Schedule Cr - Schedule Of Tax Credits - 2012

ADVERTISEMENT

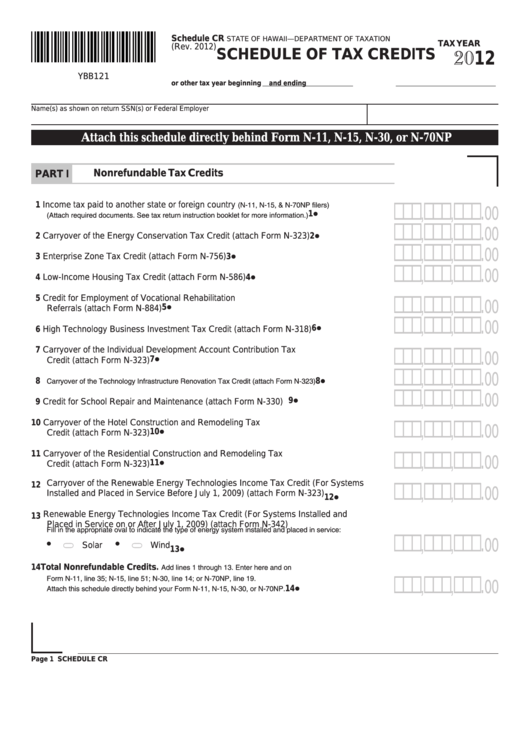

Schedule CR

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX YEAR

(Rev. 2012)

2012

SCHEDULE OF TAX CREDITS

YBB121

or other tax year beginning

and ending

Name(s) as shown on return

SSN(s) or Federal Employer I.D. No.

Attach this schedule directly behind Form N-11, N-15, N-30, or N-70NP

PART I

Nonrefundable Tax Credits

1 Income tax paid to another state or foreign country (N-11, N-15, & N-70NP filers)

!!!,!!!,!!!.00

(Attach required documents. See tax return instruction booklet for more information.) ..................... 1

!!!,!!!,!!!.00

2 Carryover of the Energy Conservation Tax Credit (attach Form N-323) .................... 2

!!!,!!!,!!!.00

3 Enterprise Zone Tax Credit (attach Form N-756) ....................................................... 3

!!!,!!!,!!!.00

4 Low-Income Housing Tax Credit (attach Form N-586) ............................................... 4

5 Credit for Employment of Vocational Rehabilitation

!!!,!!!,!!!.00

Referrals (attach Form N-884) ................................................................................... 5

!!!,!!!,!!!.00

6 High Technology Business Investment Tax Credit (attach Form N-318) .................... 6

7 Carryover of the Individual Development Account Contribution Tax

!!!,!!!,!!!.00

Credit (attach Form N-323) ........................................................................................ 7

!!!,!!!,!!!.00

8 Carryover of the Technology Infrastructure Renovation Tax Credit (attach Form N-323) ................... 8

!!!,!!!,!!!.00

9 Credit for School Repair and Maintenance (attach Form N-330) ............................... 9

10 Carryover of the Hotel Construction and Remodeling Tax

!!!,!!!,!!!.00

Credit (attach Form N-323) ........................................................................................ 10

11 Carryover of the Residential Construction and Remodeling Tax

!!!,!!!,!!!.00

Credit (attach Form N-323) ........................................................................................ 11

12 Carryover of the Renewable Energy Technologies Income Tax Credit (For Systems

!!!,!!!,!!!.00

Installed and Placed in Service Before July 1, 2009) (attach Form N-323) ............... 12

13 Renewable Energy Technologies Income Tax Credit (For Systems Installed and

Placed in Service on or After July 1, 2009) (attach Form N-342)

Fill in the appropriate oval to indicate the type of energy system installed and placed in service:

!!!,!!!,!!!.00

=

=

•

•

Solar

Wind ................................................................................ 13

14 Total Nonrefundable Credits. Add lines 1 through 13. Enter here and on

Form N-11, line 35; N-15, line 51; N-30, line 14; or N-70NP, line 19.

!!!,!!!,!!!.00

Attach this schedule directly behind your Form N-11, N-15, N-30, or N-70NP. ................................ 14

Page 1

SCHEDULE CR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2