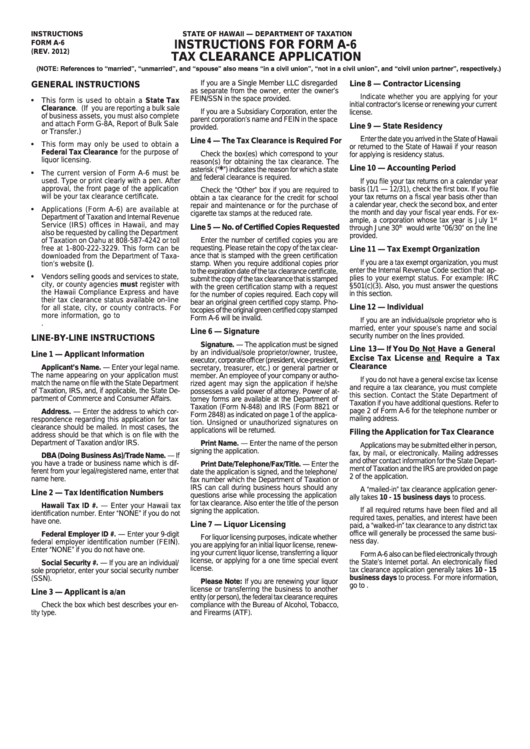

Instructions For Form A-6 - Tax Clearance Application

ADVERTISEMENT

INSTRUCTIONS

STATE OF HAWAII — DEPARTMENT OF TAXATION

INSTRUCTIONS FOR FORM A-6

FORM A-6

(REV. 2012)

TAX CLEARANCE APPLICATION

(NOTE: References to “married”, “unmarried”, and “spouse” also means “in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

If you are a Single Member LLC disregarded

GENERAL INSTRUCTIONS

Line 8 — Contractor Licensing

as separate from the owner, enter the owner’s

Indicate whether you are applying for your

•

FEIN/SSN in the space provided.

This form is used to obtain a State Tax

initial contractor’s license or renewing your current

Clearance. (If you are reporting a bulk sale

If you are a Subsidiary Corporation, enter the

license.

of business assets, you must also complete

parent corporation’s name and FEIN in the space

and attach Form G-8A, Report of Bulk Sale

Line 9 — State Residency

provided.

or Transfer.)

Enter the date you arrived in the State of Hawaii

Line 4 — The Tax Clearance is Required For

•

This form may only be used to obtain a

or returned to the State of Hawaii if your reason

Federal Tax Clearance for the purpose of

Check the box(es) which correspond to your

for applying is residency status.

liquor licensing.

reason(s) for obtaining the tax clearance. The

Line 10 — Accounting Period

*

asterisk (“

”) indicates the reason for which a state

•

The current version of Form A-6 must be

and federal clearance is required.

used. Type or print clearly with a pen. After

If you file your tax returns on a calendar year

approval, the front page of the application

basis (1/1 — 12/31), check the first box. If you file

Check the “Other” box if you are required to

will be your tax clearance certificate.

your tax returns on a fiscal year basis other than

obtain a tax clearance for the credit for school

a calendar year, check the second box, and enter

repair and maintenance or for the purchase of

•

Applications (Form A-6) are available at

the month and day your fiscal year ends. For ex-

cigarette tax stamps at the reduced rate.

Department of Taxation and Internal Revenue

ample, a corporation whose tax year is July 1

st

Service (IRS) offices in Hawaii, and may

Line 5 — No. of Certified Copies Requested

th

through June 30

would write “06/30” on the line

also be requested by calling the Department

provided.

