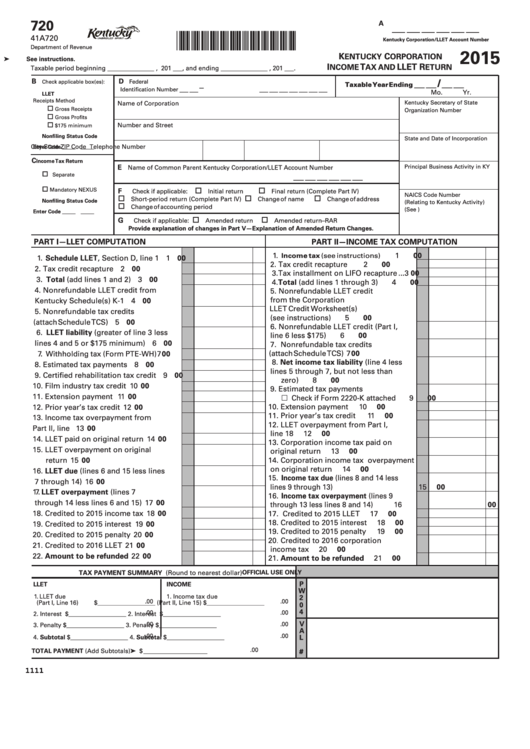

720

__ __ __ __ __ __

A

*1500030200*

41A720

Kentucky Corporation/LLET Account Number

Department of Revenue

2015

K

C

ENTUCKY

ORPORATION

➤ See instructions.

I

T

LLET R

NCOME

AX AND

ETURN

Taxable period beginning _______________ , 201 ___, and ending _______________ , 201 ___.

__ __ / __ __

B

D

Federal

Check applicable box(es):

Taxable Year Ending

__ __ – __ __ __ __ __ __ __

Identification Number

Mo.

Yr.

LLET

Receipts Method

Kentucky Secretary of State

Name of Corporation

Gross Receipts

Organization Number

Gross Profits

Number and Street

$175 minimum

Nonfiling Status Code

State and Date of Incorporation

City

State

ZIP Code

Telephone Number

Enter Code _____ _____

C

Income Tax Return

E

Principal Business Activity in KY

Name of Common Parent

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

Separate

Mandatory NEXUS

F

Check if applicable:

Initial return

Final return (Complete Part IV)

NAICS Code Number

Short-period return (Complete Part IV)

Change of name

Change of address

Nonfiling Status Code

(Relating to Kentucky Activity)

Change of accounting period

(See )

Enter Code _____ _____

G

Check if applicable:

Amended return

Amended return–RAR

Provide explanation of changes in Part V—Explanation of Amended Return Changes.

PART I—LLET COMPUTATION

PART II—INCOME TAX COMPUTATION

1.

............

1

00

Income tax (see instructions)

1. Schedule LLET, Section D, line 1 .......... 1

00

2. Tax credit recapture ...........................

2

00

2. Tax credit recapture ............................... 2

00

3. Tax installment on LIFO recapture ...

3

00

3. Total (add lines 1 and 2) ........................ 3

00

4. Total (add lines 1 through 3) .............

4

00

4. Nonrefundable LLET credit from

5. Nonrefundable LLET credit

from the Corporation

Kentucky Schedule(s) K-1 ..................... 4

00

LLET Credit Worksheet(s)

5. Nonrefundable tax credits

(see instructions) ...............................

5

00

(attach Schedule TCS) ............................ 5

00

6. Nonrefundable LLET credit (Part I,

6. LLET liability (greater of line 3 less

line 6 less $175) .................................

6

00

lines 4 and 5 or $175 minimum) ........... 6

00

7. Nonrefundable tax credits

(attach Schedule TCS) .......................

7

00

7. Withholding tax (Form PTE-WH)........... 7

00

8. Net income tax liability (line 4 less

8. Estimated tax payments ....................... 8

00

lines 5 through 7, but not less than

9. Certified rehabilitation tax credit .......... 9

00

zero) ....................................................

8

00

10. Film industry tax credit ......................... 10

00

9. Estimated tax payments

11. Extension payment ............................... 11

00

Check if Form 2220-K attached .....

9

00

10. Extension payment ...........................

10

00

12. Prior year’s tax credit ............................ 12

00

11. Prior year’s tax credit ........................

11

00

13. Income tax overpayment from

12. LLET overpayment from Part I,

Part II, line 17.......................................... 13

00

line 18 .................................................

12

00

14. LLET paid on original return ................. 14

00

13. Corporation income tax paid on

15. LLET overpayment on original

original return ....................................

13

00

return ...................................................... 15

00

14. Corporation income tax overpayment

on original return ..............................

14

00

16. LLET due (lines 6 and 15 less lines

15. Income tax due (lines 8 and 14 less

7 through 14) .......................................... 16

00

lines 9 through 13) ................................

15

00

17. LLET overpayment (lines 7

16. Income tax overpayment (lines 9

through 14 less lines 6 and 15) ............. 17

00

through 13 less lines 8 and 14) ............

16

00

18. Credited to 2015 income tax ................. 18

00

17. Credited to 2015 LLET .......................

17

00

18. Credited to 2015 interest ...................

18

00

19. Credited to 2015 interest ....................... 19

00

19. Credited to 2015 penalty ...................

19

00

20. Credited to 2015 penalty ....................... 20

00

20. Credited to 2016 corporation

21. Credited to 2016 LLET ........................... 21

00

income tax .........................................

20

00

22. Amount to be refunded ........................ 22

00

21. Amount to be refunded ....................

21

00

TAX PAYMENT SUMMARY (Round to nearest dollar)

OFFICIAL USE ONLY

P

LLET

INCOME

W

1. LLET due

1. Income tax due

2

.00

.00

(Part I, Line 16)

$___________________

(Part II, Line 15)

$___________________

0

4

.00

.00

2. Interest

$___________________

2. Interest

$___________________

V

.00

.00

3. Penalty

$___________________

3. Penalty

$___________________

A

.00

.00

4. Subtotal

$___________________

4. Subtotal

$___________________

L

.00

#

TOTAL PAYMENT (Add Subtotals) ................................➤ $ _____________________

1111

1

1 2

2 3

3