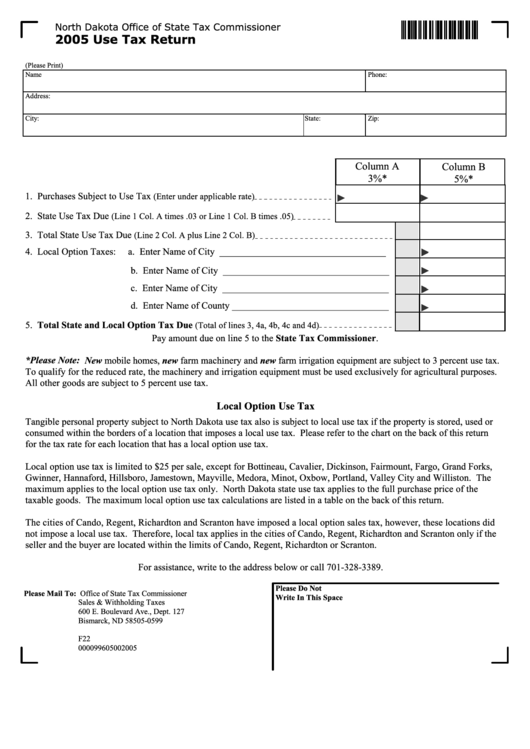

North Dakota Office of State Tax Commissioner

2005 Use Tax Return

(Please Print)

Name

Phone:

Address:

City:

State:

Zip:

Column A

Column B

3%*

5%*

1. Purchases Subject to Use Tax

(Enter under applicable rate)

2. State Use Tax Due

(Line 1 Col. A times .03 or Line 1 Col. B times .05)

3. Total State Use Tax Due

(Line 2 Col. A plus Line 2 Col. B)

4. Local Option Taxes:

a. Enter Name of City ___________________________________

b. Enter Name of City ___________________________________

c. Enter Name of City ___________________________________

d. Enter Name of County _________________________________

5. Total State and Local Option Tax Due

(Total of lines 3, 4a, 4b, 4c and 4d)

Pay amount due on line 5 to the State Tax Commissioner.

*Please Note: New mobile homes, new farm machinery and new farm irrigation equipment are subject to 3 percent use tax.

To qualify for the reduced rate, the machinery and irrigation equipment must be used exclusively for agricultural purposes.

All other goods are subject to 5 percent use tax.

Local Option Use Tax

Tangible personal property subject to North Dakota use tax also is subject to local use tax if the property is stored, used or

consumed within the borders of a location that imposes a local use tax. Please refer to the chart on the back of this return

for the tax rate for each location that has a local option use tax.

Local option use tax is limited to $25 per sale, except for Bottineau, Cavalier, Dickinson, Fairmount, Fargo, Grand Forks,

Gwinner, Hannaford, Hillsboro, Jamestown, Mayville, Medora, Minot, Oxbow, Portland, Valley City and Williston. The

maximum applies to the local option use tax only. North Dakota state use tax applies to the full purchase price of the

taxable goods. The maximum local option use tax calculations are listed in a table on the back of this return.

The cities of Cando, Regent, Richardton and Scranton have imposed a local option sales tax, however, these locations did

not impose a local use tax. Therefore, local tax applies in the cities of Cando, Regent, Richardton and Scranton only if the

seller and the buyer are located within the limits of Cando, Regent, Richardton or Scranton.

For assistance, write to the address below or call 701-328-3389.

Please Do Not

Please Mail To: Office of State Tax Commissioner

Write In This Space

Sales & Withholding Taxes

600 E. Boulevard Ave., Dept. 127

Bismarck, ND 58505-0599

F22

000099605002005

1

1