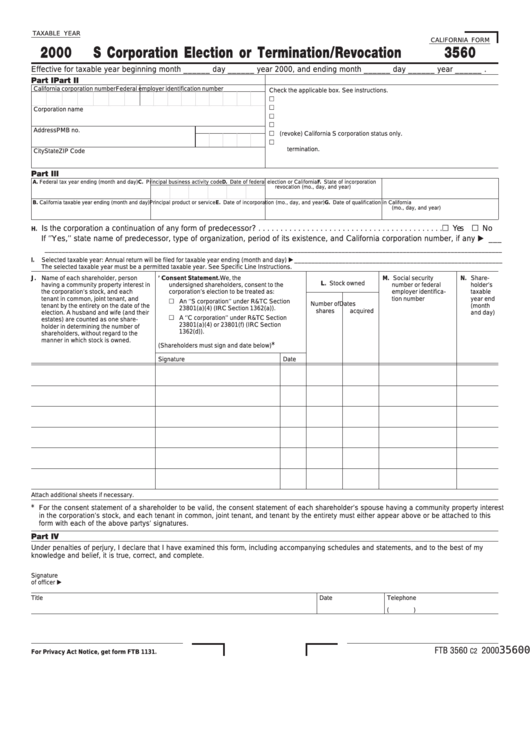

California Form 3560 - S Corporation Election Or Termination/revocation - 2000

ADVERTISEMENT

TAXABLE YEAR

CALIFORNIA FORM

2000

S Corporation Election or Termination/Revocation

3560

Effective for taxable year beginning month ______ day ______ year 2000, and ending month ______ day ______ year ______ .

Part I

Part II

California corporation number

Federal employer identification number

Check the applicable box. See instructions.

1. Report a new federal S corporation election.

2. Elect to remain or to become a California C corporation.

Corporation name

3. Elect California S corporation status by a federal S corporation.

4. Report a federal S corporation termination/revocation.

Address

PMB no.

5. Terminate (revoke) California S corporation status only.

6. Correct an untimely or invalid S corporation election or an inadvertent

termination.

City

State

ZIP Code

Part Ill

A. Federal tax year ending (month and day)

C. Principal business activity code

D. Date of federal election or California

F. State of incorporation

revocation (mo., day, and year)

B. California taxable year ending (month and day)

Principal product or service

E. Date of incorporation (mo., day, and year)

G. Date of qualification in California

(mo., day, and year)

Is the corporation a continuation of any form of predecessor? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

H.

If ‘’Yes,’’ state name of predecessor, type of organization, period of its existence, and California corporation number, if any

___

______________________________________________________________________________________________________________________________________

I.

Selected taxable year: Annual return will be filed for taxable year ending (month and day)

_____________________________________________________________

The selected taxable year must be a permitted taxable year. See Specific Line Instructions.

J. Name of each shareholder, person

K. Shareholders’ Consent Statement. We, the

M. Social security

N. Share-

L. Stock owned

having a community property interest in

undersigned shareholders, consent to the

number or federal

holder’s

the corporation’s stock, and each

corporation’s election to be treated as:

employer identifica-

taxable

tenant in common, joint tenant, and

tion number

year end

An ‘’S corporation’’ under R&TC Section

Number of

Dates

tenant by the entirety on the date of the

(month

23801(a)(4) (IRC Section 1362(a)).

shares

acquired

election. A husband and wife (and their

and day)

A ‘’C corporation’’ under R&TC Section

estates) are counted as one share-

23801(a)(4) or 23801(f) (IRC Section

holder in determining the number of

1362(d)).

shareholders, without regard to the

manner in which stock is owned.

*

(Shareholders must sign and date below)

Signature

Date

Attach additional sheets if necessary.

*

For the consent statement of a shareholder to be valid, the consent statement of each shareholder’s spouse having a community property interest

in the corporation’s stock, and each tenant in common, joint tenant, and tenant by the entirety must either appear above or be attached to this

form with each of the above partys’ signatures.

Part IV

Under penalties of perjury, I declare that I have examined this form, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete.

Signature

of officer

Title

Date

Telephone

(

)

356000109

FTB 3560

2000

C2

For Privacy Act Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1