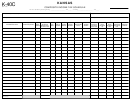

Form Rv-083 - Municipal/special Jurisdiction Tax Schedule Page 3

ADVERTISEMENT

South Dakota Dept. of Revenue - Municipal/Special Jurisdiction Tax Schedule

Reporting Period____________

License #__________________

City

Code

Net Taxable Sales

%

Column A Tax Due City

Code

Net Taxable Sales

%

Column A Tax Due

Ramona*

297-2

1.0%

- Wasta*

377-2

1.0%

-

Rapid City

298-1

1.0%

- Watertown*

379-2

2.0%

-

Rapid City*

298-2

2.0%

- Watertown

379-1

1.0%

-

Redfield*

301-2

2.0%

- Waubay*

380-2

2.0%

-

Redfield

301-1

1.0%

- Webster*

382-2

2.0%

-

Reliance*

305-2

2.0%

- Webster

382-1

1.0%

-

Reliance

305-1

1.0%

- Wentworth*

383-2

2.0%

-

Revillo*

308-2

1.0%

- Wessington*

384-2

1.0%

-

Roscoe*

312-2

1.0%

-

385-2

2.0%

-

Wessington Springs*

Rosholt*

314-2

1.0%

- White*

388-2

2.0%

-

Roslyn*

315-2

2.0%

- White Lake*

389-2

2.0%

-

Saint Lawrence

320-2

2.0%

- White Lake

389-1

1.0%

-

Salem*

322-2

2.0%

- White River*

391-2

2.0%

-

Salem

322-1

1.0%

- Whitewood*

393-2

2.0%

-

Scotland*

324-2

2.0%

- Whitewood

393-1

1.0%

-

Selby*

325-2

2.0%

- Willow Lake*

394-2

2.0%

-

Sherman*

328-2

1.0%

- Wilmot*

395-2

2.0%

-

Sioux Falls*

330-2

2.0%

- Winner*

397-2

2.0%

-

Sioux Falls

330-1

1.0%

- Winner

397-1

1.0%

-

Sisseton*

331-2

2.0%

- Witten*

398-2

2.0%

-

Sisseton

331-1

1.0%

- Wolsey*

399-2

2.0%

-

South Shore*

333-2

1.0%

- Wood*

400-2

2.0%

-

Spearfish*

334-2

2.0%

- Woonsocket*

401-2

2.0%

-

Spearfish

334-1

1.0%

- Worthing*

402-2

2.0%

-

Spencer*

335-2

2.0%

- Worthing

402-1

1.0%

-

Springfield*

336-2

2.0%

- Yale

404-2

1.0%

-

Stickney*

337-2

2.0%

- Yankton*

405-2

2.0%

-

Stratford*

340-2

1.0%

- Yankton

405-1

1.0%

-

Sturgis*

341-2

2.0%

-

TOTAL COLUMN A

Sturgis

341-1

1.0%

-

-

Summerset*

425-2

2.0%

-

Summerset

425-1

1.0%

-

OTHER TAXES

Summit*

342-2

2.0%

-

Tax

Code

Net Taxable Sales

%

Column A Tax Due

Tabor*

343-2

2.0%

- Telecommunication

900-1

4.0%

-

Tea*

344-2

2.0%

- Tourism Tax

700-1

1.5%

-

Tea

344-1

1.0%

- Motor Vehicle

600-1

4.5%

-

Timber Lake*

345-2

2.0%

- Sioux Falls Lodging

800-1

1.0%

-

Total Other Taxes

Toronto*

347-2

1.0%

-

-

Trent*

349-2

1.0%

-

Special Jurisdiction Tax

Code

Net Taxable Sales

%

Column A Tax Due

Tripp*

350-2

2.0%

- Cheyenne Sales

408-4

4.0%

-

Tulare*

351-2

1.0%

- Cheyenne Excise

408-2

2.0%

-

Tyndall*

355-2

2.0%

- Cheyenne Tourism

408-5

1.5%

-

Utica*

357-2

1.0%

- Crow Creek Sales

417-4

4.0%

-

Valley Springs*

359-2

2.0%

- Crow Creek Excise

417-2

2.0%

-

-

Veblen*

360-2

1.0%

- Crow Creek Tourism

417-5

1.5%

Vermillion*

362-2

2.0%

- Pine Ridge Sales

411-4

4.0%

-

Vermillion

362-1

1.0%

- Pine Ridge Excise

411-2

2.0%

-

Viborg*

363-2

2.0%

- Rosebud Sales

412-4

4.0%

-

Viborg

363-1

1.0%

- Rosebud Excise

412-2

2.0%

-

Volga*

367-2

2.0%

- Rosebud Tourism

412-5

1.5%

-

Volin*

368-2

2.0%

-

414-4

4.0%

-

Sisseton Wahpeton Use

Wagner*

369-2

2.0%

-

414-2

2.0%

-

Sisseton Wahpeton Excise

Wakonda*

370-2

2.0%

- Standing Rock Sales

413-4

4.0%

-

Wall*

372-2

2.0%

- Standing Rock Excise

413-2

2.0%

-

Wall

372-1

1.0%

-

413-5

1.5%

-

Standing Rock Tourism

Wallace*

373-2

1.0%

- Yankton Use

418-4

4.0%

-

Ward*

375-2

2.0%

-

418-2

2.0%

-

Yankton Excise

Total Special Jurisdiction Taxes

Warner*

376-2

2.0%

-

-

GRAND TOTAL

-

* Indicates the General Rate

Bold Indicates the Gross Receipts Rate

RV-083 July - December 2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3