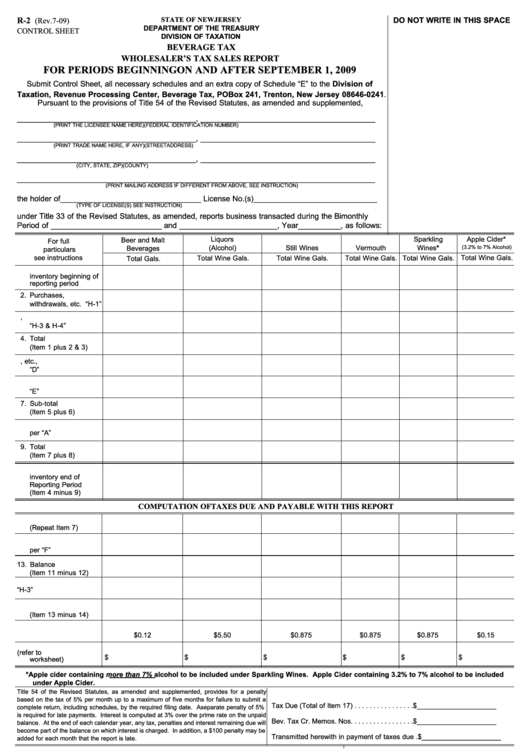

R-2

STATE OF NEW JERSEY

DO NOT WRITE IN THIS SPACE

(Rev.7-09)

DEPARTMENT OF THE TREASURY

CONTROL SHEET

DIVISION OF TAXATION

BEVERAGE TAX

WHOLESALER’S TAX SALES REPORT

FOR PERIODS BEGINNING ON AND AFTER SEPTEMBER 1, 2009

Submit Control Sheet, all necessary schedules and an extra copy of Schedule “E” to the Division of

Taxation, Revenue Processing Center, Beverage Tax, PO Box 241, Trenton, New Jersey 08646-0241.

Pursuant to the provisions of Title 54 of the Revised Statutes, as amended and supplemented,

__________________________________________, _________________________________________

(PRINT THE LICENSEE NAME HERE)

(FEDERAL IDENTIFICATION NUMBER)

__________________________________________, _________________________________________

(PRINT TRADE NAME HERE, IF ANY)

(STREET ADDRESS)

__________________________________________, _________________________________________

(CITY, STATE, ZIP)

(COUNTY)

____________________________________________________________________________________

(PRINT MAILING ADDRESS IF DIFFERENT FROM ABOVE, SEE INSTRUCTION)

the holder of_________________________________ License No.(s)_____________________________

(TYPE OF LICENSE(S) SEE INSTRUCTION)

under Title 33 of the Revised Statutes, as amended, reports business transacted during the Bimonthly

Period of __________________________ and _______________________, Year__________, as follows:

Liquors

Sparkling

Apple Cider*

Beer and Malt

For full

(Alcohol)

Still Wines

Vermouth

Wines*

(3.2% to 7% Alcohol)

Beverages

particulars

see instructions

Total Wine Gals.

Total Wine Gals.

Total Wine Gals.

Total Wine Gals.

Total Wine Gals.

Total Gals.

1. Actual physical

inventory beginning of

reporting period

2. Purchases,

withdrawals, etc. “H-1”

3. Returns accepted,

“H-3 & H-4”

4. Total

(Item 1 plus 2 & 3)

5. Taxable sales, etc.,

“D”

6. Exemption claimed per

“E”

7. Sub-total

(Item 5 plus 6)

8. Sales and returns

per “A”

9. Total

(Item 7 plus 8)

10. Actual physical

inventory end of

Reporting Period

(Item 4 minus 9)

COMPUTATION OF TAXES DUE AND PAYABLE WITH THIS REPORT

11. Tax due sales

(Repeat Item 7)

12. Exemption taken

per “F”

13. Balance

(Item 11 minus 12)

14. Tax Credit per “H-3”

15. Net taxable sales

(Item 13 minus 14)

16. Tax rates

$0.12

$5.50

$0.875

$0.875

$0.875

$0.15

17. Tax due (refer to

$

$

$

$

$

$

worksheet)

* Apple cider containing more than 7% alcohol to be included under Sparkling Wines. Apple Cider containing 3.2% to 7% alcohol to be included

under Apple Cider.

Title 54 of the Revised Statutes, as amended and supplemented, provides for a penalty

based on the tax of 5% per month up to a maximum of five months for failure to submit a

Tax Due (Total of Item 17) . . . . . . . . . . . . . . . . $ _____________________

complete return, including schedules, by the required filing date. A separate penalty of 5%

is required for late payments. Interest is computed at 3% over the prime rate on the unpaid

Bev. Tax Cr. Memos. Nos. . . . . . . . . . . . . . . . . $ _____________________

balance. At the end of each calendar year, any tax, penalties and interest remaining due will

become part of the balance on which interest is charged. In addition, a $100 penalty may be

Transmitted herewith in payment of taxes due . $ _____________________

added for each month that the report is late.

This report shall cover two calendar months’ business from the first to the last of the two month period inclusive, and shall

DO NOT WRITE IN THIS SPACE

be signed by the licensee, or the proper officer if the licensee is a corporation or by the duly authorized agent of the

licensee. The report with schedules and check or money order (no stamps) for the amount of taxes due shall be filed with

the Division of Taxation, Revenue Processing Center, PO Box 241, Trenton, NJ 08646-0241, within FIFTEEN DAYS after

the expiration of the period reported upon. Beverage Tax Reports shall be filed covering each bimonthly period or part of

a period that a license is in force even though during the period no business is transacted under the license. (OVER)

1

1 2

2