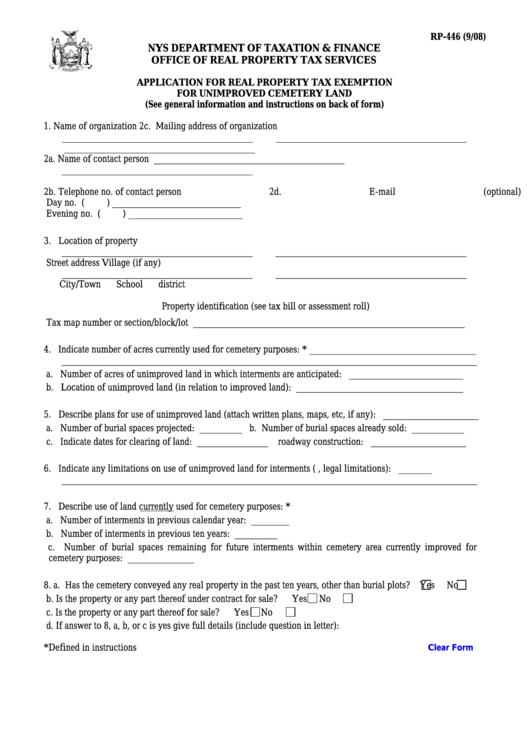

RP-446 (9/08)

NYS DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REAL PROPERTY TAX EXEMPTION

FOR UNIMPROVED CEMETERY LAND

(See general information and instructions on back of form)

1. Name of organization

2c. Mailing address of organization

________________________________________

________________________________________

________________________________________

2a. Name of contact person

________________________________________

________________________________________

2b. Telephone no. of contact person

2d. E-mail (optional) __________________________

Day no. (

) ___________________________

Evening no. (

) ________________________

3. Location of property

________________________________________

________________________________________

Street address

Village (if any)

________________________________________

________________________________________

City/Town

School district

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot _________________________________________________________

4. Indicate number of acres currently used for cemetery purposes: * ___________________________________

_______________________________________________________________________________________

a. Number of acres of unimproved land in which interments are anticipated: ________________________

b. Location of unimproved land (in relation to improved land): ___________________________________

5. Describe plans for use of unimproved land (attach written plans, maps, etc, if any): ____________________

a. Number of burial spaces projected: _________ b. Number of burial spaces already sold: ___________

c. Indicate dates for clearing of land: _______________ roadway construction: ____________________

6. Indicate any limitations on use of unimproved land for interments (e.g. physical, legal limitations): _______

_______________________________________________________________________________________

7. Describe use of land currently used for cemetery purposes: *

a. Number of interments in previous calendar year: ________

b. Number of interments in previous ten years: _________

c. Number of burial spaces remaining for future interments within cemetery area currently improved for

cemetery purposes: ______________

8. a. Has the cemetery conveyed any real property in the past ten years, other than burial plots?

Yes

No

b. Is the property or any part thereof under contract for sale?

Yes

No

c. Is the property or any part thereof for sale?

Yes

No

d. If answer to 8, a, b, or c is yes give full details (include question in letter):

*Defined in instructions

Clear Form

1

1 2

2