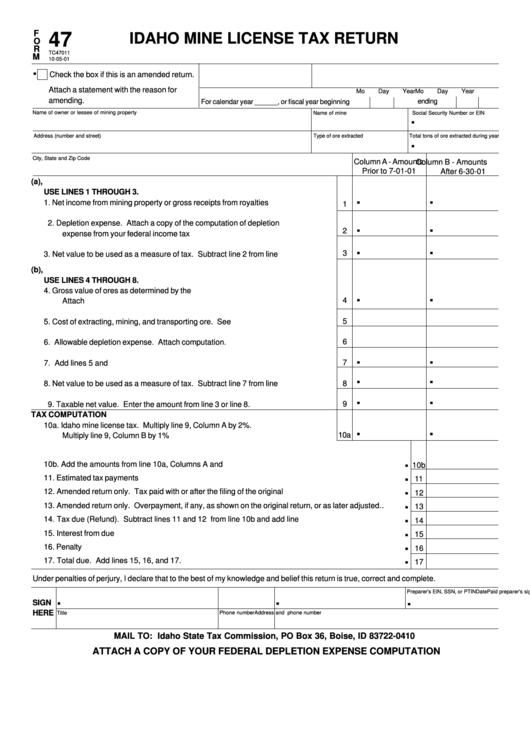

F

47

IDAHO MINE LICENSE TAX RETURN

O

R

TC47011

M

10-05-01

.

Check the box if this is an amended return.

Attach a statement with the reason for

Mo

Day

Year

Mo

Day

Year

amending.

ending

For calendar year ______, or fiscal year beginning

Name of owner or lessee of mining property

Name of mine

Social Security Number or EIN

.

Address (number and street)

Type of ore extracted

Total tons of ore extracted during year

.

City, State and Zip Code

Column A - Amounts

Column B - Amounts

Prior to 7-01-01

After 6-30-01

A. IF TAX IS BEING COMPUTED ACCORDING TO SECTION 47-1202(a),

USE LINES 1 THROUGH 3.

.

.

1.

Net income from mining property or gross receipts from royalties ..................

1

2.

Depletion expense. Attach a copy of the computation of depletion

.

.

2

expense from your federal income tax return. ................................................

.

.

3

3.

Net value to be used as a measure of tax. Subtract line 2 from line 1. ...........

B. IF TAX IS BEING COMPUTED ACCORDING TO SECTION 47-1202(b),

USE LINES 4 THROUGH 8.

4.

Gross value of ores as determined by the U.S. Department of Interior.

.

.

4

Attach computation. ......................................................................................

5

5.

Cost of extracting, mining, and transporting ore. See instructions. ................

6

6.

Allowable depletion expense. Attach computation. .......................................

.

.

7

7.

Add lines 5 and 6. .........................................................................................

.

.

8

8.

Net value to be used as a measure of tax. Subtract line 7 from line 4. ...........

.

.

9

9.

Taxable net value. Enter the amount from line 3 or line 8.

TAX COMPUTATION

10a. Idaho mine license tax. Multiply line 9, Column A by 2%.

.

.

10a

Multiply line 9, Column B by 1%. ....................................................................

.

10b. Add the amounts from line 10a, Columns A and B. ........................................................................

10b

.

11.

Estimated tax payments .................................................................................................................

11

.

12.

Amended return only. Tax paid with or after the filing of the original return ....................................

12

.

13.

Amended return only. Overpayment, if any, as shown on the original return, or as later adjusted. .

13

.

14.

Tax due (Refund). Subtract lines 11 and 12 from line 10b and add line 13. ..................................

14

.

15.

Interest from due date ...................................................................................................................

15

.

16.

Penalty ..........................................................................................................................................

16

.

17.

Total due. Add lines 15, 16, and 17.

17

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Signature of officer/owner

Date

Paid preparer's signature

Preparer's EIN, SSN, or PTIN

.

.

.

SIGN

HERE

Title

Phone number

Address and phone number

MAIL TO: Idaho State Tax Commission, PO Box 36, Boise, ID 83722-0410

ATTACH A COPY OF YOUR FEDERAL DEPLETION EXPENSE COMPUTATION

1

1 2

2