Form Ct-W4 - Employee'S Withholding Certifi Cate - 2013

ADVERTISEMENT

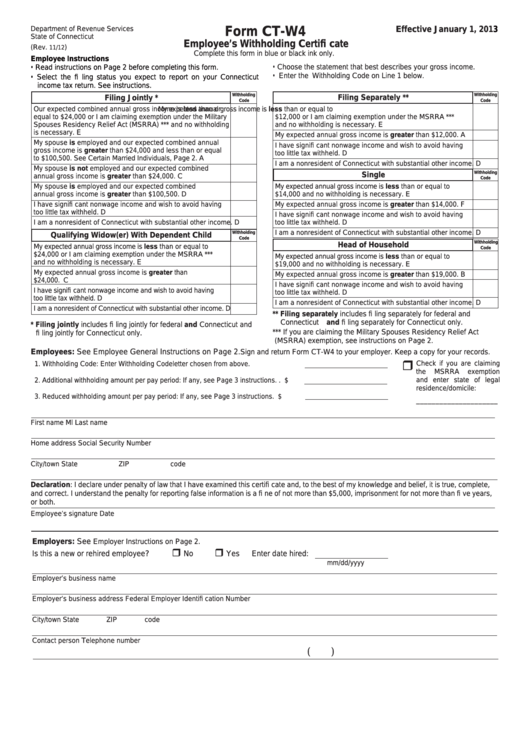

Department of Revenue Services

Form CT-W4

Effective January 1,

2013

State of Connecticut

Employee’s Withholding Certifi cate

(Rev.

)

11/12

Complete this form in blue or black ink only.

Employee Instructions

• Read instructions on Page 2 before completing this form.

• Choose the statement that best describes your gross income.

• Enter the Withholding Code on Line 1 below.

• Select the fi ling status you expect to report on your Connecticut

income tax return. See instructions.

Withholding

Withholding

Filing Separately **

Filing Jointly *

Code

Code

Our expected combined annual gross income is less than or

My expected annual gross income is less than or equal to

equal to $24,000 or I am claiming exemption under the Military

$12,000 or I am claiming exemption under the MSRRA ***

Spouses Residency Relief Act (MSRRA) *** and no withholding

and no withholding is necessary.

E

is necessary.

E

My expected annual gross income is greater than $12,000.

A

My spouse is employed and our expected combined annual

I have signifi cant nonwage income and wish to avoid having

gross income is greater than $24,000 and less than or equal

too little tax withheld.

D

to $100,500. See Certain Married Individuals, Page 2.

A

I am a nonresident of Connecticut with substantial other income.

D

My spouse is not employed and our expected combined

Withholding

Single

annual gross income is greater than $24,000.

C

Code

My expected annual gross income is less than or equal to

My spouse is employed and our expected combined

annual gross income is greater than $100,500.

D

$14,000 and no withholding is necessary.

E

I have signifi cant nonwage income and wish to avoid having

My expected annual gross income is greater than $14,000.

F

too little tax withheld.

D

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

I am a nonresident of Connecticut with substantial other income.

D

I am a nonresident of Connecticut with substantial other income.

D

Withholding

Qualifying Widow(er) With Dependent Child

Code

Withholding

Head of Household

My expected annual gross income is less than or equal to

Code

$24,000 or I am claiming exemption under the MSRRA ***

My expected annual gross income is less than or equal to

and no withholding is necessary.

E

$19,000 and no withholding is necessary.

E

My expected annual gross income is greater than

My expected annual gross income is greater than $19,000.

B

$24,000.

C

I have signifi cant nonwage income and wish to avoid having

I have signifi cant nonwage income and wish to avoid having

too little tax withheld.

D

too little tax withheld.

D

I am a nonresident of Connecticut with substantial other income.

D

I am a nonresident of Connecticut with substantial other income.

D

** Filing separately includes fi ling separately for federal and

Connecticut and fi ling separately for Connecticut only.

* Filing jointly includes fi ling jointly for federal and Connecticut and

*** If you are claiming the Military Spouses Residency Relief Act

fi ling jointly for Connecticut only.

(MSRRA) exemption, see instructions on Page 2.

Employees: See Employee General Instructions on Page 2.

Sign and return Form CT-W4 to your employer. Keep a copy for your records.

Check if you are claiming

1. Withholding Code: Enter Withholding Code letter chosen from above. ....................... 1.

the

MSRRA

exemption

and enter state of legal

2. Additional withholding amount per pay period: If any, see Page 3 instructions. . ......... 2. $

residence/domicile:

3. Reduced withholding amount per pay period: If any, see Page 3 instructions. ............ 3. $

_____________________

First name

Ml

Last name

Home address

Social Security Number

City/town

State

ZIP code

Declaration: I declare under penalty of law that I have examined this certifi cate and, to the best of my knowledge and belief, it is true, complete,

and correct. I understand the penalty for reporting false information is a fi ne of not more than $5,000, imprisonment for not more than fi ve years,

or both.

Employee’s signature

Date

Employers: See

Employer Instructions on Page 2.

No

Yes Enter date hired:

Is this a new or rehired employee?

mm/dd/yyyy

Employer’s business name

Employer’s business address

Federal Employer Identifi cation Number

City/town

State

ZIP code

Contact person

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4