Form B-7-1800 - Beverage Tax Bond

Download a blank fillable Form B-7-1800 - Beverage Tax Bond in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form B-7-1800 - Beverage Tax Bond with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

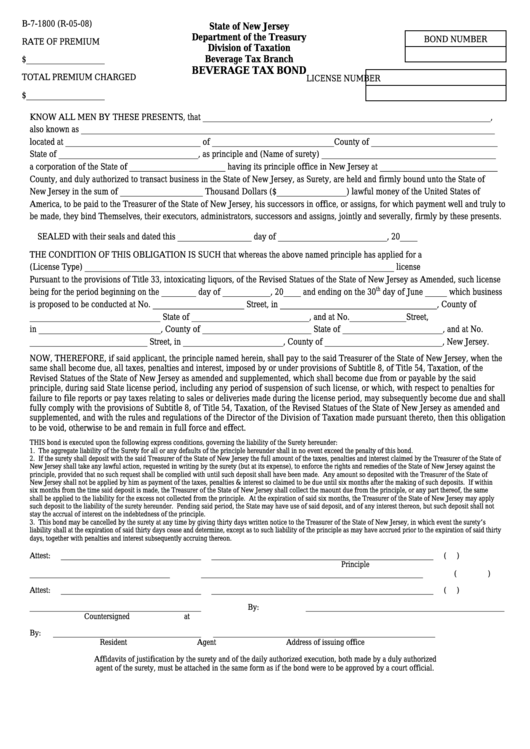

B-7-1800 (R-05-08)

State of New Jersey

Department of the Treasury

BOND NUMBER

RATE OF PREMIUM

Division of Taxation

Beverage Tax Branch

$__________________

BEVERAGE TAX BOND

TOTAL PREMIUM CHARGED

LICENSE NUMBER

$__________________

KNOW ALL MEN BY THESE PRESENTS, that __________________________________________________________________,

also known as _______________________________________________________________________________________________

located at _______________________________ of ____________________________County of _____________________________

State of ________________________________, as principle and (Name of surety) ________________________________________

a corporation of the State of ______________________ having its principle office in New Jersey at ___________________________

County, and duly authorized to transact business in the State of New Jersey, as Surety, are held and firmly bound unto the State of

New Jersey in the sum of ___________________ Thousand Dollars ($________________) lawful money of the United States of

America, to be paid to the Treasurer of the State of New Jersey, his successors in office, or assigns, for which payment well and truly to

be made, they bind Themselves, their executors, administrators, successors and assigns, jointly and severally, firmly by these presents.

SEALED with their seals and dated this _________________ day of _________________________, 20____

THE CONDITION OF THIS OBLIGATION IS SUCH that whereas the above named principle has applied for a

(License Type) _______________________________________________________________________ license

Pursuant to the provisions of Title 33, intoxicating liquors, of the Revised Statues of the State of New Jersey as Amended, such license

th

being for the period beginning on the ________ day of ___________, 20____ and ending on the 30

day of June _____ which business

is proposed to be conducted at No. _____________________ Street, in ____________________________________, County of

______________________________ State of ___________________________, and at No._____________Street,

in ____________________________, County of _________________________ State of _______________________, and at No.

___________________________ Street, in _______________________, County of ___________________________, New Jersey.

NOW, THEREFORE, if said applicant, the principle named herein, shall pay to the said Treasurer of the State of New Jersey, when the

same shall become due, all taxes, penalties and interest, imposed by or under provisions of Subtitle 8, of Title 54, Taxation, of the

Revised Statues of the State of New Jersey as amended and supplemented, which shall become due from or payable by the said

principle, during said State license period, including any period of suspension of such license, or which, with respect to penalties for

failure to file reports or pay taxes relating to sales or deliveries made during the license period, may subsequently become due and shall

fully comply with the provisions of Subtitle 8, of Title 54, Taxation, of the Revised Statues of the State of New Jersey as amended and

supplemented, and with the rules and regulations of the Director of the Division of Taxation made pursuant thereto, then this obligation

to be void, otherwise to be and remain in full force and effect.

THIS bond is executed upon the following express conditions, governing the liability of the Surety hereunder:

1. The aggregate liability of the Surety for all or any defaults of the principle hereunder shall in no event exceed the penalty of this bond.

2. If the surety shall deposit with the said Treasurer of the State of New Jersey the full amount of the taxes, penalties and interest claimed by the Treasurer of the State of

New Jersey shall take any lawful action, requested in writing by the surety (but at its expense), to enforce the rights and remedies of the State of New Jersey against the

principle, provided that no such request shall be complied with until such deposit shall have been made. Any amount so deposited with the Treasurer of the State of

New Jersey shall not be applied by him as payment of the taxes, penalties & interest so claimed to be due until six months after the making of such deposits. If within

six months from the time said deposit is made, the Treasurer of the State of New Jersey shall collect the maount due from the principle, or any part thereof, the same

shall be applied to the liability for the excess not collected from the principle. At the expiration of said six months, the Treasurer of the State of New Jersey may apply

such deposit to the liability of the surety hereunder. Pending said period, the State may have use of said deposit, and of any interest thereon, but such deposit shall not

stay the accrual of interest on the indebtedness of the principle.

3. This bond may be cancelled by the surety at any time by giving thirty days written notice to the Treasurer of the State of New Jersey, in which event the surety’s

liability shall at the expiration of said thirty days cease and determine, except as to such liability of the principle as may have accrued prior to the expiration of said thirty

days, together with penalties and interest subsequently accruing thereon.

Attest:

____________________________________

_________________________________________________________ (L.S.)

Principle

____________________________________

_________________________________________________________ (L.S.)

Attest:

____________________________________

_________________________________________________________ (L.S.)

____________________________________________

By:

___________________________________________________

Countersigned at

By:

______________________________________

_________________________________________________________

Resident Agent

Address of issuing office

Affidavits of justification by the surety and of the daily authorized execution, both made by a duly authorized

agent of the surety, must be attached in the same form as if the bond were to be approved by a court official.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1