Enter the number of certified copies you are

of Taxation on Oahu at 808-587-4242 or toll

free at 1-800-222-3229. This form can be

requesting. Please retain the copy of the tax clear-

Line 11 — Tax Exempt Organization

ance that is stamped with the green certification

downloaded from the Department of Taxa-

If you are a tax exempt organization, you must

tion’s website ( ).

stamp. When you require additional copies prior

enter the Internal Revenue Code section that ap-

to the expiration date of the tax clearance certificate,

•

Vendors selling goods and services to state,

plies to your exempt status. For example: IRC

submit the copy of the tax clearance that is stamped

city, or county agencies must register with

§501(c)(3). Also, you must answer the questions

with the green certification stamp with a request

the Hawaii Compliance Express and have

in this section.

for the number of copies required. Each copy will

their tax clearance status available on-line

bear an original green certified copy stamp. Pho-

Line 12 — Individual

for all state, city, or county contracts. For

tocopies of the original green certified copy stamped

more information, go to https://vendors.

Form A-6 will be invalid.

If you are an individual/sole proprietor who is

ehawaii.gov.

married, enter your spouse’s name and social

Line 6 — Signature

security number on the lines provided.

LINE-BY-LINE INSTRUCTIONS

Signature. — The application must be signed

Line 13 — If You Do Not Have a General

by an individual/sole proprietor/owner, trustee,

Line 1 — Applicant Information

Excise Tax License and Require a Tax

executor, corporate officer (president, vice-president,

Clearance

Applicant’s Name. — Enter your legal name.

secretary, treasurer, etc.) or general partner or

The name appearing on your application must

member. An employee of your company or autho-

If you do not have a general excise tax license

match the name on file with the State Department

rized agent may sign the application if he/she

and require a tax clearance, you must complete

of Taxation, IRS, and, if applicable, the State De-

possesses a valid power of attorney. Power of at-

this section. Contact the State Department of

partment of Commerce and Consumer Affairs.

torney forms are available at the Department of

Taxation if you have additional questions. Refer to

Taxation (Form N-848) and IRS (Form 8821 or

page 2 of Form A-6 for the telephone number or

Address. — Enter the address to which cor-

Form 2848) as indicated on page 1 of the applica-

mailing address.

respondence regarding this application for tax

tion. Unsigned or unauthorized signatures on

clearance should be mailed. In most cases, the

applications will be returned.

Filing the Application for Tax Clearance

address should be that which is on file with the

Department of Taxation and/or IRS.

Print Name. — Enter the name of the person

Applications may be submitted either in person,

signing the application.

fax, by mail, or electronically. Mailing addresses

DBA (Doing Business As)/Trade Name. — If

and other contact information for the State Depart-

you have a trade or business name which is dif-

Print Date/Telephone/Fax/Title. — Enter the

ment of Taxation and the IRS are provided on page

ferent from your legal/registered name, enter that

date the application is signed, and the telephone/

2 of the application.

name here.

fax number which the Department of Taxation or

IRS can call during business hours should any

A “mailed-in” tax clearance application gener-

Line 2 — Tax Identification Numbers

questions arise while processing the application

ally takes 10 - 15 business days to process.

for tax clearance. Also enter the title of the person

Hawaii Tax ID #. — Enter your Hawaii tax

If all required returns have been filed and all

signing the application.

identification number. Enter “NONE” if you do not

required taxes, penalties, and interest have been

have one.

Line 7 — Liquor Licensing

paid, a “walked-in” tax clearance to any district tax

office will generally be processed the same busi-

Federal Employer ID #. — Enter your 9-digit

For liquor licensing purposes, indicate whether

ness day.

federal employer identification number (FEIN).

you are applying for an initial liquor license, renew-

Enter “NONE” if you do not have one.

ing your current liquor license, transferring a liquor

Form A-6 also can be filed electronically through

license, or applying for a one time special event

the State’s Internet portal. An electronically filed

Social Security #. — If you are an individual/

license.

tax clearance application generally takes 10 - 15

sole proprietor, enter your social security number

business days to process. For more information,

(SSN).

Please Note: If you are renewing your liquor

go to

license or transferring the business to another

Line 3 — Applicant is a/an

entity (or person), the federal tax clearance requires

Check the box which best describes your en-

compliance with the Bureau of Alcohol, Tobacco,

and Firearms (ATF).

tity type.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1