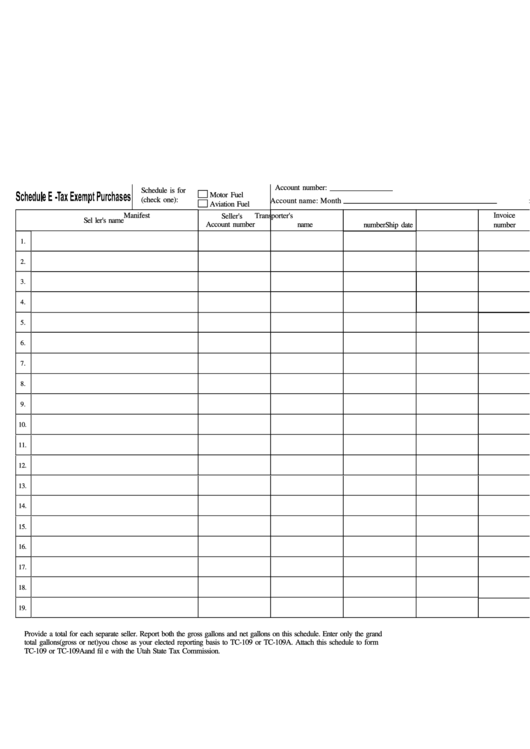

Schedule E - Tax Exempt Purchases

ADVERTISEMENT

Account number: _________________

Schedule is for

Motor Fuel

(check one):

Account name:

Month:

Aviati on Fuel

Transporter's

Manifest

Invoice

Seller's

Sel ler's name

Account number

name

number

Ship date

number

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

Provi de a total for each separate sel

ler. Report both the gross gall

ons and net gallons on this schedul

e. Enter onl y the grand

total gallons

(gross or net)

you chose as your elected reporting basis to TC-109 or TC-109A. Attach this schedul

e to form

TC-109 or TC-109A

and fil e with the Utah State T

ax Commission.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1