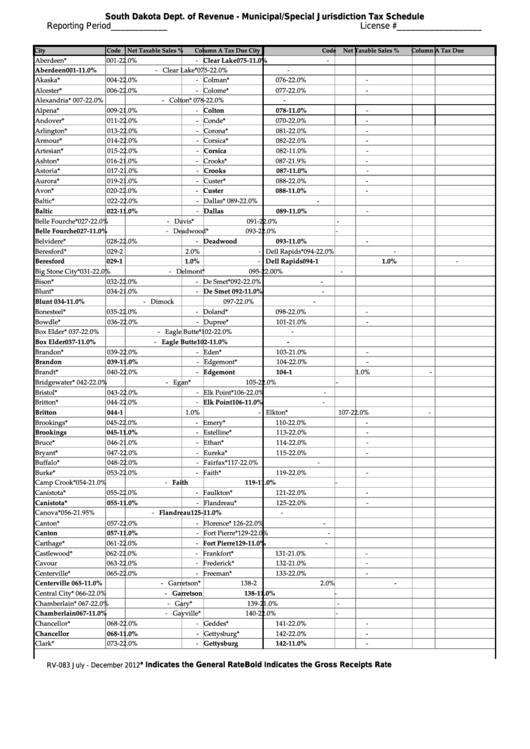

Form Rv-083 - Municipal/special Jurisdiction Tax Schedule

ADVERTISEMENT

South Dakota Dept. of Revenue - Municipal/Special Jurisdiction Tax Schedule

Reporting Period____________

License #__________________

City

Code

Net Taxable Sales

%

Column A Tax Due City

Code

Net Taxable Sales

%

Column A Tax Due

Aberdeen*

001-2

2.0%

- Clear Lake

075-1

1.0%

-

Aberdeen

001-1

1.0%

- Clear Lake*

075-2

2.0%

-

Akaska*

004-2

2.0%

- Colman*

076-2

2.0%

-

Alcester*

006-2

2.0%

- Colome*

077-2

2.0%

-

Alexandria*

007-2

2.0%

- Colton*

078-2

2.0%

-

Alpena*

009-2

1.0%

- Colton

078-1

1.0%

-

Andover*

011-2

2.0%

- Conde*

070-2

2.0%

-

Arlington*

013-2

2.0%

- Corona*

081-2

2.0%

-

Armour*

014-2

2.0%

- Corsica*

082-2

2.0%

-

Artesian*

015-2

2.0%

- Corsica

082-1

1.0%

-

Ashton*

016-2

1.0%

- Crooks*

087-2

1.9%

-

Astoria*

017-2

1.0%

- Crooks

087-1

1.0%

-

Aurora*

019-2

1.0%

- Custer*

088-2

2.0%

-

Avon*

020-2

2.0%

- Custer

088-1

1.0%

-

Baltic*

022-2

2.0%

- Dallas*

089-2

2.0%

-

Baltic

022-1

1.0%

- Dallas

089-1

1.0%

-

Belle Fourche*

027-2

2.0%

- Davis*

091-2

2.0%

-

Belle Fourche

027-1

1.0%

- Deadwood*

093-2

2.0%

-

Belvidere*

028-2

2.0%

- Deadwood

093-1

1.0%

-

Beresford*

029-2

2.0%

- Dell Rapids*

094-2

2.0%

-

Beresford

029-1

1.0%

- Dell Rapids

094-1

1.0%

-

Big Stone City*

031-2

2.0%

- Delmont*

095-2

2.00%

-

Bison*

032-2

2.0%

- De Smet*

092-2

2.0%

-

Blunt*

034-2

1.0%

- De Smet

092-1

1.0%

-

Blunt

034-1

1.0%

- Dimock

097-2

2.0%

-

Bonesteel*

035-2

2.0%

- Doland*

098-2

2.0%

-

Bowdle*

036-2

2.0%

- Dupree*

101-2

1.0%

-

Box Elder*

037-2

2.0%

- Eagle Butte*

102-2

2.0%

-

Box Elder

037-1

1.0%

- Eagle Butte

102-1

1.0%

-

Brandon*

039-2

2.0%

- Eden*

103-2

1.0%

-

Brandon

039-1

1.0%

- Edgemont*

104-2

2.0%

-

Brandt*

040-2

2.0%

- Edgemont

104-1

1.0%

-

Bridgewater*

042-2

2.0%

- Egan*

105-2

2.0%

-

Bristol*

043-2

2.0%

- Elk Point*

106-2

2.0%

-

Britton*

044-2

2.0%

- Elk Point

106-1

1.0%

-

Britton

044-1

1.0%

- Elkton*

107-2

2.0%

-

Brookings*

045-2

2.0%

- Emery*

110-2

2.0%

-

Brookings

045-1

1.0%

- Estelline*

113-2

2.0%

-

Bruce*

046-2

1.0%

- Ethan*

114-2

2.0%

-

Bryant*

047-2

2.0%

- Eureka*

115-2

2.0%

-

Buffalo*

048-2

2.0%

- Fairfax*

117-2

2.0%

-

Burke*

053-2

2.0%

- Faith*

119-2

2.0%

-

Camp Crook*

054-2

1.0%

- Faith

119-1

1.0%

-

Canistota*

055-2

2.0%

- Faulkton*

121-2

2.0%

-

Canistota*

055-1

1.0%

- Flandreau*

125-2

2.0%

-

Canova*

056-2

1.95%

- Flandreau

125-1

1.0%

-

Canton*

057-2

2.0%

- Florence*

126-2

2.0%

-

Canton

057-1

1.0%

- Fort Pierre*

129-2

2.0%

-

Carthage*

061-2

2.0%

- Fort Pierre

129-1

1.0%

-

Castlewood*

062-2

2.0%

- Frankfort*

131-2

1.0%

-

Cavour

063-2

2.0%

- Frederick*

132-2

1.0%

-

Centerville*

065-2

2.0%

- Freeman*

133-2

2.0%

-

Centerville

065-1

1.0%

- Garretson*

138-2

2.0%

-

Central City*

066-2

2.0%

- Garretson

138-1

1.0%

-

Chamberlain*

067-2

2.0%

- Gary*

139-2

1.0%

-

Chamberlain

067-1

1.0%

- Gayville*

140-2

2.0%

-

Chancellor*

068-2

2.0%

- Geddes*

141-2

2.0%

-

Chancellor

068-1

1.0%

- Gettysburg*

142-2

2.0%

-

Clark*

073-2

2.0%

- Gettysburg

142-1

1.0%

-

* Indicates the General Rate

Bold Indicates the Gross Receipts Rate

RV-083 July - December 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3