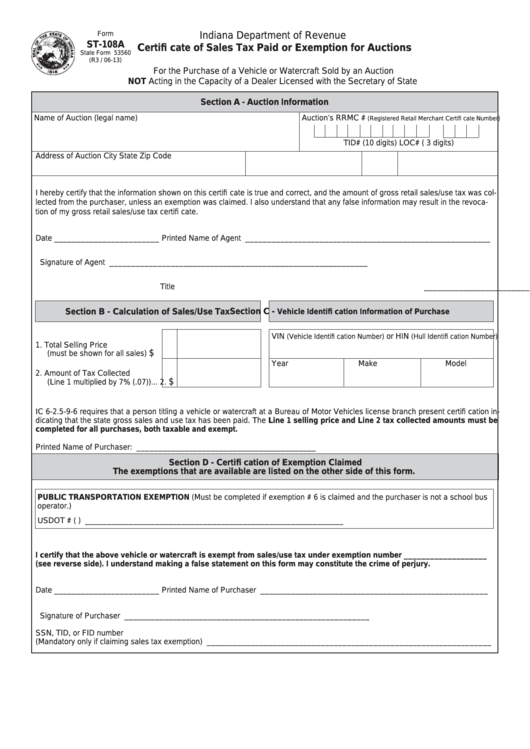

Form

Indiana Department of Revenue

ST-108A

Certifi cate of Sales Tax Paid or Exemption for Auctions

State Form 53560

(R3 / 06-13)

For the Purchase of a Vehicle or Watercraft Sold by an Auction

NOT Acting in the Capacity of a Dealer Licensed with the Secretary of State

Section A - Auction Information

Name of Auction (legal name)

Auction’s RRMC #

(Registered Retail Merchant Certifi cate Number)

TID# (10 digits)

LOC# ( 3 digits)

Address of Auction

City

State

Zip Code

I hereby certify that the information shown on this certifi cate is true and correct, and the amount of gross retail sales/use tax was col-

lected from the purchaser, unless an exemption was claimed. I also understand that any false information may result in the revoca-

tion of my gross retail sales/use tax certifi cate.

Date ________________________ Printed Name of Agent ________________________________________________________

Signature of Agent ___________________________________________________________

Title _______________________________________________________________________

Section C -

Section B - Calculation of Sales/Use Tax

Vehicle Identifi cation Information of Purchase

VIN

or HIN

(Vehicle Identifi cation Number)

(Hull Identifi cation Number)

1. Total Selling Price

$

(must be shown for all sales).....

1.

Year

Make

Model

2. Amount of Tax Collected

$

(Line 1 multiplied by 7% (.07))...

2.

IC 6-2.5-9-6 requires that a person titling a vehicle or watercraft at a Bureau of Motor Vehicles license branch present certifi cation in-

dicating that the state gross sales and use tax has been paid. The Line 1 selling price and Line 2 tax collected amounts must be

completed for all purchases, both taxable and exempt.

Printed Name of Purchaser: _________________________________________

Section D - Certifi cation of Exemption Claimed

The exemptions that are available are listed on the other side of this form.

PUBLIC TRANSPORTATION EXEMPTION (Must be completed if exemption # 6 is claimed and the purchaser is not a school bus

operator.)

USDOT # (U.S. Department of Transportation Number) ___________________________________________________________

I certify that the above vehicle or watercraft is exempt from sales/use tax under exemption number ___________________

(see reverse side). I understand making a false statement on this form may constitute the crime of perjury.

Date ________________________ Printed Name of Purchaser ____________________________________________________

Signature of Purchaser ________________________________________________________

SSN, TID, or FID number

(Mandatory only if claiming sales tax exemption) _________________________________________________________________

1

1 2

2