Form S1040ez - City Of Saginaw Income Tax - 2001

ADVERTISEMENT

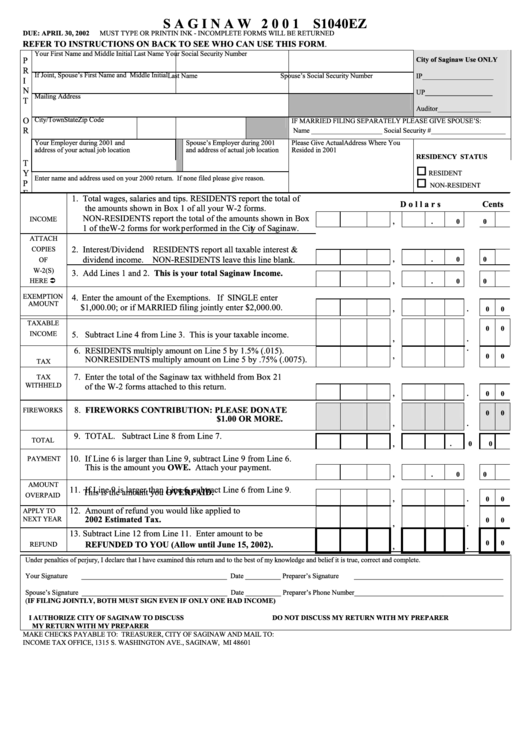

S A G I N A W 2 0 0 1 S1040EZ

DUE: APRIL 30, 2002

MUST TYPE OR PRINT IN INK - INCOMPLETE FORMS WILL BE RETURNED

REFER TO INSTRUCTIONS ON BACK TO SEE WHO CAN USE THIS FORM.

Your First Name and Middle Initial

Last Name

Your Social Security Number

P

City of Saginaw Use ONLY

R

If Joint, Spouse’s First Name and Middle Initial

Last Name

Spouse’s Social Security Number

IP____________________

I

N

UP___________________

Mailing Address

T

Auditor_______________

O

City/Town

State

Zip Code

IF MARRIED FILING SEPARATELY PLEASE GIVE SPOUSE’S:

R

Name ____________________ Social Security #_____________________

Your Employer during 2001 and

Spouse’s Employer during 2001

Please Give Actual Address Where You

address of your actual job location

and address of actual job location

Resided in 2001

RESIDENCY STATUS

T

Y

RESIDENT

Enter name and address used on your 2000 return. If none filed please give reason.

P

NON-RESIDENT

E

1. Total wages, salaries and tips. RESIDENTS report the total of

D o l l a r s

Cents

the amounts shown in Box 1 of all your W-2 forms.

NON-RESIDENTS report the total of the amounts shown in Box

INCOME

,

.

0

0

1 of theW-2 forms for work performed in the City of Saginaw.

ATTACH

2. Interest/Dividend RESIDENTS report all taxable interest &

COPIES

dividend income. NON-RESIDENTS leave this line blank.

,

.

0

0

OF

W-2(S)

3. Add Lines 1 and 2. This is your total Saginaw Income.

HERE

,

.

0

0

EXEMPTION

4. Enter the amount of the Exemptions. If SINGLE enter

AMOUNT

$1,000.00; or if MARRIED filing jointly enter $2,000.00.

,

.

0

0

TAXABLE

0

0

INCOME

5. Subtract Line 4 from Line 3. This is your taxable income.

,

.

6. RESIDENTS multiply amount on Line 5 by 1.5% (.015).

,

.

0

0

NONRESIDENTS multiply amount on Line 5 by .75% (.0075).

TAX

7. Enter the total of the Saginaw tax withheld from Box 21

TAX

WITHHELD

of the W-2 forms attached to this return.

,

.

0

0

8. FIREWORKS CONTRIBUTION: PLEASE DONATE

FIREWORKS

0

0

$1.00 OR MORE.

,

.

TOTAL

9. TOTAL. Subtract Line 8 from Line 7.

,

.

0

0

10. If Line 6 is larger than Line 9, subtract Line 9 from Line 6.

PAYMENT

This is the amount you OWE. Attach your payment.

,

.

0

0

AMOUNT

11. If Line 9 is larger than Line 6, subtract Line 6 from Line 9

.

OVERPAID

This is the amount you OVERPAID.

,

.

0

0

12. Amount of refund you would like applied to

APPLY TO

2002 Estimated Tax.

NEXT YEAR

0

0

,

.

13. Subtract Line 12 from Line 11. Enter amount to be

0

0

REFUNDED TO YOU (Allow until June 15, 2002).

REFUND

,

.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete.

Your Signature

_________________________________________ Date __________ Preparer’s Signature

__________________________________________

Spouse’s Signature _________________________________________ Date __________ Preparer’s Phone Number__________________________________________

(IF FILING JOINTLY, BOTH MUST SIGN EVEN IF ONLY ONE HAD INCOME)

I AUTHORIZE CITY OF SAGINAW TO DISCUSS

DO NOT DISCUSS MY RETURN WITH MY PREPARER

MY RETURN WITH MY PREPARER

MAKE CHECKS PAYABLE TO: TREASURER, CITY OF SAGINAW AND MAIL TO:

INCOME TAX OFFICE, 1315 S. WASHINGTON AVE., SAGINAW, MI 48601

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1