Reset Form

Print Form

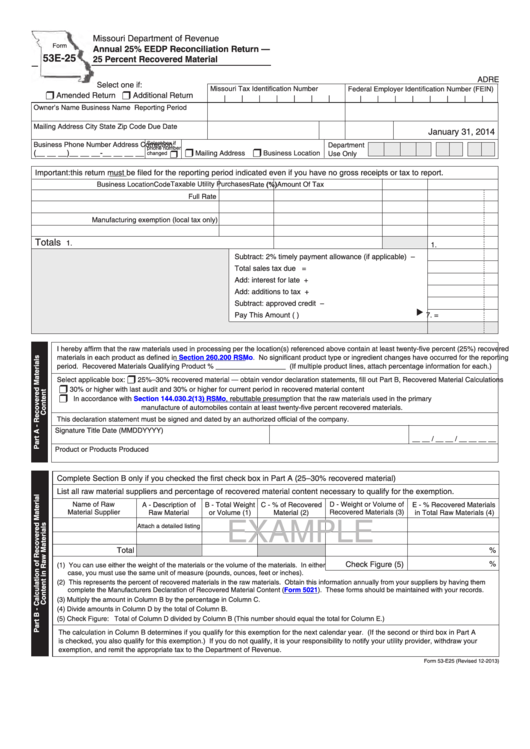

Missouri Department of Revenue

Form

Annual 25% EEDP Reconciliation Return —

53E-25

25 Percent Recovered Material

ADRE

Select one if:

Missouri Tax Identification Number

Federal Employer Identification Number (FEIN)

r

Amended Return

r

Additional Return

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner’s Name

Business Name

Reporting Period

Mailing Address

City

State

Zip Code

Due Date

January 31, 2014

Select box if

Business Phone Number

Address Correction:

Department

phone number

(__ __ __)__ __ __-__ __ __ __

r

r

Mailing Address

Business Location

Use Only

changed

r

Important: this return must be filed for the reporting period indicated even if you have no gross receipts or tax to report.

Taxable Utility Purchases

Business Location

Code

Rate (%)

Amount Of Tax

Full Rate

Manufacturing exemption (local tax only)

Totals ...........................................................................

1.

1.

Subtract: 2% timely payment allowance (if applicable) ....... 2. –

Total sales tax due ............................................................. 3. =

Add: interest for late payment.............................................. 4. +

Add: additions to tax ............................................................ 5. +

Subtract: approved credit .................................................... 6. –

Pay This Amount (U.S. Funds Only) ..............................

7. =

I hereby affirm that the raw materials used in processing per the location(s) referenced above contain at least twenty-five percent (25%) recovered

Section 260.200

RSMo. No significant product type or ingredient changes have occurred for the reporting

materials in each product as defined in

period. Recovered Materials Qualifying Product % __________________ (If multiple product lines, attach percentage information for each.)

r

Select applicable box:

25%–30% recovered material — obtain vendor declaration statements, fill out Part B, Recovered Material Calculations

r

30% or higher with last audit and 30% or higher for current period in recovered material content

r

Section 144.030.2(13)

RSMo, rebuttable presumption that the raw materials used in the primary

In accordance with

manufacture of automobiles contain at least twenty-five percent recovered materials.

This declaration statement must be signed and dated by an authorized official of the company.

Signature

Title

Date (MMDDYYYY)

__ __ / __ __ / __ __ __ __

Product or Products Produced

Complete Section B only if you checked the first check box in Part A (25–30% recovered material)

List all raw material suppliers and percentage of recovered material content necessary to qualify for the exemption.

Name of Raw

D - Weight or Volume of

A - Description of

B - Total Weight

C - % of Recovered

E - % Recovered Materials

Material Supplier

Recovered Materials (3)

Raw Material

or Volume (1)

Material (2)

in Total Raw Materials (4)

EXAMPLE

Attach a detailed listing

Total

%

%

Check Figure (5)

(1) You can use either the weight of the materials or the volume of the materials. In either

case, you must use the same unit of measure (pounds, ounces, feet or inches).

(2) This represents the percent of recovered materials in the raw materials. Obtain this information annually from your suppliers by having them

complete the Manufacturers Declaration of Recovered Material Content

(Form

5021). These forms should be maintained with your records.

(3) Multiply the amount in Column B by the percentage in Column C.

(4) Divide amounts in Column D by the total of Column B.

(5) Check Figure: Total of Column D divided by Column B (This number should equal the total for Column E.)

The calculation in Column B determines if you qualify for this exemption for the next calendar year. (If the second or third box in Part A

is checked, you also qualify for this exemption.) If you do not qualify, it is your responsibility to notify your utility provider, withdraw your

exemption, and remit the appropriate tax to the Department of Revenue.

Form 53-E25 (Revised 12-2013)

1

1 2

2 3

3