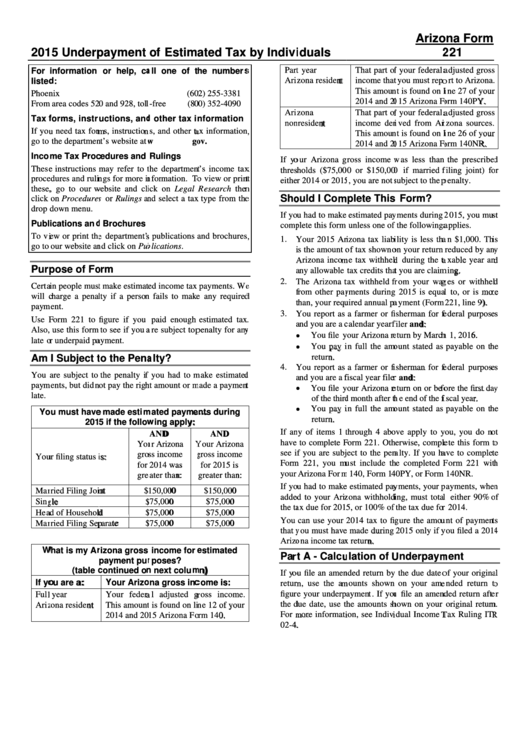

Form 221 - Underpayment Of Estimated Tax By Individuals Instructions - 2015

ADVERTISEMENT

Arizo

ona Form

201

15 Underp

payment

of Estima

ated Tax

by Indivi

iduals

2

221

Part

t year

That part of

f your federal a

adjusted gross

For

information

or help, ca

all one of t

he numbers

s

Ariz

zona resident

income that

t you must repo

ort to Arizona.

listed

d:

This amoun

nt is found on li

ine 27 of your

Phoen

nix

(60

02) 255-3381

2014 and 20

015 Arizona Fo

orm 140PY.

From

m area codes 52

0 and 928, toll

l-free

(80

00) 352-4090

Ariz

zona

That part of

f your federal a

adjusted gross

Tax f

forms, instr

uctions, and

d other tax i

nformation

non

nresident

income deri

ived from Ari

izona sources.

If you

u need tax form

ms, instruction

ns, and other ta

ax information,

,

This amoun

nt is found on li

ine 26 of your

go to

the departmen

nt’s website at w

ov.

2014 and 20

015 Arizona Fo

orm 140NR.

Inco

me Tax Proc

cedures and

Rulings

If yo

our Arizona g

gross income w

was less than

the prescribe

d

These

e instructions

may refer to t

the department

t’s income tax

x

thres

sholds ($75,00

00 or $150,000

0 if married f

filing joint) fo

or

proce

edures and rulin

ngs for more in

nformation. To

o view or print

t

eithe

er 2014 or 2015

5, you are not s

subject to the p

penalty.

these,

, go to our w

website and cli

ick on Legal R

Research then

n

Sho

ould I Com

mplete This

Form?

click

on Procedures

s or Rulings an

nd select a tax

x type from the

e

drop

down menu.

If yo

ou had to make

e estimated pay

yments during 2

2015, you mus

st

Publ

ications and

d Brochures

comp

plete this form

unless one of

the following a

applies.

To vi

iew or print th

e department’s

s publications

and brochures,

,

1. Y

Your 2015 Ar

rizona tax liabi

ility is less tha

an $1,000. Thi

is

go to

our website an

nd click on Pub

blications.

i

is the amount o

of tax shown o

on your return

reduced by any

y

A

Arizona incom

me tax withheld

d during the ta

axable year an

d

Purp

pose of Fo

orm

a

any allowable

tax credits that

t you are claim

ming.

2. T

The Arizona t

tax withheld fr

from your wag

ges or withheld

d

Certa

ain people must

t make estimat

ted income tax

payments. We

e

f

from other pay

yments during

2015 is equal

l to, or is mor

e

will c

charge a penal

lty if a person

n fails to make

e any required

d

t

than, your requ

uired annual pa

ayment (Form

221, line 9).

paym

ment.

3. Y

You report as

a farmer or fi

sherman for fe

ederal purpose

es

Use F

Form 221 to

figure if you

paid enough

estimated tax

.

a

and you are a c

calendar year f

filer and:

Also,

use this form

to see if you a

are subject to p

penalty for any

y

You file y

your Arizona re

eturn by March

h 1, 2016.

late o

or underpaid pa

ayment.

You pay i

in full the amo

ount stated as

payable on th

e

return.

Am

I Subject t

to the Pena

alty?

4. Y

You report as

a farmer or fi

isherman for fe

ederal purpose

es

You

are subject to

the penalty if

f you had to m

make estimated

d

a

and you are a f

fiscal year filer

r and:

paym

ments, but did n

not pay the righ

ht amount or m

made a payment

t

You file y

your Arizona re

eturn on or befo

fore the first day

y

late.

of the third

d month after th

he end of the fi

iscal year.

You pay i

in full the amo

ount stated as

payable on th

e

Yo

ou must have

e made estim

mated payme

ents during

return.

201

5 if the follow

wing apply:

If an

ny of items 1 t

through 4 abo

ove apply to y

ou, you do no

ot

AND

AND

have

to complete F

Form 221. Oth

erwise, comple

ete this form to

o

You

ur Arizona

Y

Your Arizona

see i

f you are subj

ect to the pena

alty. If you ha

ave to complet

e

gro

ss income

g

gross income

You

ur filing status i

is:

Form

m 221, you mu

ust include th

he completed F

Form 221 with

h

for

2014 was

for 2015 is

your

Arizona Form

m 140, Form 14

40PY, or Form

140NR.

gre

eater than:

greater than:

If yo

ou had to make

e estimated pay

yments, your p

payments, when

n

Mar

rried Filing Join

nt

$

150,000

$150,000

added

d to your Ariz

zona withholdi

ing, must total

l either 90% o

of

Sing

gle

$75,000

$

$75,000

the ta

ax due for 2015

5, or 100% of

the tax due for

r 2014.

Hea

ad of Househol

d

$75,000

$

$75,000

You

can use your

2014 tax to fig

gure the amou

unt of payment

ts

Mar

rried Filing Sep

parate

$75,000

$

$75,000

that y

you must have

e made during

2015 only if y

you filed a 2014

4

Arizo

ona income tax

x return.

W

What is my Ar

rizona gross

income for e

estimated

Par

rt A - Calcu

ulation of U

Underpaym

ment

payment pur

rposes?

(table c

continued on

n next colum

mn)

If yo

ou file an amen

nded return by

the due date o

of your origina

al

If yo

ou are a:

Your Arizo

ona gross inc

come is:

return

rn, use the am

mounts shown

on your ame

ended return t

o

figur

re your underp

ayment. If you

u file an amend

ded return afte

er

Full

l year

Your federa

al adjusted gr

ross income.

the d

due date, use th

he amounts sh

hown on your

original return

n.

Ariz

zona resident

This amount

t is found on lin

ne 12 of your

For m

more informati

ion, see Indivi

idual Income T

Tax Ruling ITR

R

2014 and 20

15 Arizona Fo

orm 140.

02-4.

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5