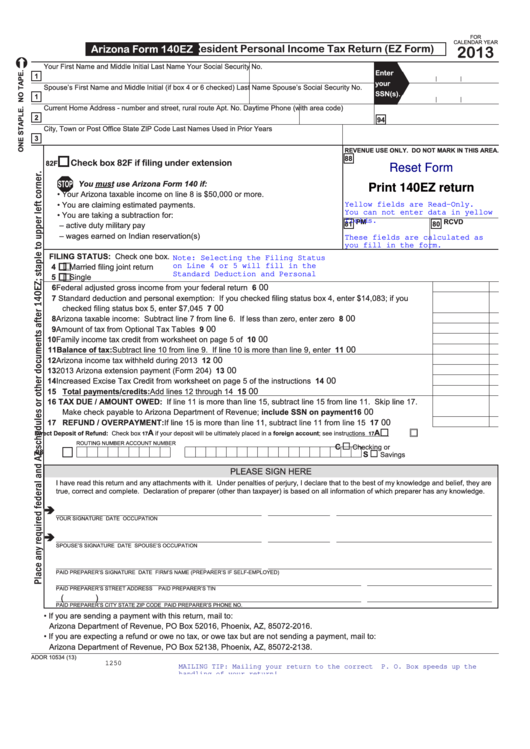

Resident Personal Income Tax Return (EZ Form)

Arizona Form 140EZ

2013

Your First Name and Middle Initial

Last Name

Your Social Security No.

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

Last Names Used in Prior Years

3

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Check box 82F if filing under extension

82F

Reset Form

STOP

You must use Arizona Form 140 if:

Print 140EZ return

• Your Arizona taxable income on line 8 is $50,000 or more.

• You are claiming estimated payments.

Yellow fields are Read-Only.

• You are taking a subtraction for:

You can not enter data in yellow

81 PM

80 RCVD

fields.

– active duty military pay

– wages earned on Indian reservation(s)

These fields are calculated as

you fill in the form.

FILING STATUS: Check one box.

Note: Selecting the Filing Status

4

Married filing joint return

on Line 4 or 5 will fill in the

Standard Deduction and Personal

5

Single

Exemption value on Line 7.

00

6 Federal adjusted gross income from your federal return ...........................................................................

6

7 Standard deduction and personal exemption: If you checked filing status box 4, enter $14,083; if you

00

checked filing status box 5, enter $7,045 ...................................................................................................

7

00

8 Arizona taxable income: Subtract line 7 from line 6. If less than zero, enter zero ...................................

8

00

9 Amount of tax from Optional Tax Tables ....................................................................................................

9

Go to Optional Tax Table

00

10 Family income tax credit from worksheet on page 5 of instructions........................................................... 10

00

11 Balance of tax: Subtract line 10 from line 9. If line 10 is more than line 9, enter zero............................ 11

00

12 Arizona income tax withheld during 2013 .................................................................................................. 12

00

13 2013 Arizona extension payment (Form 204) ............................................................................................ 13

00

14 Increased Excise Tax Credit from worksheet on page 5 of the instructions ............................................... 14

00

15 Total payments/credits: Add lines 12 through 14 ................................................................................... 15

16 TAX DUE / AMOUNT OWED: If line 11 is more than line 15, subtract line 15 from line 11. Skip line 17.

00

Make check payable to Arizona Department of Revenue; include SSN on payment .............................. 16

00

17 REFUND / OVERPAYMENT: If line 15 is more than line 11, subtract line 11 from line 15 ....................... 17

A

A

Direct Deposit of Refund: Check box

if your deposit will be ultimately placed in a foreign account; see instructions ....

17

17

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

PLEASE SIGN HERE

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are

true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

YOUR SIGNATURE

DATE

OCCUPATION

SPOUSE’S SIGNATURE

DATE

SPOUSE’S OCCUPATION

PAID PREPARER’S SIGNATURE

DATE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PAID PREPARER’S STREET ADDRESS

PAID PREPARER’S TIN

(

)

PAID PREPARER’S CITY

STATE

ZIP CODE

PAID PREPARER’S PHONE NO.

• If you are sending a payment with this return, mail to:

Arizona Department of Revenue, PO Box 52016, Phoenix, AZ, 85072-2016.

• If you are expecting a refund or owe no tax, or owe tax but are not sending a payment, mail to:

Arizona Department of Revenue, PO Box 52138, Phoenix, AZ, 85072-2138.

ADOR 10534 (13)

1250

MAILING TIP: Mailing your return to the correct

P. O. Box speeds up the

handling of your return!

1

1 2

2 3

3 4

4 5

5 6

6 7

7