Clear Form

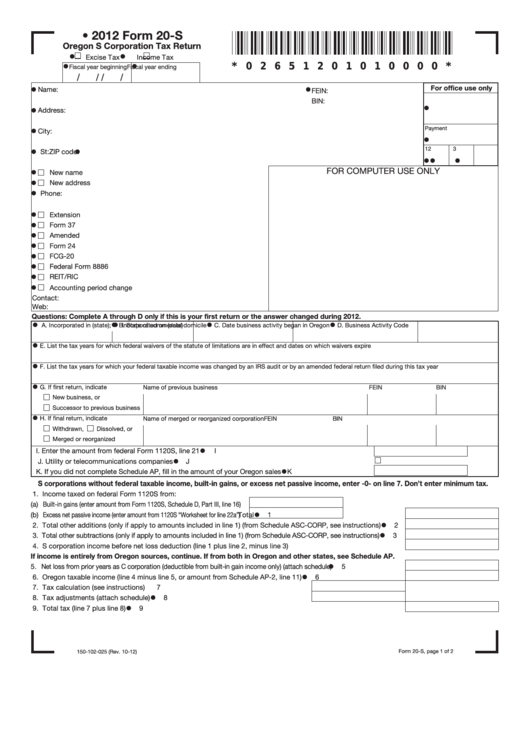

• 2012 Form 20-S

Oregon S Corporation Tax Return

•

•

Excise Tax

Income Tax

•

•

* 0 2 6 5 1 2 0 1 0 1 0 0 0 0 *

Fiscal year beginning

Fiscal year ending

/

/

/

/

•

•

For office use only

Name:

FEIN:

BIN:

•

•

Address:

•

Payment

City:

•

•

•

1

2

3

St:

ZIP code:

•

•

•

•

FOR COMPUTER USE ONLY

New name

•

New address

•

Phone:

•

Extension

•

Form 37

•

Amended

•

Form 24

•

FCG-20

•

Federal Form 8886

•

REIT/RIC

•

Accounting period change

Contact:

Web:

Questions: Complete A through D only if this is your first return or the answer changed during 2012.

•

•

•

•

•

A. Incorporated in (state);

Incorporated on (date)

B. State of commercial domicile

C. Date business activity began in Oregon

D. Business Activity Code

•

E. List the tax years for which federal waivers of the statute of limitations are in effect and dates on which waivers expire

•

F. List the tax years for which your federal taxable income was changed by an IRS audit or by an amended federal return filed during this tax year

•

G. If first return, indicate

Name of previous business

FEIN

BIN

New business, or

Successor to previous business

•

H. If final return, indicate

Name of merged or reorganized corporation

FEIN

BIN

Withdrawn,

Dissolved, or

Merged or reorganized

•

I. Enter the amount from federal Form 1120S, line 21 ..............................................................................

I

•

J. Utility or telecommunications companies ..............................................................................................

J

•

K. If you did not complete Schedule AP, fill in the amount of your Oregon sales ......................................

K

S corporations without federal taxable income, built-in gains, or excess net passive income, enter -0- on line 7. Don’t enter minimum tax.

1. Income taxed on federal Form 1120S from:

(a) Built-in gains (enter amount from Form 1120S, Schedule D, Part III, line 16) ....

•

(b) Excess net passive income (enter amount from 1120S “Worksheet for line 22a”) ....

............ Total

1

•

2. Total other additions (only if apply to amounts included in line 1) (from Schedule ASC-CORP, see instructions) .....

2

•

3. Total other subtractions (only if apply to amounts included in line 1) (from Schedule ASC-CORP, see instructions) ....

3

4. S corporation income before net loss deduction (line 1 plus line 2, minus line 3) ...........................................................4

If income is entirely from Oregon sources, continue. If from both in Oregon and other states, see Schedule AP.

•

5. Net loss from prior years as C corporation (deductible from built-in gain income only) (attach schedule) .............................

5

•

6. Oregon taxable income (line 4 minus line 5, or amount from Schedule AP-2, line 11) .............................................

6

7. Tax calculation (see instructions) ..............................................................................

7

•

8. Tax adjustments (attach schedule) ...........................................................................

8

•

9. Total tax (line 7 plus line 8) ........................................................................................................................................

9

Form 20-S, page 1 of 2

150-102-025 (Rev. 10-12)

1

1 2

2