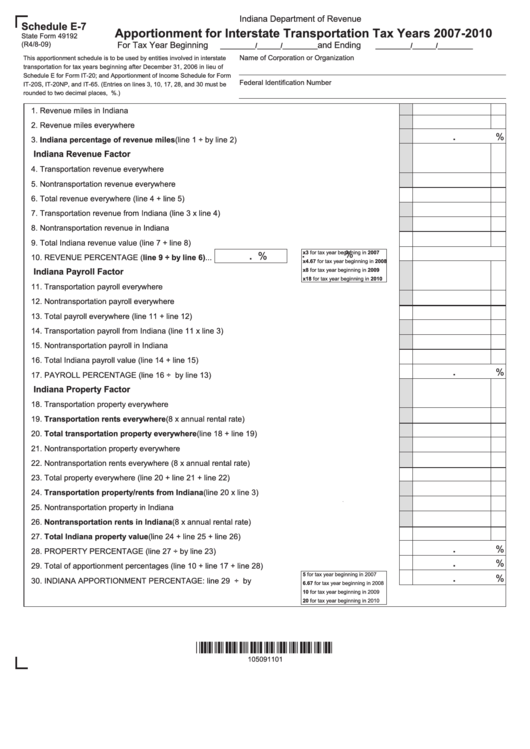

Schedule E-7 (State Form 49192) - Apportionment For Interstate Transportation Tax Years 2007-2010

ADVERTISEMENT

Indiana Department of Revenue

Schedule E-7

Apportionment for Interstate Transportation Tax Years 2007-2010

State Form 49192

For Tax Year Beginning

and Ending

(R4/8-09)

_________/______/_________

_________/______/_________

Name of Corporation or Organization

This apportionment schedule is to be used by entities involved in interstate

transportation for tax years beginning after December 31, 2006 in lieu of

Schedule E for Form IT-20; and Apportionment of Income Schedule for Form

Federal Identification Number

IT-20S, IT-20NP, and IT-65. (Entries on lines 3, 10, 17, 28, and 30 must be

rounded to two decimal places, i.e. 98.76%.)

1. Revenue miles in Indiana .........................................................................................................................

1

2. Revenue miles everywhere ......................................................................................................................

2

.

%

3. Indiana percentage of revenue miles (line 1 ÷ by line 2) ..........................................................................................

3

Indiana Revenue Factor

4. Transportation revenue everywhere ........................................................................................................

4

5. Nontransportation revenue everywhere ...................................................................................................

5

6. Total revenue everywhere (line 4 + line 5) ...............................................................................................

6

7. Transportation revenue from Indiana (line 3 x line 4) ...............................................................................

7

8. Nontransportation revenue in Indiana ......................................................................................................

8

9. Total Indiana revenue value (line 7 + line 8) .............................................................................................

9

.

%

.

%

x3 for tax year beginning in 2007

10. REVENUE PERCENTAGE (line 9 ÷ by line 6) ...

.....

... 10

x4.67 for tax year beginning in 2008

Indiana Payroll Factor

x8 for tax year beginning in 2009

x18 for tax year beginning in 2010

11. Transportation payroll everywhere ........................................................................................................... 11

12. Nontransportation payroll everywhere ...................................................................................................... 12

13. Total payroll everywhere (line 11 + line 12) .............................................................................................. 13

14. Transportation payroll from Indiana (line 11 x line 3) ................................................................................ 14

15. Nontransportation payroll in Indiana ......................................................................................................... 15

16. Total Indiana payroll value (line 14 + line 15) ........................................................................................... 16

.

%

17. PAYROLL PERCENTAGE (line 16 ÷ by line 13) ...................................................................................... 17

Indiana Property Factor

18. Transportation property everywhere ......................................................................................................... 18

19. Transportation rents everywhere (8 x annual rental rate)..................................................................... 19

20. Total transportation property everywhere (line 18 + line 19) ............................................................... 20

21. Nontransportation property everywhere ................................................................................................... 21

22. Nontransportation rents everywhere (8 x annual rental rate) ................................................................... 22

23. Total property everywhere (line 20 + line 21 + line 22) ............................................................................. 23

24. Transportation property/rents from Indiana (line 20 x line 3) .............................................................. 24

25. Nontransportation property in Indiana ...................................................................................................... 25

26. Nontransportation rents in Indiana (8 x annual rental rate) ................................................................. 26

27. Total Indiana property value (line 24 + line 25 + line 26) ...................................................................... 27

.

%

28. PROPERTY PERCENTAGE (line 27 ÷ by line 23) ................................................................................... 28

.

%

29. Total of apportionment percentages (line 10 + line 17 + line 28) .............................................................. 29

5 for tax year beginning in 2007

.

%

30. INDIANA APPORTIONMENT PERCENTAGE: line 29 ÷ by .......................

... 30

6.67 for tax year beginning in 2008

10 for tax year beginning in 2009

20 for tax year beginning in 2010

*105091101*

105091101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3