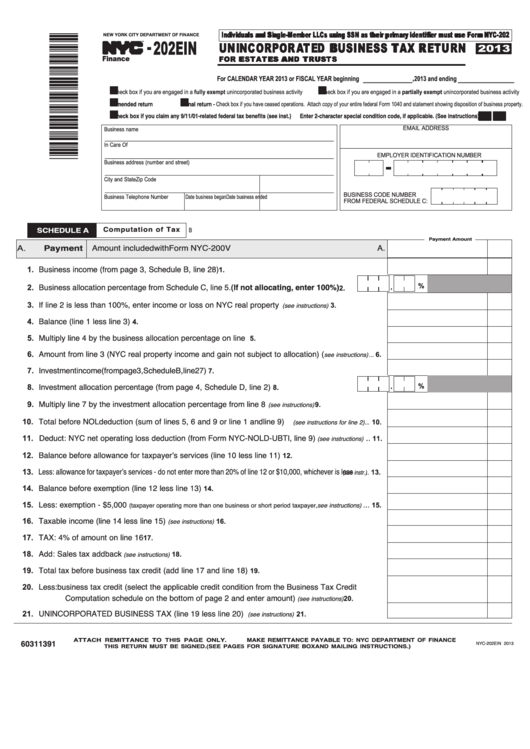

Form Nyc-202ein - Unincorporated Business Tax Return - 2013

ADVERTISEMENT

- 202EIN

I I n n d d i i v v i i d d u u a a l l s s a a n n d d S S i i n n g g l l e e - - M M e e m m b b e e r r L L L L C C s s u u s s i i n n g g S S S S N N a a s s t t h h e e i i r r p p r r i i m m a a r r y y i i d d e e n n t t i i f f i i e e r r m m u u s s t t u u s s e e F F o o r r m m N N Y Y C C - - 2 2 0 0 2 2

NEW YORK CITY DEPARTMENT OF FINANCE

U U N N I I N N C C O O R R P P O O R R A A T T E E D D B B U U S S I I N N E E S S S S T T A A X X R R E E T T U U R R N N

2013

TM

Finance

F F O O R R E E S S T T A A T T E E S S A A N N D D T T R R U U S S T T S S

For CALENDAR YEAR 2013 or FISCAL YEAR beginning ______________ , 2013 and ending ________________

I I

I I

Check box if you are engaged in a fully exempt unincorporated business activity

Check box if you are engaged in a partially exempt unincorporated business activity

I I

I I

Amended return

Final return - Check box if you have ceased operations. Attach copy of your entire federal Form 1040 and statement showing disposition of business property.

I

I I

I

I I

Check box if you claim any 9/11/01-related federal tax benefits (see inst.)

Enter 2 character special condition code, if applicable. (See instructions):

EMAIL ADDRESS

Business name

In Care Of

EMPLOYER IDENTIFICATION NUMBER

Business address (number and street)

City and State

Zip Code

BUSINESS CODE NUMBER

Business Telephone Number

Date business began

Date business ended

FROM FEDERAL SCHEDULE C:

Computation of Tax

SCHEDULE A

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Payment Amount

Payment

Amount included with Form NYC-200V ................................................................. A.

A.

1. Business income (from page 3, Schedule B, line 28)

................................................................................ 1.

2. Business allocation percentage from Schedule C, line 5. (If not allocating, enter 100%).....

.

%

2.

3. If line 2 is less than 100%, enter income or loss on NYC real property

....................

(see instructions)

3.

4. Balance (line 1 less line 3)................................................................................................................

4.

5. Multiply line 4 by the business allocation percentage on line 2........................................................

5.

6. Amount from line 3 (NYC real property income and gain not subject to allocation) (

see instructions) ...

6.

7. Investment income (from page 3, Schedule B, line 27)....................................................................

7.

8. Investment allocation percentage (from page 4, Schedule D, line 2).................................

.

%

8.

9. Multiply line 7 by the investment allocation percentage from line 8

...........................

(see instructions)

9.

10. Total before NOL deduction (sum of lines 5, 6 and 9 or line 1 and line 9)

(see instructions for line 2)...

10.

11. Deduct: NYC net operating loss deduction (from Form NYC-NOLD-UBTI, line 9)

..

(see instructions)

11.

12. Balance before allowance for taxpayerʼs services (line 10 less line 11).........................................

12.

13. Less: allowance for taxpayerʼs services - do not enter more than 20% of line 12 or $10,000, whichever is less

(see instr.) ..

13.

14. Balance before exemption (line 12 less line 13) .............................................................................

14.

15. Less: exemption - $5,000

...

(taxpayer operating more than one business or short period taxpayer, see instructions)

15.

16. Taxable income (line 14 less line 15)

.......................................................................

(see instructions)

16.

17. TAX: 4% of amount on line 16

..................................................................................................................... 17.

18. Add: Sales tax addback

....................................................................................................... 18.

(see instructions)

19. Total tax before business tax credit (add line 17 and line 18) ........................................................

19.

20. Less: business tax credit (select the applicable credit condition from the Business Tax Credit

Computation schedule on the bottom of page 2 and enter amount)

............

(see instructions)

20.

21. UNINCORPORATED BUSINESS TAX (line 19 less line 20)

..................................

(see instructions)

21.

60311391

AT TA C H R E M I T TA N C E T O T H I S PA G E O N LY.

MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE

NYC-202EIN 2013

THIS RETURN MUST BE SIGNED. (SEE PAGE 5 FOR SIGNATURE BOX AND MAILING INSTRUCTIONS.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5