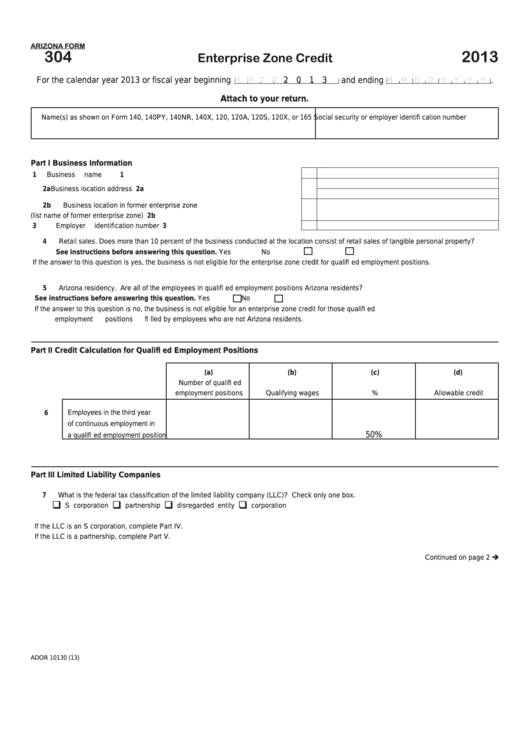

ARIZONA FORM

304

2013

Enterprise Zone Credit

For the calendar year 2013 or fiscal year beginning

2 0 1 3 and ending

.

M M D D

M M D D Y Y Y Y

Attach to your return.

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X, or 165

Social security or employer identifi cation number

Part I

Business Information

1

Business name ...................................................................................................

1

2a Business location address ..................................................................................

2a

2b Business location in former enterprise zone

(list name of former enterprise zone) .................................................................

2b

3

Employer identifi cation number ..........................................................................

3

4

Retail sales. Does more than 10 percent of the business conducted at the location consist of retail sales of tangible personal property?

See instructions before answering this question.

Yes

No

If the answer to this question is yes, the business is not eligible for the enterprise zone credit for qualifi ed employment positions.

5

Arizona residency. Are all of the employees in qualifi ed employment positions Arizona residents?

See instructions before answering this question.

Yes

No

If the answer to this question is no, the business is not eligible for an enterprise zone credit for those qualifi ed

employment positions fi lled by employees who are not Arizona residents.

Part II

Credit Calculation for Qualifi ed Employment Positions

(a)

(b)

(c)

(d)

Number of qualifi ed

employment positions

Qualifying wages

%

Allowable credit

Employees in the third year

6

of continuous employment in

50%

a qualifi ed employment position

Part III Limited Liability Companies

7 What is the federal tax classification of the limited liability company (LLC)? Check only one box.

S corporation

partnership

disregarded entity

corporation

If the LLC is an S corporation, complete Part IV.

If the LLC is a partnership, complete Part V.

Continued on page 2

ADOR 10130 (13)

1

1 2

2 3

3 4

4