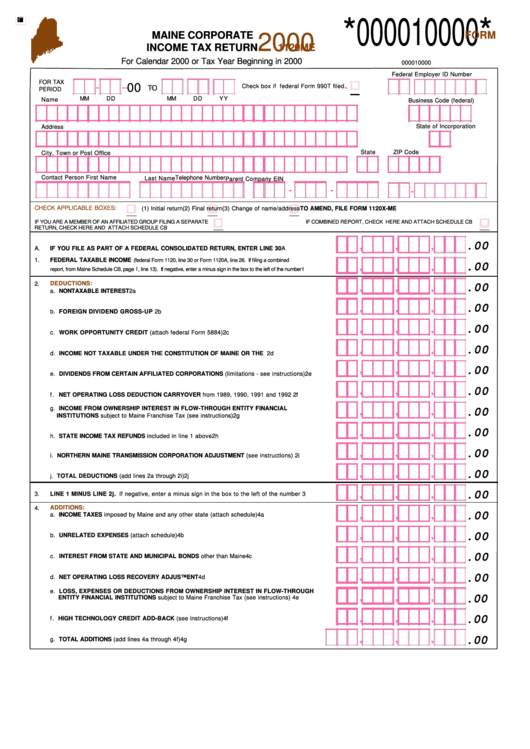

Form 1120me - Maine Corporate Income Tax Return - 2000

ADVERTISEMENT

*000010000*

MAINE CORPORATE

FORM

2000

INCOME TAX RETURN

1120ME

For Calendar 2000 or Tax Year Beginning in 2000

000010000

Federal Employer ID Number

FOR TAX

00

-

-

-

-

-

Check box if federal Form 990T filed

TO

PERIOD

MM

DD

MM

DD

Y Y

Name

Business Code (federal)

State of Incorporation

Address

State

ZIP Code

City, Town or Post Office

Contact Person First Name

Telephone Number

Last Name

Parent Company EIN

-

-

-

CHECK APPLICABLE BOXES:

(1) Initial return

(2) Final return

(3) Change of name/address

TO AMEND, FILE FORM 1120X-ME

IF YOU ARE A MEMBER OF AN AFFILIATED GROUP FILING A SEPARATE

IF COMBINED REPORT, CHECK HERE AND ATTACH SCHEDULE CB

RETURN, CHECK HERE AND ATTACH SCHEDULE CB

.00

,

,

,

A.

IF YOU FILE AS PART OF A FEDERAL CONSOLIDATED RETURN, ENTER LINE 30 ..................... A

1.

FEDERAL TAXABLE INCOME

(federal Form 1120, line 30 or Form 1120A, line 26. If filing a combined

.00

,

,

,

report, from Maine Schedule CB, page 1, line 13). If negative, enter a minus sign in the box to the left of the number ..................... 1

DEDUCTIONS:

2.

.00

,

,

,

a. NONTAXABLE INTEREST .................................................................................................. 2a

.00

,

,

,

b. FOREIGN DIVIDEND GROSS-UP ...................................................................................... 2b

.00

,

,

,

c. WORK OPPORTUNITY CREDIT (attach federal Form 5884) ................................................... 2c

.00

,

,

,

d. INCOME NOT TAXABLE UNDER THE CONSTITUTION OF MAINE OR THE U.S. ...................... 2d

,

,

,

.00

e. DIVIDENDS FROM CERTAIN AFFILIATED CORPORATIONS (limitations - see instructions) ........ 2e

,

,

,

.00

f . NET OPERATING LOSS DEDUCTION CARRYOVER from 1989, 1990, 1991 and 1992 ............... 2f

g. INCOME FROM OWNERSHIP INTEREST IN FLOW-THROUGH ENTITY FINANCIAL

,

,

,

.00

INSTITUTIONS subject to Maine Franchise Tax (see instructions) ............................................. 2g

,

,

,

.00

h. STATE INCOME TAX REFUNDS included in line 1 above......................................................... 2h

,

,

,

.00

i. NORTHERN MAINE TRANSMISSION CORPORATION ADJUSTMENT (see instructions) ............... 2i

,

,

,

.00

j. TOTAL DEDUCTIONS (add lines 2a through 2i) ....................................................................... 2j

,

,

,

.00

3.

LINE 1 MINUS LINE 2j. If negative, enter a minus sign in the box to the left of the number ............ 3

ADDITIONS:

4.

,

,

,

.00

a. INCOME TAXES imposed by Maine and any other state (attach schedule) ................................ 4a

,

,

,

.00

b. UNRELATED EXPENSES (attach schedule) .......................................................................... 4b

,

,

,

.00

c. INTEREST FROM STATE AND MUNICIPAL BONDS other than Maine ....................................... 4c

,

,

,

.00

d. NET OPERATING LOSS RECOVERY ADJUSTMENT .............................................................. 4d

e. LOSS, EXPENSES OR DEDUCTIONS FROM OWNERSHIP INTEREST IN FLOW-THROUGH

,

,

,

.00

ENTITY FINANCIAL INSTITUTIONS subject to Maine Franchise Tax (see instructions) ............... 4e

,

,

,

.00

f . HIGH TECHNOLOGY CREDIT ADD-BACK (see instructions) .................................................. 4f

,

,

,

.00

g. TOTAL ADDITIONS (add lines 4a through 4f) ................................................................. 4g

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4