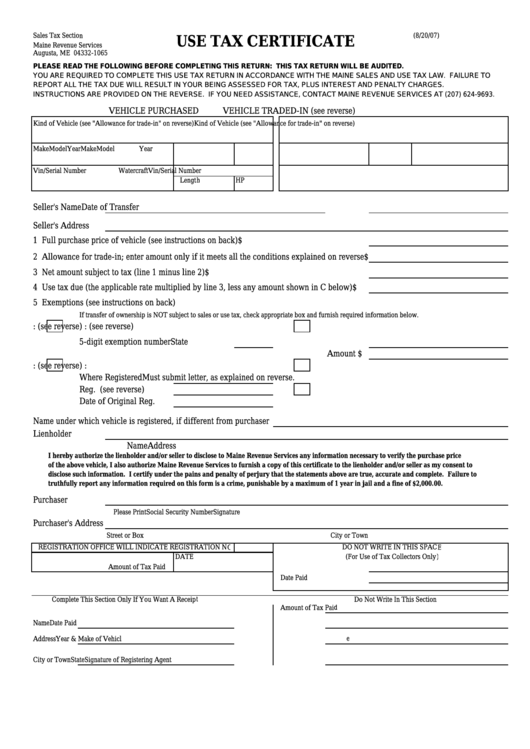

Sales Tax Section

S.T.M.V. 6U (8/20/07)

USE TAX CERTIFICATE

Maine Revenue Services

Augusta, ME 04332-1065

PLEASE READ THE FOLLOWING BEFORE COMPLETING THIS RETURN: THIS TAX RETURN WILL BE AUDITED.

YOU ARE REQUIRED TO COMPLETE THIS USE TAX RETURN IN ACCORDANCE WITH THE MAINE SALES AND USE TAX LAW. FAILURE TO

REPORT ALL THE TAX DUE WILL RESULT IN YOUR BEING ASSESSED FOR TAX, PLUS INTEREST AND PENALTY CHARGES.

INSTRUCTIONS ARE PROVIDED ON THE REVERSE. IF YOU NEED ASSISTANCE, CONTACT MAINE REVENUE SERVICES AT (207) 624-9693.

VEHICLE PURCHASED

VEHICLE TRADED-IN (see reverse)

Kind of Vehicle (see "Allowance for trade-in" on reverse)

Kind of Vehicle (see "Allowance for trade-in" on reverse)

Make

Model

Year

Make

Model

Year

Vin/Serial Number

Watercraft

Vin/Serial Number

Length

HP

Seller's Name

Date of Transfer

Seller's Address

1 Full purchase price of vehicle (see instructions on back)

$

2 Allowance for trade-in; enter amount only if it meets all the conditions explained on reverse

$

3 Net amount subject to tax (line 1 minus line 2)

$

4 Use tax due (the applicable rate multiplied by line 3, less any amount shown in C below)

$

5 Exemptions (see instructions on back)

If transfer of ownership is NOT subject to sales or use tax, check appropriate box and furnish required information below.

A.

Exempt Organization: (see reverse)

C.

Sales Tax Paid Elsewhere: (see reverse)

5-digit exemption number

State

Amount $

B.

Previously Used by You Elsewhere: (see reverse)

D.

Amputee Veteran:

Where Registered

Must submit letter, as explained on reverse.

Reg. No.

E.

Other (see reverse)

Date of Original Reg.

Name under which vehicle is registered, if different from purchaser

Lienholder

Name

Address

I hereby authorize the lienholder and/or seller to disclose to Maine Revenue Services any information necessary to verify the purchase price

of the above vehicle, I also authorize Maine Revenue Services to furnish a copy of this certificate to the lienholder and/or seller as my consent to

disclose such information. I certify under the pains and penalty of perjury that the statements above are true, accurate and complete. Failure to

truthfully report any information required on this form is a crime, punishable by a maximum of 1 year in jail and a fine of $2,000.00.

Purchaser

Please Print

Social Security Number

Signature

Purchaser's Address

Street or Box No.

City or Town

State

Zip

REGISTRATION OFFICE WILL INDICATE REGISTRATION NO

DO NOT WRITE IN THIS SPACE

DATE

(For Use of Tax Collectors Only)

Amount of Tax Paid

Date Paid

Complete This Section Only If You Want A Receipt

Do Not Write In This Section

Amount of Tax Paid

Name

Date Paid

Address

Year & Make of Vehicle

City or Town

State

Signature of Registering Agent

1

1 2

2