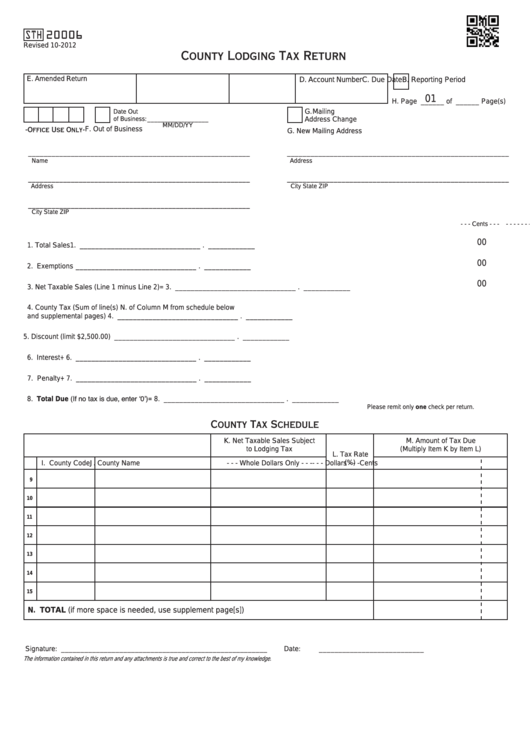

STH

20006

Revised 10-2012

County Lodging Tax Return

E. Amended Return

A.Taxpayer FEIN/SSN

B. Reporting Period

C. Due Date

D. Account Number

01

H. Page ______ of ______ Page(s)

G. Mailing

Date Out

Address Change

of Business: __________________

MM/DD/YY

F. Out of Business

-Office Use Only-

G. New Mailing Address

_________________________________________________________

_________________________________________________________

Address

Name

_________________________________________________________

_________________________________________________________

City

State

ZIP

Address

_________________________________________________________

City

State

ZIP

- - - - - - - - - - - - Dollars - - - - - - - - - - - -

- - - Cents - - -

00

1. Total Sales .................................................................................................................................1. _______________________________ . ____________

00

2. Exemptions............................................................................................................................. - 2. _______________________________ . ____________

00

3. Net Taxable Sales (Line 1 minus Line 2) ............................................................................... = 3. _______________________________ . ____________

4. County Tax (Sum of line(s) N. of Column M from schedule below

and supplemental pages) ......................................................................................................... 4. _______________________________ . ____________

5. Discount (limit $2,500.00)....................................................................................................... - 5. _______________________________ . ____________

6. Interest .................................................................................................................................. + 6. _______________________________ . ____________

7. Penalty .................................................................................................................................. + 7. _______________________________ . ____________

8. Total Due (If no tax is due, enter ‘0’) ..................................................................................... = 8. _______________________________ . ____________

Please remit only one check per return.

County Tax Schedule

K. Net Taxable Sales Subject

M. Amount of Tax Due

to Lodging Tax

(Multiply Item K by Item L)

L. Tax Rate

I. County Code

J. County Name

- - - Whole Dollars Only - - -

(%)

- - - Dollars - - -

Cents

9

10

11

12

13

14

15

N. TOTAL (if more space is needed, use supplement page[s])

Signature: _____________________________________________________

Date: ___________________________

The information contained in this return and any attachments is true and correct to the best of my knowledge.

1

1 2

2